TCF Bank 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50 | TCF Financial Corporation and Subsidiaries

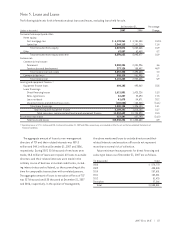

Lease Financing TCF provides various types of lease

financing that are classified for accounting purposes as

direct financing, sales-type or operating leases. Leases

that transfer substantially all of the benefits and risks of

equipment ownership to the lessee are classified as direct

financing or sales-type leases and are included in loans

and leases. Direct financing and sales-type leases are carried

at the combined present value of the future minimum lease

payments and the lease residual value. The determination of

the lease classification requires various judgments and esti-

mates by management including the fair value of the equip-

ment at lease inception, useful life of the equipment under

lease, estimate of the lease residual value and collectibility

of minimum lease payments.

Sales-type leases generate dealer profit which is recog-

nized at lease inception by recording lease revenue net of

the lease cost. Lease revenue consists of the present value

of the future minimum lease payments. Lease cost consists

of the leased equipment’s book value, less the present value

of its residual. The revenues associated with other types of

leases are recognized over the term of the underlying leases.

Interest income on direct financing and sales-type leases

is recognized using methods which approximate a level

yield over the fixed, non-cancelable term of the leases.

TCF receives pro-rata rent payments for the interim period

until the lease contract commences and the fixed, non-

cancelable, lease term begins. TCF recognizes these interim

payments in the month they are earned and records the

income in interest income on direct finance leases.

Management has policies and procedures in place for the

determination of lease classification and review of the

related judgments and estimates for all lease financings.

Some lease financings include a residual value compo-

nent, which represents the estimated fair value of the

leased equipment at the expiration of the initial term of

the transaction. The estimation of residual values involves

judgments regarding product and technology changes,

customer behavior, shifts in supply and demand and other

economic assumptions. These estimates are reviewed at

least annually and downward adjustments, if necessary,

are charged to non-interest expense in the periods in which

they become known.

Leases which do not transfer substantially all benefits

and risks of ownership to the lessee are classified as oper-

ating leases. Operating leases represent a rental agreement

where ownership of the underlying equipment resides with

the lessor. Such leased equipment and related initial direct

costs are included in other assets on the balance sheet and

are depreciated on a straight-line basis over the term of

the lease to its estimated salvage value. Depreciation

expense is recorded as operating lease expense and included

in non-interest expense. Operating lease rental income is

recognized when it is due according to the provisions of

the lease and is reflected as a component of non-interest

income. An allowance for lease losses is not provided on

operating leases.

Income Taxes Income taxes are accounted for using the

asset and liability method. Under this method, deferred tax

assets and liabilities are recognized for the future tax con-

sequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities

and their respective tax-basis carrying amounts. Deferred

tax assets and liabilities are measured using enacted tax

rates expected to apply to taxable income in the years in

which those temporary differences are expected to be

recovered or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recognized in income

in the period that includes the enactment date.

The determination of current and deferred income taxes

is a critical accounting estimate which is based on complex

analyses of many factors including interpretation of federal

and state income tax laws, the evaluation of uncertain tax

positions, differences between the tax and financial report-

ing bases of assets and liabilities (temporary differences),

estimates of amounts due or owed such as the timing of

reversal of temporary differences and current financial

accounting standards. Additionally, there can be no assur-

ance that estimates and interpretations used in determining

income tax liabilities may not be challenged by federal and

state taxing authorities. Actual results could differ signifi-

cantly from the estimates and tax law interpretations used in

determining the current and deferred income tax liabilities.

In the preparation of income tax returns, tax positions are

taken based on interpretation of federal and state income