TCF Bank 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

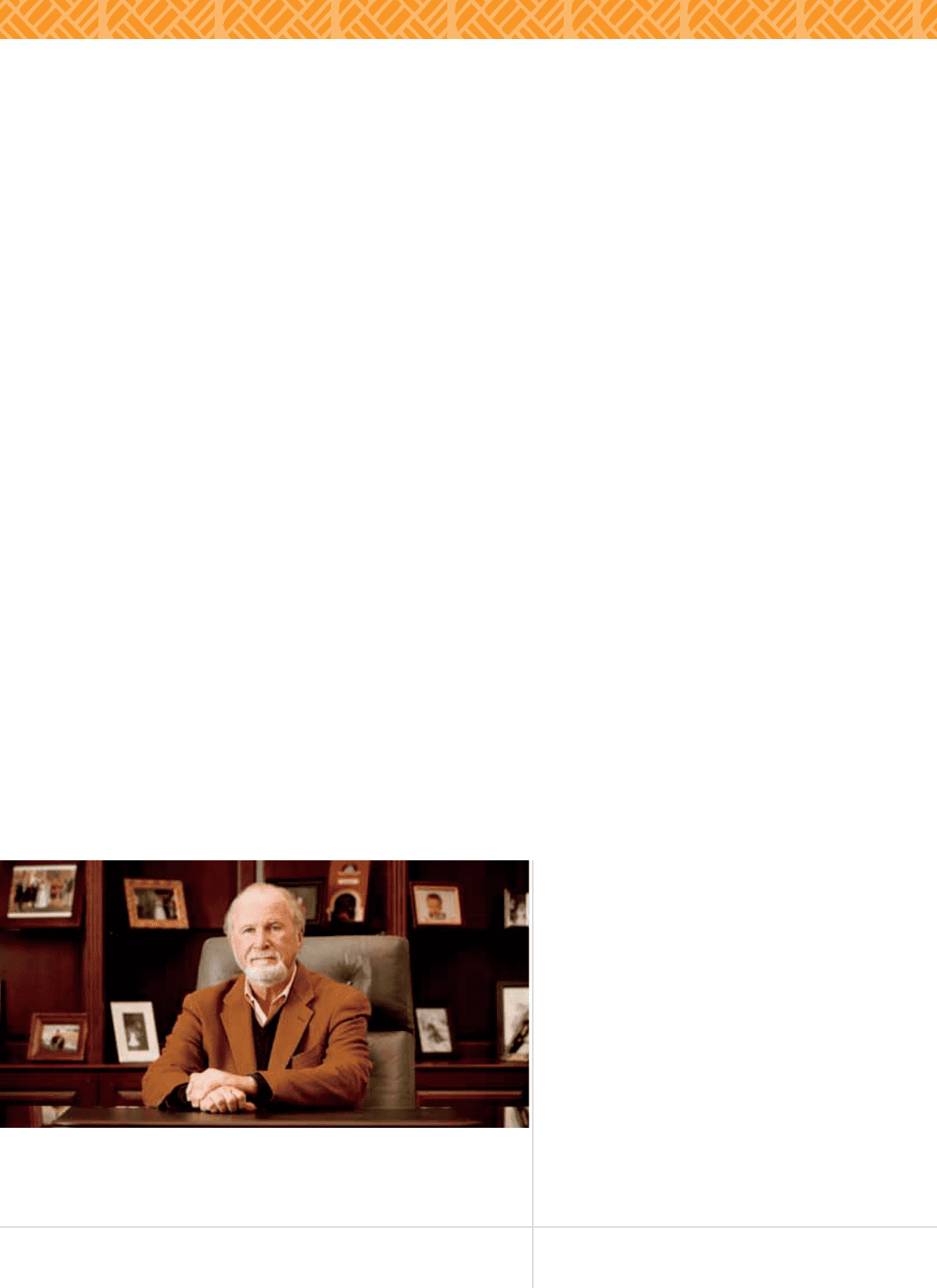

William A. Cooper,

Chairman of the Board & Chief Executive Officer

Dear Stockholders:

2011 was one of the most challenging

years I’ve experienced in my 39 years

in the banking industry. For the past

couple of years, we have all believed

that the “next year” will be the year

everything turns around. This has not

proven to be the case as economic

issues such as high unemployment

and deflated home values have shown

minimal improvement. Also, legislation

such as the Dodd-Frank Act, is

negatively impacting revenues. In

addition, record low interest rates are

impacting the margin. All in all, the

banking industry is changing and it

will be those banks that can adapt

and stay ahead of the curve that will

come out ahead.

2012 will be a year in which we pro-

actively build and invest in TCF’s future,

regardless of the state of the economy.

An evolution is already taking place at

TCF that will position us to take advan-

tage of new marketplace opportunities

and be successful in the changing

banking environment. We are now

focused on growing our diversified

regional and national lending businesses

funded by a regional, core deposit

platform. We have implemented a new

functional management structure that

will better support this growth strategy.

Despite this evolution of TCF, we are

committed to staying true to the

conservative banking philosophy that

has made TCF the successful and

profitable company it is today. This

year marked TCF’s 21st consecutive year

of profitability. Our commitment to

convenience, conservative underwriting,

and secured and diversified loan and

lease portfolios are just part of the

philosophy that has been the foundation

of our company for so many years.

I believe that applying this philosophy to

the changing banking environment will

allow us to stay ahead of the curve and

make TCF a premier investment choice.

A Look at 2011

• Throughout 2011, we continued to see

the same economic problems that have

affected us since the financial crisis

began. It is important to remember

that the current financial crisis we are

experiencing was largely the result of

the risky lending practices demonstrated

by many of our peers. TCF is not

entirely blameless for some of the

problems we have experienced. For

example, we should have foreseen the

burst of the rapidly expanding housing

bubble. However, we did not engage

in many of the risky activities used by

other financial institutions.

• As a result of the continued imple-

mentation of legislative and regulatory

requirements, TCF again spent a

significant amount of time and money,

not only on compliance, but research-

ing and implementing various new

strategies to allow us to be successful

in the new banking environment.

Considerations of strategic shift include

the following:

Durbin Amendment Impact TCF spent

a great deal of effort with its legal

challenge of the constitutionality of

the Durbin Amendment and its impact

on debit card interchange. While we

ultimately decided to drop our lawsuit,

we felt that it highlighted many key

areas of concern in the Durbin

Amendment that proved to be a factor

in the Federal Reserve’s final rule

allowing for banks to receive more than

double the interchange compared to

their initial proposed rule. That being

said, the Durbin Amendment will still

cost TCF approximately $60 million

per year in lost interchange revenue.

We have to look to recover this lost

revenue where we can.

02 TCF Financial Corporation and Subsidiaries