TCF Bank 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TCF Financial Corporation | 2011 Annual Report

Foundational strength. Visionary future.

Table of contents

-

Page 1

Foundational strength. Visionary future. TCF Financial Corporation | 2011 Annual Report -

Page 2

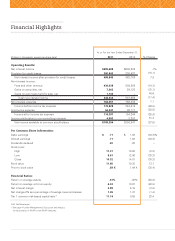

... or For the Year Ended December 31, (Dollars in thousands, except per-share data) 2011 2010 % Change Operating Results: Net interest income Provision for credit losses Net interest income after provision for credit losses Non-interest income: Fees and other revenue Gains on securities, net Gains... -

Page 3

1923 Twin City Building and Loan Association begins business 1972 First $1 billion in assets achieved 1986 TCF becomes a publicly-traded company 1997 TCF enters leasing business with acquisition of Winthrop Resources Corporation -

Page 4

... retail checking account opened 2008 TCF expands into inventory finance business in the U.S. and Canada 2011 TCF enters auto finance business with acquisition of Gateway One Lending & Finance, LLC 2012 Evolution of TCF focusing on disciplined asset growth, especially national specialty finance... -

Page 5

... profitable bank it is today. Table of Contents 02 Letter to Our Stockholders 12 Board of Directors Annual Report on Form 10-K 01 08 18 19 56 60 103 Business Risk Factors Selected Financial Data Management's Discussion and Analysis Consolidated Financial Statements Notes to Consolidated Financial... -

Page 6

... to the changing banking environment will allow us to stay ahead of the curve and make TCF a premier investment choice. regional and national lending businesses funded by a regional, core deposit platform. We have implemented a new functional management structure that will better support this growth... -

Page 7

... acquisition of Gateway One Lending & Finance, Inc. (Gateway One), an indirect auto ï¬nance company headquartered in California. While these new programs will result in additional operational risks, I am conï¬dent that with the extensive due diligence completed, their experienced management teams... -

Page 8

...pay off our senior unsecured notes and continue the growth of our very successful specialty ï¬nance businesses. TCF's capital management strategy is prudent and provides ï¬,exibility to take advantage of balance sheet opportunities. • With TCF's annual dividend rate of $.20 per share in 2011, TCF... -

Page 9

... the current economic conditions, TCF continued to fund new consumer real estate loans to creditworthy customers during 2011. The new loans have performed well with low delinquencies and minimal charge-offs. We expect to have more opportunities to add loans in this portfolio as home values stabilize... -

Page 10

... charge-offs decreased only 2 percent, or 2 basis points, in 1986 In 1986, TCF became one of the first banks to offer free checking. To this day, TCF continues to develop convenient and innovative deposit account products. 2011. Overall, credit metrics showed some improvement from peak 2010 levels... -

Page 11

... 2011. Commercial net charge-offs and provision tend to be lumpy as credits are worked out, especially in this Real estate owned properties decreased throughout 2011. This was an encouraging sign as the length of time in the foreclosure process continues to be lengthy. At December 31, 2011, TCF... -

Page 12

... fees and service charges declined 20 percent from 2010 primarily due to the full annual impact in 2011 of Regulation E, the opt-in regulations regarding ATM transactions and one-time debit card transactions that became effective in August 2010. While I feel TCF did a good job educating customers... -

Page 13

... BRP's inventory ï¬nance program and the acquisition of the Gateway One auto lending business. In 2012, we will need to successfully integrate these businesses to take advantage of the growth prospects they provide. Our new management structure will make this process much more efï¬cient. We must... -

Page 14

... the types of fees charged going forward. Fee strategies may be impacted by the changes we make as well as the ensuing public perception. We already saw this in 2011 when public outcry caused Bank of America to back off of their plan to charge a debit card usage fee. 10 TCF Financial Corporation... -

Page 15

...TCF's Chief Financial Ofï¬cer and has now assumed the role of Vice Chairman of Funding, Operations and Finance. Craig was previously Executive Vice President overseeing TCF's specialty ï¬nance division and will you to all of our employees for all of their hard work during another challenging year... -

Page 16

...Lending, TCF Financial Corporation Director since 2012 Past Chair, University of Minnesota Foundation, Former Acting President, Wellesley College Director since 1988 Partner, Fredrikson & Byron PA Director since 2010 Vice Chairman and Executive Vice President, Funding, Operations and Finance, TCF... -

Page 17

...State or other jurisdiction of (I.f.S. Employer Identification No.) incorporation or organization) 200 Lake Street East, Mail Code EX0-03-A, Wayzata, Minnesota 55391-1693 (Address of principal executive offices and zip code) Registrant's telephone number, including area code: 952-745-2760 Securities... -

