TCF Bank 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

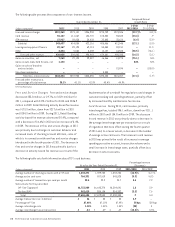

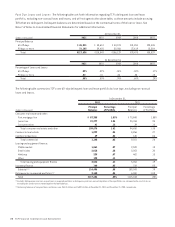

The continued success of TCF’s debit card program is

highly dependent on the success and viability of Visa and the

continued use by customers and acceptance by merchants

of its cards. On June 29, 2011, the Federal Reserve issued its

final debit card interchange rule, establishing a debit card

interchange fee cap. These rules became effective October

1, 2011, and apply to issuers that, together with their

affiliates, have assets of $10 billion or more. Compared with

the fourth quarter of 2010, the average interchange rate per

transaction decreased slightly more than 50% during the

fourth quarter of 2011 and resulted in a reduction of TCF’s

interchange revenue of $14.7 million. See “Item 1A. Risk

Factors” for more information.

ATM Revenue ATM revenue totaled $27.9 million for 2011,

down from $29.8 million in 2010 and $30.4 million in 2009.

The declines in ATM revenue were primarily due to fewer fee

generating transactions and reduced ATM fleet.

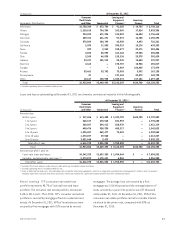

Leasing and Equipment Finance Revenue Leasing

and equipment finance revenue in 2011 was relatively

flat compared with 2010. Leasing and equipment finance

revenues in 2010 increased $20.1 million, or 29%, from 2009.

The increase in 2010 from 2009 was primarily due to increased

operating lease revenue resulting from the acquisition

of Fidelity National Capital, Inc (“FNCI”) in 2009, which

also had a corresponding increase in operating lease

depreciation of $14.4 million in 2010.

Leasing and equipment finance revenues may fluctuate

from period to period based on customer-driven factors not

within TCF’s control.

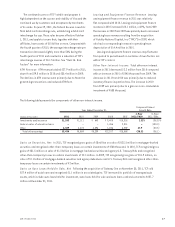

Other Non-Interest Income Total other non-interest

income in 2011 decreased $2.2 million from 2010 compared

with an increase in 2010 of $345 thousand from 2009. The

decrease in 2011 from 2010 was primarily due to reduced

inventory finance inspection fees. The increase in 2010

from 2009 was primarily due to a gain on a non-marketable

investment of $538 thousand.

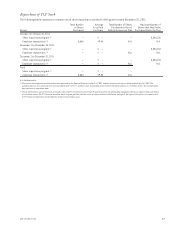

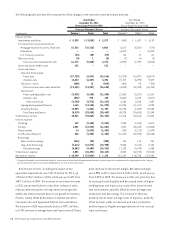

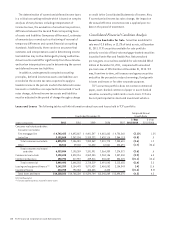

The following table presents the components of other non-interest income.

Year Ended December 31,

Compound Annual

Growth Rate

(Dollars in thousands) 2011 2010 2009 2008 2007

1-Year

2011/2010

5-Year

2011/2006

Investments and insurance $1,105 $1,111 $ 643 $ 9,405 $10,318 (.5)% (36.5)%

Gains on sales of education loans – – – 1,456 2,011 – (100.0)

Other 2,329 4,473 4,596 1,246 6,259 47.9 (30.5)

Total other earnings $3,434 $5,584 $5,239 $12,107 $18,588 (38.5) (36.1)

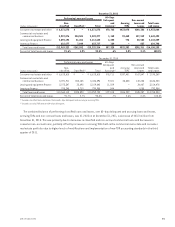

Gains on Securities, Net In 2011, TCF recognized gross gains of $8 million on sales of $522.5 million in mortgage-backed

securities and recognized other-than-temporary losses on certain investments of $768 thousand. In 2010, TCF recognized gross

gains of $31.5 million on sales of $1.3 billion in mortgage-backed securities and agency U.S. Treasury Bills and recognized

other-than-temporary losses on certain investments of $2.1 million. In 2009, TCF recognized gross gains of $31.9 million, on

sales of $2.1 billion of mortgage-backed securities and agency debentures and U.S. Treasury Bills and recognized other-than-

temporary losses on certain investments of $2 million.

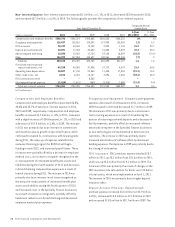

Gains on Auto Loans Held for Sale, Net Following the acquisition of Gateway One on November 30, 2011, TCF sold

$37.4 million of auto loans and recognized $1.1 million in associated gains. TCF increased its portfolio of managed auto

assets, which include auto loans held for investment, auto loans held for sale and auto loans sold and serviced to $437.7

million at December 31, 2011.

272011 Form 10-K