TCF Bank 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 | TCF Financial Corporation and Subsidiaries

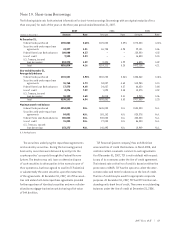

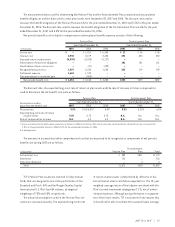

The total amount of unrecognized tax benefits that, if

recognized, would affect the tax provision and the effective

income tax rate is $6.5 million, net of related tax benefit

effects.

TCF’s policy is to report interest and penalties, if any,

related to unrecognized tax benefits in income tax expense

in the Consolidated Statements of Income. The gross amount

of accrued interest at December 31, 2007 is $1.4 million.

TCF recorded a reduction of accrued interest of $768 thou-

sand during 2007.

TCF’s federal income tax returns are open and subject

to examination from the 2004 tax return year and forward.

TCF’s various state income tax returns are generally open

from the 2003 and later tax return years based on individual

state statutes of limitation. Changes in the amount of

unrecognized tax benefits within the next twelve months

from normal expirations of statutes of limitation are not

expected to be material. TCF is under examination by certain

states. TCF does not currently expect to resolve these

examinations within the next twelve months. Developments

in these examinations or other events could cause manage-

ment to change its judgment about the amount of unrecog-

nized tax benefits. Due to the amount and nature of these

possible events, an estimate of the range of reasonably

possible changes in the amount of unrecognized tax bene-

fits cannot be made.

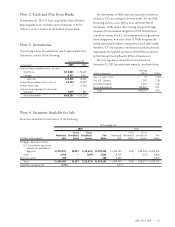

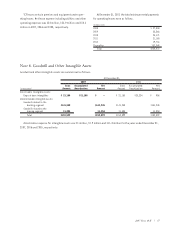

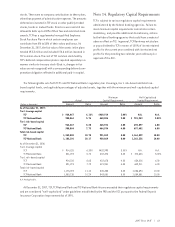

The significant components of the Company’s deferred

tax assets and deferred tax liabilities are as follows.

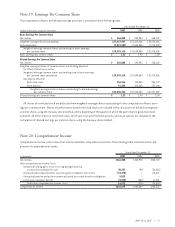

At December 31,

(In thousands) 2007 2006

Deferred tax assets:

Stock compensation and deferred

compensation plans $ 30,766 $ 30,817

Allowance for loan and lease losses 30,968 21,531

Securities available for sale 5,868 11,748

Net operating losses and credits 7,065 6,010

Valuation allowance (2,131) (2,447)

Other 7,161 5,199

Total deferred tax assets 79,697 72,858

Deferred tax liabilities:

Lease financing 109,455 94,928

Loan fees and discounts 25,412 24,000

Premises and equipment 13,143 9,220

Prepaid expenses 7,907 6,941

Pension and postretirement benefits 5,078 1,241

Investments in affordable housing 4,455 3,244

Investment in FHLB Stock 3,169 3,112

Other 3,186 1,929

Total deferred tax liabilities 171,805 144,615

Net deferred tax liabilities $ 92,108 $ 71,757

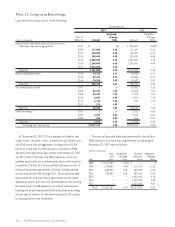

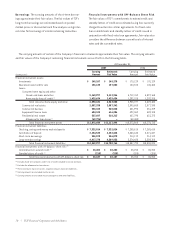

Note 13. Stockholders’ Equity

Restricted Retained Earnings Retained earnings at

December 31, 2007 includes approximately $134.4 million

for which no provision for federal income taxes has been

made. This amount represents earnings legally appropriated

to thrift bad debt reserves and deducted for federal income

tax purposes in prior years and is generally not available

for payment of cash dividends or other distributions to

shareholders. Future payments or distributions of these

appropriated earnings could invoke a tax liability for TCF

based on the amount of the distributions and the tax rates

in effect at that time.

Shareholder Rights Plan Each share of TCF common

stock outstanding includes one preferred share purchase

right. TCF’s preferred share purchase rights will become

exercisable only if a person or group acquires or announces

an offer to acquire 15% or more of TCF’s common stock.

When exercisable, each right will entitle the holder to buy

one one-hundredth of a share of a new series of junior par-

ticipating preferred stock at a price of $200. In addition,

upon the occurrence of certain events, holders of the rights

will be entitled to purchase either TCF’s common stock or

shares in an “acquiring entity” at half of the market value.

TCF’s Board of Directors is generally entitled to redeem the

rights at $.001 per right at any time before they become

exercisable. The rights will expire on June 9, 2009, if not

previously redeemed or exercised.

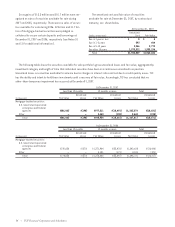

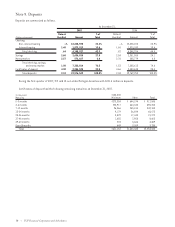

Treasury Stock and Other Treasury stock and other

consists of the following.

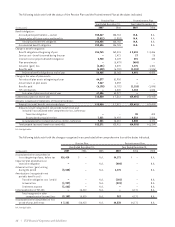

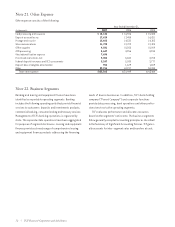

At December 31,

(In thousands) 2007 2006

Treasury stock, at cost $(126,020) $(27,827)

Shares held in trust for deferred

compensation plans, at cost (39,666) (32,945)

Total $(165,686) $(60,772)

TCF purchased 3.9 million, 3.9 million and 3.5 million

shares of its common stock during the years ended December

31, 2007, 2006 and 2005, respectively. At December 31, 2007,

TCF had 5.4 million shares remaining in its stock repurchase

programs authorized by the Board.

Shares Held in Trust for Deferred Compensation

Plans TCF has certain deferred compensation plans that

previously allowed eligible executives, senior officers and

certain other employees to defer payment of up to 100% of

their base salary and bonus as well as grants of restricted