Page 18

... 14. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and felated Stockholder Matters Certain felationships and felated Transactions, and Director Independence Principal Accounting Fees and Services 107 107... -

Page 19

...South Dakota. TCF Bank operates bank branches in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana, Arizona and South Dakota (TCF's primary banking markets). TCF's focus is on the delivery of retail and commercial banking products in markets served by TCF Bank. TCF also conducts commercial... -

Page 20

.... TCF offers retail checking account customers inexpensive, convenient access to funds at local merchants and ATMs through its debit card programs. TCF's debit card programs are supported by interchange fees charged to retailers. Key drivers of non-interest income are the number of deposit accounts... -

Page 21

..., small business and commercial deposits are a source of low-interest cost funds attracted from within TCF's primary banking markets through the offering of a broad selection of deposit instruments including consumer interest-bearing checking accounts, regular savings accounts, money market accounts... -

Page 22

... finance, inventory finance and auto finance activities. See "Item 1. Business - Wholesale Banking" for more information. Competition TCF competes with a number of depository institutions and financial service providers in its primary banking market areas and nationally, and experiences significant... -

Page 23

...managing or controlling banks, providing services for its subsidiaries, or conducting activities permitted by the Federal feserve as being closely related to the business of banking. Further restrictions or limitations on acquisitions or establishing financial subsidiaries may also be imposed by TCF... -

Page 24

... rates for 2011 ranged from $.0066 to $.0100 for each $100 of deposits. Financing Corporation assessments of $1.2 million in each of 2011, 2010 and 2009 were paid by TCF Bank. Under federal law, deposits and certain claims for administrative expenses and employee compensation against an insured... -

Page 25

... impose corporate income and franchise taxes and local tax returns in certain cities and other taxing jurisdictions. TCF's primary banking activities are in the states of Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana, Arizona and South Dakota. The methods of filing, and the methods for... -

Page 26

... and profitability are impacted by general business and economic conditions in the local markets in which TCF operates, the U.S. generally and abroad. Economic conditions have a significant impact on the demand for TCF's products and services, as well as the ability of its customers to repay loans... -

Page 27

... processes intended to identify, measure, monitor, report and analyze the types of risk to which TCF is subject, including liquidity, credit, market, interest rate, operational, legal and compliance and reputational risk. However, as with any risk management framework, there are inherent limitations... -

Page 28

...technological changes, as well as continued industry consolidation which may increase in connection with current economic and market conditions. TCF competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions... -

Page 29

... customers. Failure to successfully keep pace with technological change affecting the financial services industry could have a material adverse effect on TCF's financial condition and results of operations. New lines of business or new products and services may subject TCF to additional risk. From... -

Page 30

...ï¬nancial condition and results of operations. TCF settles funds on behalf of financial institutions, other businesses and consumers and receives funds from payment networks, consumers and other paying agents. TCF's businesses depend on their ability to process, record and monitor a large number of... -

Page 31

... TCF Bank is unable to pay dividends to it, TCF may not be able to pay obligations or pay dividends, which would have a material adverse effect on TCF's financial condition and results of operations. Changes in accounting policies or in accounting standards could materially affect how TCF reports... -

Page 32

..., cost savings, increases in geographic or product presence or other projected benefits; potential disruption to TCF's business; potential diversion of TCF management's time and attention; potential loss of key employees and customers of the target company; and potential changes in banking or tax... -

Page 33

..., financial condition and capital requirements, the cash available to pay such dividends (derived mainly from dividends and distributions from TCF Bank), as well as regulatory and contractual limitations and such other factors as the Board of Directors may deem relevant. In general, TCF Bank may... -

Page 34

... and legislative changes because TCF believes that the New Peer Group represents a more relevant group of companies in the financial services industry. The New and Old TCF Peer Groups are shown below for comparison purposes. TCF Stock Performance Chart Total Return Performance $140 120 100 Index... -

Page 35

... N.A. Not Applicable. (1) The current share repurchase authorization was approved by the Board of Directors on April 14, 2007 and was announced in a press release dated April 16, 2007. The authorization was for a repurchase of up to an additional 5% of TCF's common stock outstanding at the time of... -

Page 36

... in thousands, except per-share data) Loans and leases Securities available for sale Total assets Checking, savings and money market deposits Certificates of deposit Total deposits Borrowings Stockholders' equity Book value per common share Key Ratios and Other Data: 2011 2010 $14,150,255 $14,788... -

Page 37

...leases. TCF's retail lending operation offers fixed- and variable-rate loans and lines of credit secured by residential real estate properties. Commercial loans are generally made on properties or to customers located within TCF's primary banking markets. The leasing and equipment finance businesses... -

