TCF Bank 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 | TCF Financial Corporation and Subsidiaries

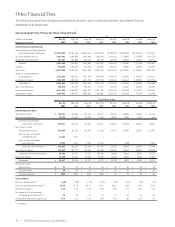

Other Financial Data

The selected quarterly financial data presented below should be read in conjunction with the Consolidated Financial

Statements and related notes.

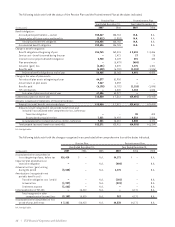

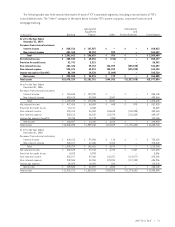

Selected Quarterly Financial Data (Unaudited) At

(Dollars in thousands, Dec. 31, Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31,

except per-share data) 2007 2007 2007 2007 2006 2006 2006 2006

Selected Financial Condition Data:

Loans and leases excluding education

and residential real estate loans $11,810,629 $11,334,162 $11,038,605 $10,815,212 $10,705,890 $10,496,031 $10,231,268 $ 9,824,661

Securities available for sale 1,963,681 2,022,505 1,943,450 1,859,244 1,816,126 1,770,427 1,781,995 1,816,135

Residential real estate loans 527,607 547,552 572,619 602,748 627,790 659,477 695,214 732,912

Subtotal 2,491,288 2,570,057 2,516,069 2,461,992 2,443,916 2,429,904 2,477,209 2,549,047

Goodwill 152,599 152,599 152,599 152,599 152,599 152,599 152,599 152,599

Total assets 15,977,054 15,530,338 14,977,704 14,898,375 14,669,734 14,319,387 14,222,561 13,851,936

Checking, savings and money

market deposits 7,322,014 7,312,568 7,331,605 7,420,480 7,285,615 7,224,223 7,261,327 7,461,186

Certificates of deposit 2,254,535 2,433,498 2,511,090 2,477,230 2,483,635 2,454,469 2,382,273 2,128,723

Total deposits 9,576,549 9,746,066 9,842,695 9,897,710 9,769,250 9,678,692 9,643,600 9,589,909

Short-term borrowings 556,070 167,319 285,828 47,376 214,112 376,397 561,374 346,528

Long-term borrowings 4,417,378 4,266,022 3,568,997 3,571,930 3,374,428 2,976,133 2,778,277 2,688,131

Stockholders’ equity 1,099,012 1,043,447 1,001,032 1,062,008 1,033,374 1,031,189 977,385 968,300

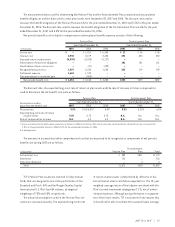

Three Months Ended

Dec. 31, Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31,

2007 2007 2007 2007 2006 2006 2006 2006

Selected Operations Data:

Net interest income $ 139,571 $ 137,704 $ 137,425 $ 135,477 $ 135,887 $ 135,033 $ 135,442 $ 131,168

Provision for credit losses 20,124 18,883 13,329 4,656 10,073 5,288 4,177 1,151

Net interest income after

provision for credit losses 119,447 118,821 124,096 130,821 125,814 129,745 131,265 130,017

Non-interest income:

Fees and other revenue 124,845 126,394 126,882 112,164 118,831 128,252 123,622 114,571

Gains on sales of securities

available for sale 11,261 2,017 ––––––

Gains on sales of branches

and real estate 2,752 1,246 2,723 31,173 – 1,260 – 2,928

Total non-interest income 138,858 129,657 129,605 143,337 118,831 129,512 123,622 117,499

Non-interest expense 172,613 162,777 162,534 164,200 165,562 162,389 160,966 160,280

Income before income tax expense 85,692 85,701 91,167 109,958 79,083 96,868 93,921 87,236

Income tax expense 22,875 26,563 29,038 27,234 25,350 30,941 26,860 29,014

Net income $ 62,817 $ 59,138 $ 62,129 $ 82,724 $ 53,733 $ 65,927 $ 67,061 $ 58,222

Per common share:

Basic earnings $ .51 $ .48 $ .49 $ .65 $ .42 $ .51 $ .52 $ .45

Diluted earnings $ .50 $ .48 $ .49 $ .65 $ .42 $ .51 $ .52 $ .45

Dividends declared $ .2425 $ .2425 $ .2425 $ .2425 $ .23 $ .23 $ .23 $ .23

Financial Ratios:

Return on average assets (1) 1.60% 1.55% 1.67% 2.24% 1.49% 1.86% 1.92% 1.71%

Return on average common equity (1) 23.55 23.39 24.16 31.81 20.68 26.44 27.75 23.82

Net interest margin (1) 3.83 3.90 4.02 4.00 4.07 4.11 4.22 4.25

Net charge-offs as a percentage

of average loans and leases (1) .46 .38 .24 .10 .24 .18 .16 .08

Average total equity to average assets 6.79 6.64 6.92 7.03 7.20 7.02 6.92 7.18

(1) Annualized.