TCF Bank 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 73

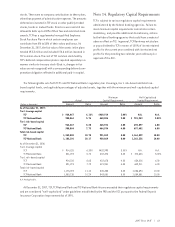

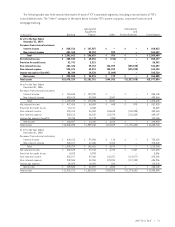

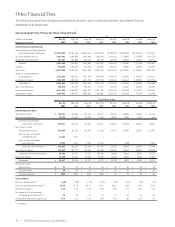

The following table sets forth certain information of each of TCF’s reportable segments, including a reconciliation of TCF’s

consolidated totals. The “other” category in the table below includes TCF’s parent company, corporate functions and

mortgage banking.

Leasing and Eliminations

Equipment and

(In thousands) Banking Finance Other Reclassifications Consolidated

At or For the Year Ended

December 31, 2007:

Revenues from external customers:

Interest income $ 820,516 $ 147,507 $ – $ – $ 968,023

Non-interest income 481,346 59,152 959 – 541,457

Total $ 1,301,862 $ 206,659 $ 959 $ – $ 1,509,480

Net interest income $ 485,535 $ 65,356 $ (714) $ – $ 550,177

Provision for credit losses 51,741 5,251 – – 56,992

Non-interest income 481,346 59,152 156,899 (155,940) 541,457

Non-interest expense 594,691 65,351 158,022 (155,940) 662,124

Income tax expense (benefit) 88,389 19,330 (2,009) – 105,710

Net income $ 232,060 $ 34,576 $ 172 $ – $ 266,808

Total assets $15,478,259 $2,281,781 $144,582 $(1,927,568) $15,977,054

At or For the Year Ended

December 31, 2006:

Revenues from external customers:

Interest income $ 763,846 $ 122,292 $ – $ – $ 886,138

Non-interest income 428,413 53,004 8,047 – 489,464

Total $ 1,192,259 $ 175,296 $ 8,047 $ – $ 1,375,602

Net interest income $ 477,453 $ 58,659 $ 445 $ 973 $ 537,530

Provision for credit losses 18,121 2,568 – – 20,689

Non-interest income 428,413 53,004 134,645 (126,598) 489,464

Non-interest expense 585,512 56,932 132,378 (125,625) 649,197

Income tax expense (benefit) 93,786 18,773 (394) – 112,165

Net income $ 208,447 $ 33,390 $ 3,106 $ – $ 244,943

Total assets $14,256,595 $ 1,989,230 $131,509 $ (1,707,600) $ 14,669,734

At or For the Year Ended

December 31, 2005:

Revenues from external customers:

Interest income $ 634,312 $ 97,596 $ 114 $ – $ 732,022

Non-interest income 425,017 47,465 5,760 – 478,242

Total $ 1,059,329 $ 145,061 $ 5,874 $ – $ 1,210,264

Net interest income $ 455,549 $ 57,014 $ 2,780 $ 2,347 $ 517,690

Provision for credit losses 4,593 3,993 – – 8,586

Non-interest income 425,017 47,465 125,337 (119,577) 478,242

Non-interest expense 549,586 48,596 125,984 (117,230) 606,936

Income tax expense 96,505 18,493 280 – 115,278

Net income $ 229,882 $ 33,397 $ 1,853 $ – $ 265,132

Total assets $12,931,312 $ 1,635,528 $195,355 $ (1,373,601) $ 13,388,594