Page 38

... team. The addition of Gateway One further diversifies TCF's lending business and provides ample growth opportunities within the U.S. auto lending marketplace, the second largest consumer finance market in the U.S. The following portions of Management's Discussion and Analysis of Financial Condition... -

Page 39

...-type lease activity, gains on sales of auto loans and increases in commercial loan prepayment fees. Wholesale Banking non-interest expense totaled $208.7 million in 2011, up $17.4 million from $191.3 million in 2010, primarily as a result of increased FDIC insurance premiums resulting from changes... -

Page 40

...: Mortgage-backed securities U.S. Treasury securities Other securities Total securities available for sale (1) Loans and leases held for sale Loans and leases: Consumer real estate: Fixed-rate Variable-rate Consumer - other Total consumer real estate and other Commercial: Fixed- and adjustable-rate... -

Page 41

...: Mortgage-backed securities Debentures U.S. Treasury securities Other securities Total securities available for sale (1) Loans and leases: Consumer real estate: Fixed-rate Variable-rate Consumer - other Total consumer real estate and other Commercial: Fixed- and adjustable-rate Variable-rate Total... -

Page 42

...real estate and other Commercial: Fixed- and adjustable-rate Variable-rate Total commercial Leasing and equipment finance Inventory finance Total loans and leases Total interest income Interest expense: Checking Savings Money market Certificates of deposit Borrowings: Short-term borrowings Long-term... -

Page 43

... finance net charge-offs and reserves as customer performance improved, partially offset by higher net charge-offs and TDf reserves for consumer real estate loans. The increase in provision for TDfs was primarily due to growth in TDfs, in part due to a new accounting standard, and use of longer term... -

Page 44

...number of checking accounts with a TCF card Average active card users Average number of transactions per card per month Sales volume for the year ended: Off-line (Signature) On-line (PIN) Total Average transaction size (in dollars) Percentage off-line Average interchange rate Average interchange fee... -

Page 45

... finance inspection fees. The increase in 2010 from 2009 was primarily due to a gain on a non-marketable investment of $538 thousand. The following table presents the components of other non-interest income. Year Ended December 31, (Dollars in thousands) Investments and insurance Gains on sales... -

Page 46

...31, (Dollars in thousands) 2011 Compensation and employee benefits $348,792 Occupancy and equipment 126,437 FDIC insurance 28,747 Deposit account premiums 22,891 Advertising and marketing 10,034 Other 146,909 Subtotal 683,810 Foreclosed real estate and repossessed assets, net 49,238 Operating lease... -

Page 47

... 2010 was primarily attributable to the reversal of reserves on several unfunded commitments that were closed and lower premium costs related to consumer real estate loan pool insurance. Visa Indemnification Expense TCF is a member of Visa U.S.A. for issuance and processing of its card transactions... -

Page 48

...change through a charge or credit to the Consolidated Statements of Income. Also, if current period income tax rates change, the impact on the annual effective income tax rate is applied year-todate in the period of enactment. Consolidated Financial Condition Analysis Securities Available for Sale... -

Page 49

...fixed-term amounts under lines of credit which are included in closed-end loans. (2) Excludes operating leases included in other assets. (3) Gross of deferred fees and costs. This table does not include the effect of prepayments, which is an important consideration in management's interest-rate risk... -

Page 50

... 31, 2010. TCF's closed-end consumer real estate loans require payments of principal and interest over a fixed term. The average home value, which is based on original values securing the loans and lines of credit in this portfolio, was $258 thousand as of December 31, 2011. Substantially all of TCF... -

Page 51

... in service. Declines in the value 2011 Form 10-K of leased equipment increase the potential for impairment losses and credit losses due to diminished collateral value, and may result in lower sales-type revenue at the end of the contractual lease term. See Note 1 of Notes to Consolidated Financial... -

Page 52

....0% 39.6 8.4 100.0% 2010 Balance $441,691 220,472 130,191 $792,354 Percent of Total 55.8% 27.8 16.4 100.0% Equipment Type Lawn and garden Powersports and other Electronics and appliances Total TCF Inventory Finance continues to expand its core programs during 2011 and signed exclusive agreements... -

Page 53

...,311 $14,150,255 2.1% 100.0% (Dollars in thousands) Consumer real estate and other Commercial real estate and commercial business Leasing and equipment finance Inventory finance Total loans and leases Percent of total loans and leases (1) (2) December 31, 2010 60+ Days Performing Loans and Leases... -

Page 54

...114,496 3,140 $117,636 Consumer real estate and other: First mortgage lien Junior lien Consumer other Total consumer real estate and other Commercial real estate Commercial business Total commercial Leasing and equipment finance: Middle market Small ticket Winthrop Other Total leasing and equipment... -

