TCF Bank 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 61

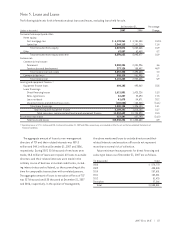

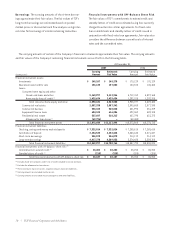

The $75 million of subordinated notes due 2014 have a

fixed-rate coupon of 5% through June 14, 2009, and will

reprice quarterly thereafter at the three-month LIBOR rate

plus 1.63%. The $50 million of subordinated notes due 2015

have a fixed-rate coupon of 5% through March 14, 2010, and

will reprice quarterly thereafter at the three-month LIBOR

rate plus 1.56%. These subordinated notes may be redeemed

by TCF Bank at par after June 14, 2009, and March 14, 2010,

respectively. The $75 million of subordinated notes due 2016

have a fixed-rate coupon of 5.5% until February 1, 2016. These

subordinated notes qualify as Tier 2 or supplementary capi-

tal for regulatory purposes, subject to certain limitations.

For certain equipment leases, TCF utilizes its lease rentals

and underlying equipment as collateral to borrow from other

financial institutions at fixed rates on a non-recourse basis.

In the event of a default by the customer on these financings,

the other financial institution has a first lien on the underly-

ing leased equipment and TCF is only entitled to residual

proceeds in excess of the outstanding borrowing balance.

Additionally, in the case of non-recourse financings, the other

financial institution has no further recourse against TCF.

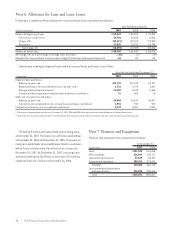

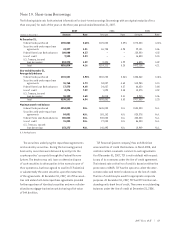

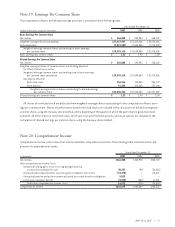

Note 12. Income Taxes

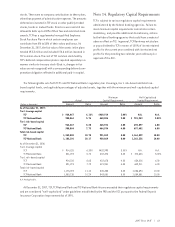

(In thousands) Current Deferred Total

Year ended December 31, 2007:

Federal $ 91,170 $13,900 $105,070

State 3,100 (2,460) 640

Total $ 94,270 $11,440 $105,710

Year ended December 31, 2006:

Federal $ 112,465 $ (439) $ 112,026

State 1,830 (1,691) 139

Total $114,295 $(2,130) $ 112,165

Year ended December 31, 2005:

Federal $ 120,793 $(7,241) $ 113,552

State 1,788 (62) 1,726

Total $ 122,581 $(7,303) $ 115,278

The effective income tax rate differs from the federal

income tax rate of 35% as a result of the following.

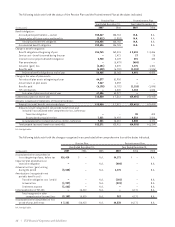

Year Ended December 31,

(In thousands) 2007 2006 2005

Federal income tax rate 35.00% 35.00% 35.00%

Increase (decrease) in income

tax expense resulting from:

State income tax, net

of federal income

tax benefit .11 .03 .29

Deductible stock dividends (1.04) (1.14) (1.17)

Investments in affordable

housing limited

partnerships (.60) (.60) (.64)

Federal settlement of

prior year issue (2.27) ––

Changes in uncertain

tax positions (2.73) (1.72) (3.67)

Other, net (.09) (.16) .49

Effective income tax rate 28.38% 31.41% 30.30%

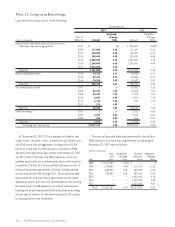

Effective January 1,2007, TCF adopted Financial Accounting

Standards Board Interpretation No. 48, Accounting for

Uncertainty in Income Taxes, an Interpretation of FASB

Statement No.109 (the Interpretation). This Interpretation

provides guidance on financial statement recognition and

measurement of tax positions taken, or expected to be

taken, in tax returns. The initial adoption of this Interpretation

had no impact on TCF’s financial statements.

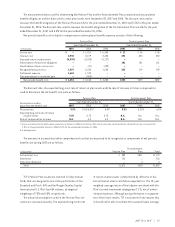

A reconciliation of the change in the gross amount,

before related tax effects, of unrecognized tax benefits

from January 1, 2007 to December 31, 2007 is as follows:

(In thousands)

Balance at January 1, 2007 $24,316

Increases for tax positions related to the

current year 2,305

Increases for tax positions related to prior years 211

Decreases for tax positions related to prior years (10,150)

Decreases related to lapse of applicable statutes

of limitation (3,642)

Balance at December 31, 2007 $13,040