TCF Bank 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

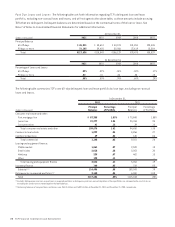

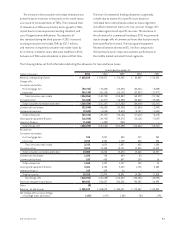

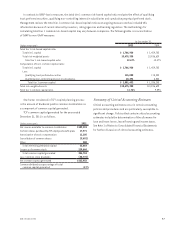

Allowance for Loan and Lease Losses The

determination of the allowance for loan and lease losses

is a critical accounting estimate. TCF’s methodologies for

determining and allocating the allowance for loan and

lease losses focus on ongoing reviews of larger individual

loans and leases, historical net charge-offs, delinquencies

in the loan and lease portfolio, the level of impaired and

non-accrual assets, values of underlying loan and lease

collateral, the overall risk characteristics of the portfolios,

changes in character or size of the portfolios, geographic

location, year of origination, prevailing economic

conditions and other relevant factors. The various factors

used in the methodologies are reviewed on a periodic basis.

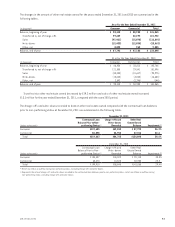

The Company considers the allowance for loan and

lease losses of $255.7 million appropriate to cover

probable losses incurred in the loan and lease portfolios

as of December 31, 2011. However, no assurance can be

given that TCF will not, in any particular period, sustain

loan and lease losses that are sizable in relation to the

amount reserved, or that subsequent evaluations of the

loan and lease portfolio, in light of factors then prevailing,

including economic conditions, TCF’s ongoing credit

review process or regulatory requirements, will not require

significant changes in the balance of the allowance for

loan and lease losses. Among other factors, an economic

slowdown, increasing levels of unemployment and/or a

decline in commercial or residential real estate values in

TCF’s markets may have an adverse impact on the current

adequacy of the allowance for loan and lease losses by

increasing credit risk and the risk of potential loss.

The total allowance for loan and lease losses is generally

available to absorb losses from any segment of the

portfolio. The allocation of TCF’s allowance for loan and

lease losses disclosed in the following table is subject to

change based on changes in the criteria used to evaluate

the allowance and is not necessarily indicative of the trend

of future losses in any particular portfolio.

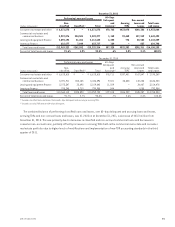

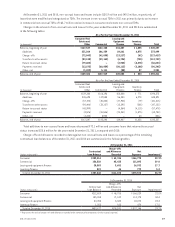

In conjunction with Note 7 of Notes to Consolidated

Financial Statements, the following includes detailed

information regarding TCF’s allowance for loan and lease

losses and net charge-offs.

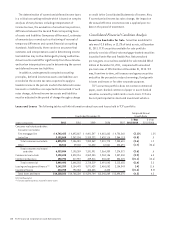

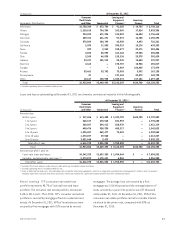

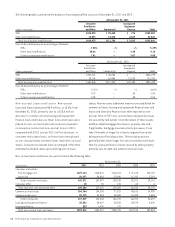

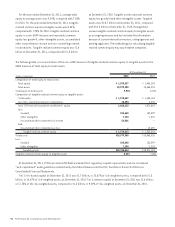

The allocation of TCF’s allowance for loan and lease losses and credit loss reserves is as follows.

Allowance as a Percentage of Total

Loans and Leases Outstanding

At December 31, At December 31,

(Dollars in thousands) 2011 2010 2009 2008 2007 2011 2010 2009 2008 2007

Consumer real estate:

First mortgage lien $115,740 $105,634 $ 89,542 $ 47,279 $16,494 2.44% 2.16% 1.80% .97% .35%

Junior lien 67,695 67,216 75,424 51,157 15,102 3.14 2.97 3.25 2.11 .64

Total consumer real estate 183,435 172,850 164,966 98,436 31,596 2.66 2.42 2.27 1.35 .45

Consumer other 1,114 1,653 2,476 2,664 2,059 2.89 4.22 4.82 4.26 .92

Total consumer real estate

and other 184,549 174,503 167,442 101,100 33,655 2.66 2.43 2.28 1.37 .46

Commercial real estate 40,446 50,788 37,274 39,386 25,891 1.26 1.53 1.14 1.32 1.01

Commercial business 6,508 11,690 6,230 11,865 7,077 2.59 3.68 1.39 2.34 1.27

Total commercial 46,954 62,478 43,504 51,251 32,968 1.36 1.71 1.17 1.47 1.06

Leasing and equipment finance 21,173 26,301 32,063 20,058 14,319 .67 .83 1.04 .81 .68

Inventory finance 2,996 2,537 1,462 33 – .48 .32 .31 .75 –

Total allowance for loan

and lease losses $255,672 $265,819 $244,471 $172,442 $80,942 1.81 1.80 1.68 1.29 .66

Other credit loss reserves:

Reserves for unfunded

commitments 1,829 2,353 3,850 1,510 399 N.A. N.A. N.A. N.A. N.A.

Total credit loss reserves $257,501 $268,172 $248,321 $173,952 $81,341 1.82% 1.81% 1.70% 1.30% .66%

N.A. Not Applicable.

40 TCF Financial Corporation and Subsidiaries