Page 55

... of contractual payments or a change in interest rate. Commercial loan modifications which are not classified as TDfs primarily involve loans on which interest rates were modified to current market rates for similarly situated borrowers who have access to alternative funds or on which TCF received... -

Page 56

... inventory finance loans when reported as nonaccrual. Most of TCF's non-accrual loans and past due loans are secured by real estate. Given the nature of these assets and the related mortgage foreclosure, property sale and, if applicable, mortgage insurance claims processes, it can take 18 months or... -

Page 57

...57,478) (60,738) (226) $345,257 Total additions to non-accrual loans and leases decreased $72.1 million and consumer loans that returned to accrual status increased $30.6 million for the year ended December 31, 2011, compared with 2010. Charge-offs and allowance recorded to date against non-accrual... -

Page 58

... in commercial or residential real estate values in TCF's markets may have an adverse impact on the current adequacy of the allowance for loan and lease losses by increasing credit risk and the risk of potential loss. The total allowance for loan and lease losses is generally available to absorb... -

Page 59

... consumer real estate and other Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Total recoveries Net charge-offs Provision charged to operations Other Balance, at end of year Net charge-offs as a percentage of average loans and leases 2011... -

Page 60

...estate net charge-offs during 2011 increased $23.3 million from 2010, including Illinois where economic conditions are lagging other TCF markets and where foreclosure times are longer, thus exposing TCF to continued losses caused by declining home values. TCF's consumer real estate charge-off policy... -

Page 61

... real estate owned for the years ended December 31, 2011 and 2010 are summarized in the following tables. (In thousands) Balance, beginning of year Transferred in, net of charge-offs Sales Write-downs Other, net Balance, end of year At or For the Year Ended December 31, 2011 Consumer Commercial... -

Page 62

... funds and fee income for TCF. Checking, savings and money market deposits totaled $11.1 billion at December 31, 2011, up $579.6 million from December 31, 2010, and comprised 91.3% of total deposits at December 31, 2011, compared with 91.1% of total deposits at December 31, 2010. The average balance... -

Page 63

... for inventory finance customers are discretionary credit arrangements which do not obligate the Company to lend. Campus marketing agreements consist of fixed or minimum obligations for exclusive marketing and naming rights with seven campuses. TCF is obligated to make various annual payments for... -

Page 64

... at December 31, 2011, compared with $18.3 billion at December 31, 2010. Management reviews tangible realized common equity to tangible assets as an ongoing measure and has included this information because of current interest by investors, rating agencies and banking regulators. The methodology... -

Page 65

...'s common capital generated for the year ended December 31, 2011 is as follows. (Dollars in thousands) 2011 Net income available to common stockholders $109,394 Common shares purchased by TCF employee benefit plans 17,971 Amortization of stock compensation 11,105 Cancellation of common shares (3,692... -

Page 66

...to the following changes in loans and leases: reduced levels of higher yielding fixed-rate consumer real estate loans and decreases in leasing and equipment finance and commercial real estate portfolio balances and average yields, partially offset by reductions in average deposit rates. Net interest... -

Page 67

... of 2011 in response to a new Federal regulation regarding debit card interchange fees. Foreclosed real estate and repossessed asset expense decreased $1.5 million, or 11.4%, for the quarter ended December 31, 2011 primarily due to decreases in the number of consumer real estate properties owned... -

Page 68

... to increase the number of deposit accounts; adverse changes in credit quality and other risks posed by TCF's loan, lease, investment and securities available for sale portfolios, including declines in commercial or residential real estate values or changes in the allowance for loan and lease losses... -

Page 69

... that deposit account losses (fraudulent checks, etc.) may increase; failure to keep pace with technological change. Litigation Risks fesults of litigation, including class action litigation concerning TCF's lending or deposit activities including account servicing processes or fees or charges, or... -

Page 70

... case scenario over the next 12 months if short- and long-term interest rates were to sustain an immediate increase of 100 basis points. Management also uses valuation analyses to measure risk in the balance sheet that might not be taken into account in the net interest income simulation analyses... -

Page 71

..., TCF estimates that an immediate 100 basis point increase in current mortgage loan interest rates would reduce prepayments on the fixed-rate mortgage-backed securities, residential real estate loans and consumer loans at December 31, 2011, by approximately $269 million, or 34.5%, in the first year... -

Page 72

...asset liquidity levels and the amount available from existing funding sources are reported to ALCO on a monthly basis. At year end, TCF's Liquidity Management Policy and current operating practices established a daily asset liquidity, in excess of the daily market risk collateral requirement of $800... -

