TCF Bank 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

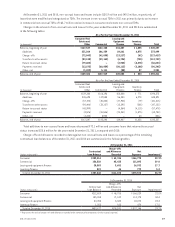

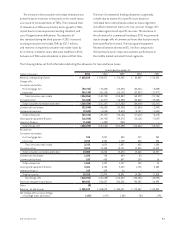

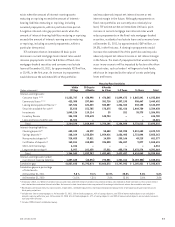

Contractual Obligations and Commitments As disclosed in Notes 11 and 12 of Notes to Consolidated Financial

Statements, TCF has certain obligations and commitments to make future payments under contracts. At December 31, 2011,

the aggregate contractual obligations (excluding bank deposits) and commitments are as follows.

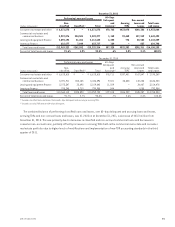

(In thousands) Payments Due by Period

Contractual Obligations Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Total borrowings (1) $4,388,080 $ 64,038 $523,671 $2,134,348 $1,666,023

Annual rental commitments under non-cancelable

operating leases 214,131 26,193 52,359 44,964 90,615

Campus marketing agreements 47,214 3,159 7,164 6,033 30,858

Total $4,649,425 $ 93,390 $583,194 $2,185,345 $1,787,496

(In thousands) Amount of Commitment – Expiration by Period

Commitments Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Commitments to lend:

Consumer real estate and other $1,349,779 $ 89,852 $106,718 $ 79,754 $1,073,455

Commercial 279,076 156,461 49,401 47,239 25,975

Leasing and equipment finance 177,534 177,534 – – –

Total commitments to lend 1,806,389 423,847 156,119 126,993 1,099,430

Standby letters of credit and guarantees

on industrial revenue bonds 26,964 19,842 415 6,707 –

Total $1,833,353 $443,689 $156,534 $ 133,700 $1,099,430

(1) Total borrowings excludes interest.

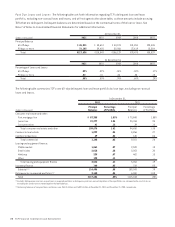

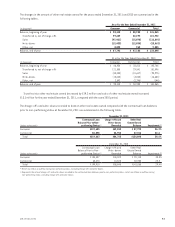

Commitments to lend are agreements to lend to a

customer provided there is no violation of any condition

in the contract. These commitments generally have fixed

expiration dates or other termination clauses and may

require payment of a fee. Since certain of the commitments

are expected to expire without being drawn upon, the

total commitment amounts do not necessarily represent

future cash requirements. By contract, the Company, in

its sole discretion, may terminate or otherwise modify the

credit arrangement in place with a customer. Collateral

predominantly consists of residential and commercial

real estate. The credit facilities established for inventory

finance customers are discretionary credit arrangements

which do not obligate the Company to lend.

Campus marketing agreements consist of fixed or

minimum obligations for exclusive marketing and naming

rights with seven campuses. TCF is obligated to make

various annual payments for these rights in the form of

royalties and scholarships through 2029. TCF also has

various renewal options, which may extend the terms of

these agreements. Campus marketing agreements are an

important element of TCF’s campus banking strategy.

See Note 18 of Notes to Consolidated Financial

Statements for information on standby letters of credit

and guarantees on industrial revenue bonds.

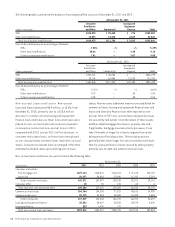

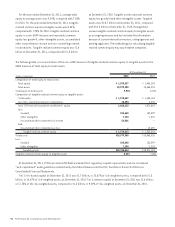

Equity Total equity at December 31, 2011 was $1.9 billion,

or 9.90% of total assets, up from $1.5 billion, or 8.02% of

total assets, at December 31, 2010. The increase in total

equity was primarily the result of TCF’s public offering

of common stock in March 2011 and increased retained

earnings. Dividends to common stockholders on a per share

basis totaled 20 cents in both 2011 and 2010. TCF’s dividend

payout ratio was 28.1% and 18.3% in 2011 and 2010,

respectively. The Company’s primary funding sources for

dividends are dividends received from TCF Bank.

At December 31, 2011, TCF had 5.4 million shares

remaining in its stock repurchase program authorized by its

Board of Directors, but would need approval from the Federal

Reserve before repurchasing stock under this authorization.

452011 Form 10-K