TCF Bank 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11 . I n c o m e Ta x e s

Income taxes were lower than planned in 2007 due to

favorable tax developments including the closing of

certain previous years’ tax returns, changes in state tax

laws, and positive developments in income tax audits.

2008 Focus Areas and Concerns

1 . T h e Y i e l d C u r v e a n d I n t e r e s t R a t e s

The strong headwinds continue and make this area

very challenging to manage. The current credit crunch

and liquidity crisis has crept into deposit pricing and

increased our deposit costs. Further Federal Reserve

Board interest rate cuts may be difficult to offset through

lower deposit rates.

2 . C r e d i t Q u a l i t y

Economic conditions are always a major risk for all

banks, including TCF. A recession would adversely

impact our results through increased loan and lease

charge-offs and higher loss provisions. Further deterio-

ration in home values is also a risk. We expect TCF’s

credit quality to deteriorate modestly in 2008 with

somewhat higher charge-off levels. Our risk is elevated

in this area due to the weak Michigan economy and

depressed housing market.

3 . R e t a i l B a n k i n g

In 2008, we are refocusing our retail banking efforts to

improve the quality of our deposit accounts and grow

deposit balances. Active checking account customers

produce higher revenues and have lower attrition rates.

We have enhanced our internal reporting and changed

employee incentives to influence their behavior.

Growing deposits in this economic climate is going to

be very difficult.

Retail banking is an important area for our company

and one with significant future financial benefits.

This is a high priority item for our entire management

team in 2008.

2007 Annual Report | page 7Letter to Stockholders

Retail banking is an important area for

our company and one with significant future

financial benefits.

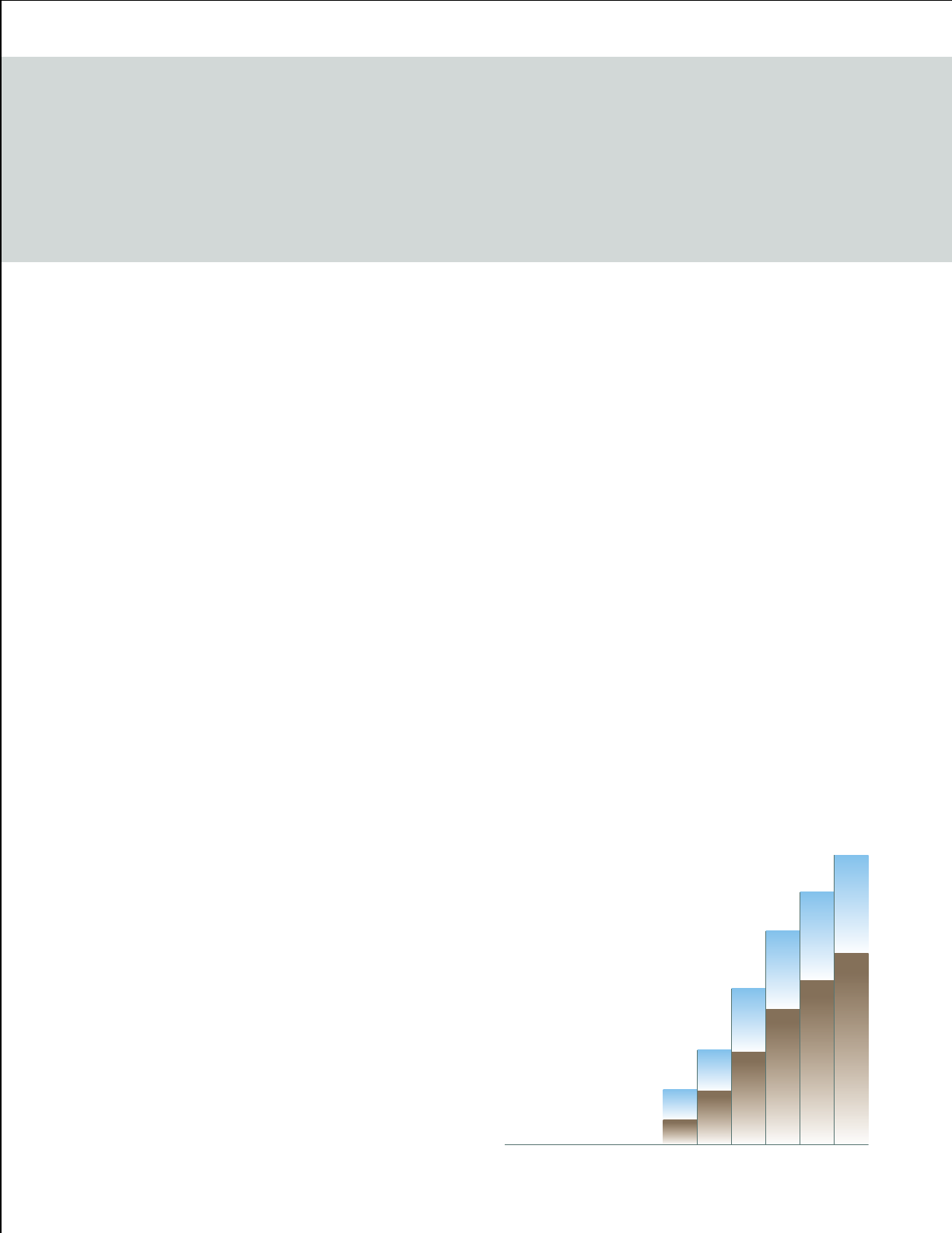

12/07

141

12/06

123

12/05

104

12/04

76

12/03

46

12/02

27

Total New

Branches

Number of Branches

■Supermarket Branches

■Traditional and Campus Branches

Branches opened since January 1, 2002.