Page 73

... and 28 to the consolidated financial statements, the Company has elected to change its method of accounting for pension and other postretirement benefits in 2011. All periods have been retrospectively restated for this accounting change. Minneapolis, Minnesota February 21, 2012 2011 Form 10-K 55 -

Page 74

...,174 - Assets Cash and due from banks Investments Securities available for sale Loans and leases held for sale Loans and leases: Consumer real estate and other Commercial Leasing and equipment finance Inventory finance Total loans and leases Allowance for loan and lease losses Net loans and leases... -

Page 75

...on auto loans held for sale, net Total non-interest income Non-interest expense: Compensation and employee benefits Occupancy and equipment FDIC insurance Deposit account premiums Advertising and marketing Other Subtotal Foreclosed real estate and repossessed assets, net Operating lease depreciation... -

Page 76

...105 - Stock compensation tax benefits - - - 280 - Change in shares held in trust for deferred compensation plans, at cost - - - 10,474 - Balance, December 31, 2011 160,366,380 $ - $1,604 $715,247 $1,127,823 See accompanying notes to consolidated financial statements. 58 TCF Financial Corporation and... -

Page 77

... of Federal Home Loan Bank stock Proceeds from sales of real estate owned Purchases of premises and equipment Acquisition of Fidelity National Capital, Inc., net of cash acquired Other, net Net cash used by investing activities Cash flows from financing activities: Net increase in deposits Net... -

Page 78

...primarily in retail banking and wholesale banking through its primary subsidiary, TCF National Bank ("TCF Bank"). TCF Bank owns leasing and equipment finance, inventory finance, auto finance and feal Estate Investment Trust ("fEIT") subsidiaries. These subsidiaries are consolidated with TCF Bank and... -

Page 79

... and the fixed non-cancelable, lease term begins. TCF recognizes these interim payments in the month they are earned and records the income in interest income on direct finance leases. Management has policies and procedures in place for the determination of lease classification and review of the... -

Page 80

... penalties. Changes in the estimated amounts due or owed may result from closing of the statute of limitations on tax returns, new legislation, clarification of existing legislation through government pronouncements, the courts and through the examination process. TCF's policy is to report interest... -

Page 81

... due. If the loan is current at notification of bankruptcy, the loan is placed on non-accrual status at 90 days past due or when four payments are owed, or after a partial charge-off, which management feels is appropriate based on the experience of TCF's customer activity and loan type. There is no... -

Page 82

... compensation. Employee Benefits Plans During the fourth quarter of 2011, TCF retrospectively changed its method of accounting for pension and other postretirement benefits. TCF's prior policy was to report net actuarial gains and losses as a component of stockholders' equity in the Consolidated... -

Page 83

... business and provides growth opportunities within the U.S. auto lending marketplace. As a result of the acquisition, Gateway One became a wholly-owned subsidiary of TCF Bank and, accordingly, its results of operations since November 30, 2011 have been included within TCF's consolidated financial... -

Page 84

... sheet and fee growth and cross selling opportunities. The goodwill was assigned to TCF's Wholesale Banking segment. None of the goodwill recognized is expected to be deductible for income tax purposes. Pursuant to the terms of the acquisition, three key members of Gateway One's management team... -

Page 85

...investment category and length of time individual securities have been in a continuous unrealized loss position. Unrealized losses on securities available for sale are due to lower values for equity securities or changes in interest rates and not due to credit quality issues. TCF has the ability and... -

Page 86

...Operating leases of $69.6 million and $77.4 million at December 31, 2011 and December 31, 2010, respectively, are included in other assets in the Consolidated Statements of Financial Condition. From time to time, TCF sells minimum lease payments to third-party financial institutions at fixed rates... -

Page 87

... contractual servicing fees are adequate to compensate TCF for its servicing responsibilities. The unpaid principal balance of auto loans serviced for third parties was $425.1 million at December 31, 2011. Future minimum lease payments receivable for direct financing, sales-type leases and operating... -

Page 88

... reserves and other information regarding the allowance for loan and lease losses and balances by type of allowance methodology. TCF's key credit quality indicator is the receivable's performance status, defined as accruing or non-accruing. Consumer Real Estate and Other $ 174,503 (169,534) 13,005... -

Page 89

... Consumer real estate and other: First mortgage lien $ 4,525,951 Junior lien 2,110,334 Other 34,829 Total consumer real estate and other 6,671,114 Commercial real estate 3,092,855 Commercial business 227,970 Total commercial 3,320,825 Leasing and equipment finance: Middle market 1,627,369 Small... -

