TCF Bank 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

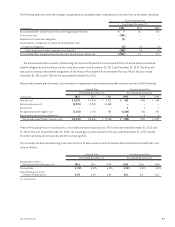

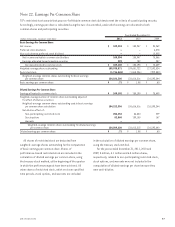

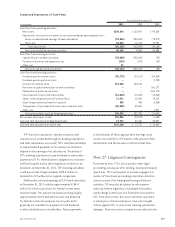

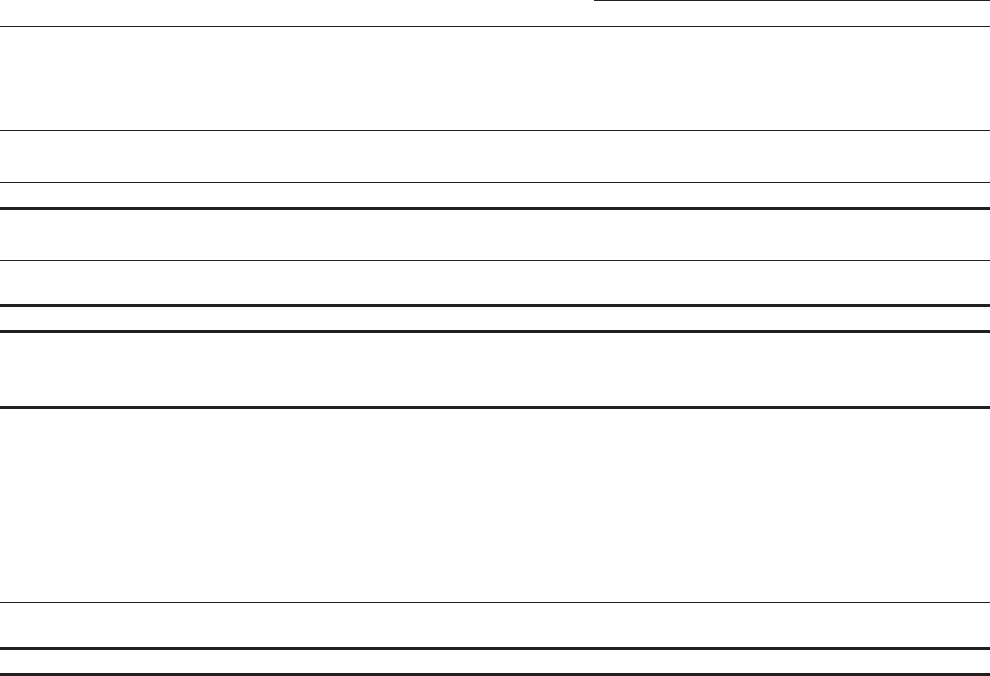

Note 22. Earnings Per Common Share

TCF’s restricted stock awards that pay non-forfeitable common stock dividends meet the criteria of a participating security.

Accordingly, earnings per share is calculated using the two-class method, under which earnings are allocated to both

common shares and participating securities.

Year Ended December 31,

(Dollars in thousands, except per-share data) 2011 2010 2009

Basic Earnings Per Common Share

Net income $ 109,394 $ 150,947 $ 94,269

Preferred stock dividends – – 6,378

Non-cash deemed preferred stock dividend – – 12,025

Net income available to common stockholders 109,394 150,947 75,866

Earnings allocated to participating securities 292 752 257

Earnings allocated to common stock $ 109,102 $ 150,195 $ 75,609

Weighted-average share outstanding 155,938,871 139,681,722 127,592,824

Restricted stock (1,716,565) (1,065,206) (999,580)

Weighted-average common shares outstanding for basic earnings

per common share 154,222,306 138,616,516 126,593,244

Basic earnings per common share $ .71 $ 1.08 $ .60

Diluted Earnings Per Common Share

Earnings allocated to common stock $ 109,102 $ 150,195 $ 75,609

Weighted-average number of common share outstanding adjusted

for effect of dilutive securities:

Weighted-average common shares outstanding used in basic earnings

per common share calculation 154,222,306 138,616,516 126,593,244

Net dilutive effect of:

Non-participating restricted stock 204,354 56,844 229

Stock options 82,560 139,155 167

Warrants – – –

Weighted-average common shares outstanding for diluted earnings

per common share 154,509,220 138,812,515 126,593,640

Diluted earnings per common share $ .71 $ 1.08 $ .60

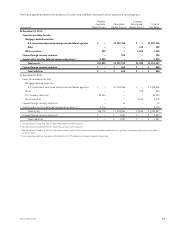

All shares of restricted stock are deducted from

weighted-average shares outstanding for the computation

of basic earnings per common share. Shares of

performance-based restricted stock are included in the

calculation of diluted earnings per common share, using

the treasury stock method, at the beginning of the quarter

in which the performance goals have been achieved. All

other shares of restricted stock, which vest over specified

time periods, stock options, and warrants are included

in the calculation of diluted earnings per common share,

using the treasury stock method.

For the years ended December 31, 2011, 2010 and

2009, 5 million, 4.1 million and 6.5 million shares,

respectively, related to non-participating restricted stock,

stock options, and warrants were not included in the

computation of diluted earnings per share because they

were anti-dilutive.

972011 Form 10-K