TCF Bank 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 53

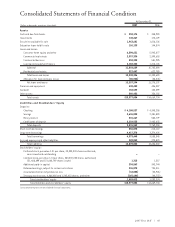

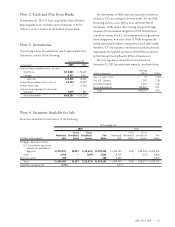

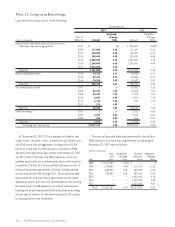

Note 2. Cash and Due from Banks

At December 31, 2007, TCF was required by Federal Reserve

Board regulations to maintain reserve balances of $97.9

million in cash on hand or at the Federal Reserve Bank.

Note 3. Investments

The carrying values of investments, which approximate their

fair values, consist of the following.

At December 31,

(In thousands) 2007 2006

Federal Home Loan Bank stock, at cost:

Des Moines $115,848 $ 73,630

Chicago 4,617 4,617

Subtotal 120,465 78,247

Federal Reserve Bank stock, at cost 20,423 20,023

Federal funds sold –71,000

Interest-bearing deposits with banks

and other 7,379 859

Total investments $148,267 $170,129

The investments in FHLB stock are required investments

related to TCF’s borrowings from these banks. All new FHLB

borrowing activity since 2000 is done with the FHLB of

Des Moines. FHLBs obtain their funding primarily through

issuance of consolidated obligations of the Federal Home

Loan Bank system. The U.S. Government does not guarantee

these obligations, and each of the 12 FHLBs are generally

jointly and severally liable for repayment of each other’s debt.

Therefore, TCF’s investments in these banks could be adversely

impacted by the financial operations of the FHLBs and actions

by the Federal Housing Board’s Office of Supervision.

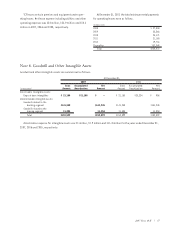

The carrying values and yields on investments at

December 31, 2007, by contractual maturity, are shown below.

Carrying

(Dollars in thousands) Value Yield

Due in 1 year or less $ 14 2.46%

Due in 5-10 years 200 2.00

Due after 10 years 7,164 4.38

No stated maturity 140,889 4.57

Total $148,267 4.56

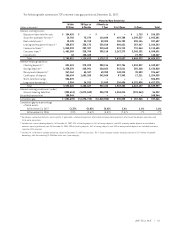

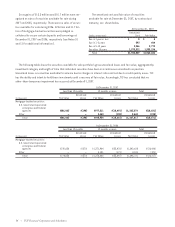

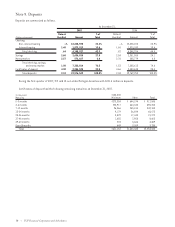

Note 4. Securities Available for Sale

Securities available for sale consist of the following.

At December 31,

2007 2006

Gross Gross Gross Gross

Amortized Unrealized Unrealized Fair Amortized Unrealized Unrealized Fair

(Dollars in thousands) Cost Gains Losses Value Cost Gains Losses Value

Mortgage-backed securities:

U.S. Government sponsored

enterprises and federal

agencies $1,975,817 $2,493 $(18,681) $1,959,630 $1,843,744 $880 $(34,046) $1,810,578

Other 3,992 – (190) 3,801 4,719 – (171) 4,548

Other securities 250 – – 250 1,000 – – 1,000

Total $1,980,059 $2,493 $(18,871) $1,963,681 $1,849,463 $880 $(34,217) $1,816,126

Weighted-average yield 5.27% 5.37%