Page 90

...additional funds committed to commercial borrowers in TDf status was $8.5 million and $2.2 million at December 31, 2011 and December 31, 2010, respectively. When a loan is modified as a TDf, there is not a direct, material impact on the loans within the Consolidated Statements of Financial Condition... -

Page 91

...) Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial real estate Commercial business Total commercial Leasing and equipment finance: Middle market Total leasing and equipment finance Total (In thousands) For the Year Ended December 31, 2010 Contractual... -

Page 92

... reporting period. TCF considers a loan to have defaulted when it becomes 90 or more days delinquent under the modified terms, has been transferred to non-accrual status or has been transferred to other real estate owned. For the Year Ended December 31, 2011 2010 Number of Loans Loan Balance... -

Page 93

... 31, 2010 felated Year-to-Date Year-to-Date Allowance Average Loan Interest Income Loan Balance fecorded Balance fecognized Impaired loans with an allowance recorded: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial real estate Commercial business Total... -

Page 94

... in accruing commercial TDfs. Included in impaired loans were $413.7 million and $326.1 million of accruing consumer real estate loan TDfs less than 90 days past due as of December 31, 2011 and December 31, 2010, respectively. TCF leases certain premises and equipment under operating leases. Net... -

Page 95

...8.9 100.0% Rate at Year-end -% .16 .07 .37 .36 .25 .75 .29 Amount $ 2,442,522 2,187,227 4,629,749 5,855,263 651,377 11,136,389 1,065,615 $12,202,004 Checking: Non-interest bearing Interest bearing Total checking Savings Money market Total checking, savings and money market Certificates of deposit... -

Page 96

.... Total Year ended December 31, average daily balance Federal Home Loan Bank advances Federal funds purchased Securities sold under repurchase agreements U.S. Treasury, tax and loan borrowings Line of Credit - TCF Commercial Finance Canada, Inc. Total Maximum month-end balance Federal Home Loan Bank... -

Page 97

... funding will be available from the FHLB at the thenprevailing market rate of interest for the term selected by TCF, subject to standard terms and conditions. The next call year and stated maturity year for the callable FHLB advances and repurchase agreements outstanding at December 31, 2011... -

Page 98

... from: State income tax, net of federal income tax benefit Investments in affordable housing Deductible stock dividends Changes in uncertain tax positions Compensation deduction limitations Non-controlling interest tax effect Tax exempt income Other, net Effective income tax rate 80 TCF Financial... -

Page 99

... unrecognized tax benefits within the next twelve months from normal expirations of statutes of limitation are not expected to be material. Deferred tax assets: Allowance for loan and lease losses Stock compensation and deferred compensation plans Securities available for sale Net operating losses... -

Page 100

... common shares, respectively. Shares Held in Trust for Deferred Compensation Plans TCF has maintained certain deferred compensation plans that previously allowed eligible executives, senior officers and certain other employees to defer payment of up to 100% of their base salary and bonus as well as... -

Page 101

.... In general, TCF Bank may not declare or pay a dividend to TCF in excess of 100% of its net retained profits for the current year combined with its retained net profits for the preceding two calendar years, which was $329.4 million at December 31, 2011, without prior approval of the Office of the... -

Page 102

...benefit recognized for stock compensation expense Weighted average amortization (years) TCF has also issued stock options under the Program that generally become exercisable over a period of one to ten years from the date of the grant and expire after ten years. All outstanding options have a fixed... -

Page 103

... million in 2011 and $6.9 million in both 2010 and 2009. Pension Plan The TCF Cash Balance Pension Plan (the "Pension Plan") is a qualified defined benefit plan covering eligible employees who are at least 21 years old and have completed a year of eligibility service with TCF. Employees hired after... -

Page 104

... at end of year Change in fair value of plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Benefits paid TCF Contributions Fair value of plan assets at end of year Funded status of plans at end of year Amounts recognized in the Statements of Financial Condition... -

Page 105

... net benefit plan cost were as follows. Pension Plan Year Ended December 31, Assumptions used to determine net benefit plan cost Discount rate Expected long-term rate of return on plan assets N.A. Not Applicable. Postretirement Plan Year Ended December 31, 2009 6.25% 8.50 2011 4.75% N.A. 2010 5.25... -

Page 106

... average long-term annual returns of 1.5%, net of administrative expenses, on plan assets over complete market cycles. A 1% difference in the expected return on plan assets would result in a $550 thousand change in net periodic benefit cost. The discount rate used to determine TCF's Pension Plan... -

Page 107

... of a customer to a third-party. These conditional commitments expire in various years through 2016. Collateral held primarily consists of commercial real estate mortgages. Since the conditions under which TCF is required to fund these commitments may not materialize, the cash requirements are... -

