TCF Bank 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

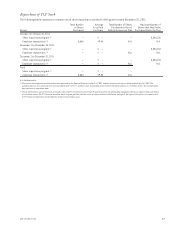

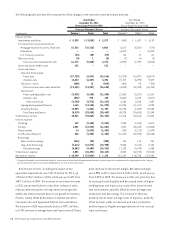

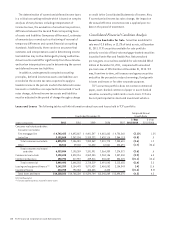

Provision for Credit Losses The following table summarizes the composition of TCF’s provision for credit losses and

percentage of the total provision for the years ended December 31, 2011, 2010 and 2009.

Year Ended December 31, Change

(Dollars in thousands) 2011 2010 2009 2011/2010 2010/2009

Consumer real estate and other $166,575 82.9% $141,960 60.1% $180,719 69.9% $ 24,615 17.3% $(38,759) (21.4)%

Commercial 25,555 12.7 67,374 28.5 36,881 14.3 (41,819) (62.1) 30,493 82.7

Leasing and equipment finance 7,395 3.7 24,883 10.5 39,325 15.2 (17,488) (70.3) (14,442) (36.7)

Inventory finance 1,318 .7 2,220 .9 1,611 .6 (902) (40.6) 609 37.8

Total $200,843 100.0% $236,437 100.0% $258,536 100.0% $(35,594) (15.1)% $(22,099) (8.5)%

TCF provided $200.8 million for credit losses in 2011,

compared with $236.4 million in 2010 and $258.5 million

in 2009. The decrease in 2011 was driven by decreases

in commercial and leasing and equipment finance net

charge-offs and reserves as customer performance

improved, partially offset by higher net charge-offs and

TDR reserves for consumer real estate loans. The increase

in provision for TDRs was primarily due to growth in TDRs,

in part due to a new accounting standard, and use of longer

term modifications. The decrease in 2010 was primarily due

to decreased levels of provision in excess of net charge-offs

in the consumer real estate portfolio.

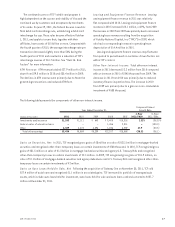

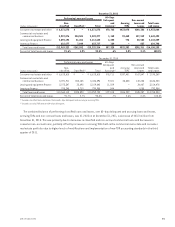

Net loan and lease charge-offs were $211 million, or

1.45% of average loans and leases, in 2011, compared

with $215.1 million, or 1.47% of average loans and leases,

in 2010 and $186.5 million, or 1.34% of average loans and

leases, in 2009.

Consumer real estate charge-off rates increased

throughout 2011 due primarily to increased delinquencies

and declines in real estate values. As a result, TCF increased

consumer real estate allowance levels. The increase in

consumer real estate net charge-offs was partially due to

a policy modification to require more frequent valuations

after loans are moved to non-accrual status until clear

title is received, in response to longer foreclosure timelines

due to court backlogs. The initial impact of the non-accrual

loan policy change accelerated the timing of charge-offs

on non-accrual consumer real estate loans by $2.2 million

in the third quarter of 2011. It had no impact on TCF’s

provision or net income since these losses were previously

provided for in the allowance for loan and lease losses.

The decrease in 2010 was driven by decreased levels of

provision in excess of net charge-offs in the consumer real

estate portfolio.

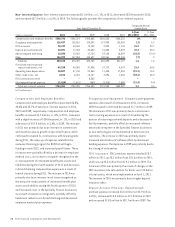

The provision for credit losses is calculated as part of

the determination of the allowance for loan and lease

losses. The determination of the allowance for loan and

lease losses and the related provision for credit losses is

a critical accounting estimate which involves a number

of factors such as historical trends in net charge-offs,

delinquencies in the loan and lease portfolio, year of loan

or lease origination, value of collateral, general economic

conditions and management’s assessment of credit risk

in the current loan and lease portfolio. Also see “Item 7.

Management’s Discussion and Analysis of Financial

Condition and Results of Operations — Consolidated

Financial Condition Analysis — Credit Quality — Allowance

for Loan and Lease Losses”.

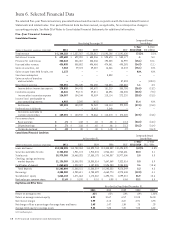

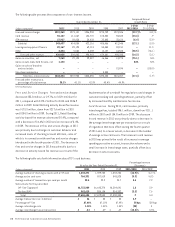

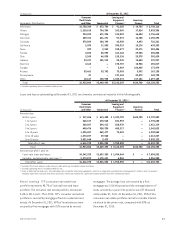

Non-Interest Income Non-interest income is a

significant source of revenue for TCF, representing 38.8%

of total revenues in 2011, 43.5% in 2010 and 45.4% in 2009,

and is an important factor in TCF’s results of operations.

Providing a wide range of retail banking services is an

integral component of TCF’s business philosophy and a major

strategy for generating additional non-interest income. Total

fees and other revenue was $436 million for 2011, compared

with $508.9 million in 2010 and $496.5 million in 2009.

252011 Form 10-K