Page 108

.... Includes $150 thousand of cash collateral received and $135 thousand of cash collateral posted at December 31, 2011. The value of forward foreign exchange contracts will vary over their contractual term as the related currency exchange rates fluctuate. The accounting for changes in the fair value... -

Page 109

...the pre-tax impact of foreign exchange activity on other non-interest expense within the Consolidated Statements of Income and Consolidated Statements of Financial Condition, by accounting designation. (In thousands) For the Year Ended December 31, 2011 2010 $(4,751) $ 1,720 $ 265 3,062 $ - (1,976... -

Page 110

...compensation plans include investments in publicly traded stocks, excluding TCF common stock reported in treasury and other equity, and U.S. Treasury notes. The fair value of these assets is based upon prices obtained from independent asset pricing services based on active markets. 92 TCF Financial... -

Page 111

...At December 31, 2010: Securities available for sale: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Other U.S. Treasury securities Other securities Forward foreign currency contracts Assets held in trust for deferred compensation plans (4) Total assets Forward... -

Page 112

..., real estate broker's price opinions, or automated valuation methods, less estimated selling costs. Certain properties require assumptions that are not observable in an active market in the determination of fair value. The fair value of repossessed and returned equipment is based on available... -

Page 113

...Loans: Consumer real estate and other Commercial real estate Commercial business Equipment finance loans Inventory finance loans Allowance for loan losses (1) Total financial instrument assets Financial instrument liabilities: Checking, savings and money market deposits Certificates of deposit Short... -

Page 114

...other assets in the Consolidated Statements of Financial Condition. This excess interest represents future proceeds and is generated as the contractual loan rate less the fixed rate that will be paid to the investor as specified in the loan sale agreements. TCF uses available market data, along with... -

Page 115

... method, under which earnings are allocated to both common shares and participating securities. (Dollars in thousands, except per-share data) 2011 $ 109,394 - - 109,394 292 $ 109,102 155,938,871 (1,716,565) Year Ended December 31, 2010 $ 150,947 - - 150,947 752 $ 150,195 139,681,722 (1,065,206... -

Page 116

..., Treasury Services and Support Services have been identified as reportable operating segments. fetail Banking includes branch banking and retail lending. Wholesale Banking includes commercial banking, leasing and equipment finance, inventory finance and auto finance. Treasury Services includes TCF... -

Page 117

...information of each of TCF's reportable segments, including a reconciliation of TCF's consolidated totals. (In thousands) fetail Banking Wholesale Banking Treasury Services Support Eliminations Services and Other(1) Consolidated At or For the Year Ended December 31, 2011: Revenues from external... -

Page 118

Note 26. Parent Company Financial Information TCF Financial Corporation's (parent company only) condensed statements of financial condition as of December 31, 2011 and 2010, and the condensed statements of income and cash flows for the years ended December 31, 2011, 2010 and 2009 are as follows. ... -

Page 119

... Plans Stock Compensation tax benefits (expense) (fepayments of) proceeds from senior unsecured term note Other, net Net cash provided (used) by financing activities Net increase (decrease) in cash Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year TCF Financial... -

Page 120

... Statements of Financial Condition for the periods presented are included below. Year Ended December 31, 2010 2009 (Dollars in thousands, except per-share data) Consolidated Statements of Income: Prior accounting: Compensation and employee benefits Income tax expense Net income available to common... -

Page 121

... Dec. 31, 2011 Sept. 30, 2011 June 30, 2011 March 31, 2011 Dec. 31, 2010 Sept. 30, 2010 June 30, 2010 March 31, 2010 Selected Financial Condition Data: Total loans and leases Securities available for sale Goodwill Total assets Deposits Short-term borrowings Long-term borrowings Total equity... -

Page 122

... of the Exchange Act) during the quarter ended December 31, 2011 that materially affected, or are reasonably likely to materially affect, TCF's internal control over financial reporting. During the fourth quarter of 2011, TCF completed the acquisition of Gateway One Lending & Finance, LLC ("Gateway... -

Page 123

... Executive Officer (Principal Executive Officer), Chief Financial Officer (Principal Financial Officer) and the Controller and Managing Director of Corporate Development (Principal Accounting Officer), completed an assessment of TCF's internal control over financial reporting as of December 31, 2011... -

Page 124

... the Public Company Accounting Oversight Board (United States), the consolidated statements of financial condition of TCF Financial Corporation and subsidiaries as of December 31, 2011 and 2010, and the related consolidated statements of operations, equity and cash flows for each of the years in the... -

Page 125

... Principal Executive Officer ("PEO"), Principal Financial Officer ("PFO") and Principal Accounting Officer ("PAO") (the "Senior Financial Management Code of Ethics") as well as a code of ethics generally applicable to all officers (including the PEO, PFO and PAO), directors and employees of TCF (the... -

Page 126

Item 12. Security Ownership of Certain Beneï¬cial Owners and Management and Related Stockholder Matters Information regarding ownership of TCF's common stock by TCF's directors, executive officers, and certain other stockholders and shares authorized under plans is set forth in the 2012 Proxy ... -

Page 127

... TCF and its subsidiaries, are filed as part of this report: Desc rip tio n Page Selected Financial Data Consolidated Statements of Financial Condition at December 31, 2011 and 2010 Consolidated Statements of Income for each of the years in the three-year period ended December 31, 2011 Consolidated... -

Page 128

... the Board and Chief Executive Officer (Principal Executive Officer) Executive Vice President and Chief Financial Officer (Principal Financial Officer) Senior Vice President, Controller and Managing Director of Corporate Development (Principal Accounting Officer) Director Director Director Director... -

Page 129

... fiscal year ended December 31, 1987, No. 0-16431]; Fifth Amendment to the Plan [incorporated by reference to Exhibit 10(a) to TCF Financial Corporation's Annual feport on Form 10-K for the fiscal year ended December 3(b) 4(a) 4(b) 4(c) 4(d) 4(e) 4(f) 4(g) 4(h) 4(i) 4(j) 10(a)* 2011 Form 10... -

Page 130

...Summary of Stock Award Program for Consumer Lending and Business Banker Divisions [incorporated by reference to Exhibit 10(b)-3 to TCF Financial Corporation's Annual feport on Form 10-K for the fiscal year ended December 31, 2005] Form of Year 2006 Executive Stock Grant Award Agreement dated January... -

Page 131

... Current feport on Form 8-K filed January 27, 2005] festated Trust Agreement as executed with First National Bank in Sioux Falls as trustee effective as of October 1, 2000 [incorporated by reference to Exhibit 10(d) of TCF Financial Corporation's Annual feport on Form 10-K for the fiscal year ended... -

Page 132

... quarter ended September 30, 2010] fesolution adopting Directors Stock Grant Program goal for fiscal year 2009 and after [incorporated by reference to Exhibit 10(n)-1 of TCF Financial Corporation's Current feport on Form 8-K filed January 23, 2009] Form of 2011 Management Incentive Plan - Executive... -

Page 133

... to TCF Financial Corporation's Current feport on Form 8-K filed February 18, 2011] Summary on Non-Employee Director Compensation Computation of fatios of Earnings to Fixed Charges for periods ended December 31, 2011, 2010, 2009, 2008 and 2007 Letter on Change in Accounting Principles Subsidiaries... -

Page 134

..., George Johnson & Company Vance K. Opperman James M. famstad 1,2,3,4,5,6,7 TCF Commercial Lending Managing Director James J. Urbanek President and Chief Executive Officer, Key Investment, Inc. 3,6 Executive Vice Presidents Douglas W. Benner Thomas f. Bobak J. Thomas Finnegan Michael f. Klemz... -

Page 135

TCF Equipment Finance, Inc. President and Chief Operating Officer William S. Henak TCF Commercial Finance Canada, Inc. President Peter D. Kelley Executive Vice President, Controller and Managing Director of Corporate Development, NCF National Bank David M. Stautz Senior Vice Presidents Barbara L.... -

Page 136

...ï¬ces Executive Offices NCF Financial Corporation 200 Lake Street East Mail Code: EX0-03-A Wayzata, MN 55391-1693 (952) 745-2760 Minnesota/South Dakota Nraditional Branches Minneapolis/St. Paul Area (45) Greater Minnesota (2) South Dakota (1) TCF Equipment Finance, Inc. Headquarters 11100 Wayzata... -

Page 137

...unclaimed property laws. TCF is not providing legal advice on unclaimed property laws. The Annual Meeting of Stockholders of TCF will be held on Wednesday, April 25, 2012, 3:00 p.m. (local time) at the Marriott Minneapolis West, 9960 Wayzata Boulevard, St. Louis Park, Minnesota. 2011 Annual Report... -

Page 138

... releases, investor presentations, quarterly conference calls, annual reports, and SEC filings. Information may also be obtained, free of charge, from: TCF Financial Corporation Corporate Communications 200 Lake Street East Mail Code: EX0-01-C Wayzata, MN 55391-1693 (952) 745-2760 Credit Ratings... -

Page 139

... a large number of low cost accounts through convenient services and products targeted to a broad range of customers. As a result of the profits we earn from the deposit business, we can minimize credit risk on the asset side. Secured and Diversified Lender TCF maintains a secured loan and lease... -

Page 140

TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 www.tcfbank.com TCFIR9350