TCF Bank 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42 | TCF Financial Corporation and Subsidiaries

Item 7A. Quantitative and

Qualitative Disclosures About

Market Risk

TCF’s results of operations are dependent to a large degree

on its net interest income and its ability to manage interest-

rate risk. Although TCF manages other risks, such as credit

risk, liquidity risk, operational and other risks, in the normal

course of its business, the Company considers interest-rate

risk to be its most significant market risk. See “Item 1A.

Risk Factors – Operational Risk Management” for further

discussion. Since TCF does not hold a trading portfolio,

the Company is not exposed to market risk from trading

activities. A mismatch between maturities, interest rate

sensitivities and prepayment characteristics of assets and

liabilities results in interest-rate risk. TCF, like most finan-

cial institutions, has material interest-rate risk exposure to

changes in both short-term and long-term interest rates as

well as variable interest rate indices (e.g., the prime rate).

TCF’s Asset/Liability Committee (ALCO) manages TCF’s

interest-rate risk based on interest rate expectations and

other factors. The principal objective of TCF’s asset/liabil-

ity management activities is to provide maximum levels of

net interest income while maintaining acceptable levels

of interest-rate risk and liquidity risk and facilitating the

funding needs of the Company.

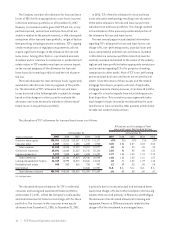

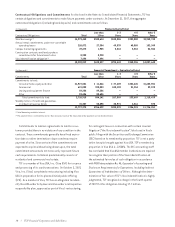

TCF utilizes net interest income simulation models to esti-

mate the near-term effects (next twelve months) of chang-

ing interest rates on its net interest income. Net interest

income simulation involves forecasting net interest income

under a variety of scenarios, including the level of interest

rates, the shape of the yield curve, and spreads between

market interest rates. The base net interest income simula-

tion performed as of December 31, 2007, assumes interest

rates are unchanged for the next twelve months. The net

interest income simulation shows that if short-term and

long-term interest rates were to sustain an immediate

increase or decrease of 100 basis points, for the next twelve

months that net interest income would not significantly

change from the base case.

Management exercises its best judgement in making

assumptions regarding events that management can impact

such as non-contractual deposit repricings and events out-

side management’s control such as customer behavior on

loan and deposit activity, counter-party decisions on callable

borrowings and the effect that competition has on both

loan and deposit pricing. These assumptions are inherently

uncertain and, as a result, net interest income simulation

results will differ from actual results due the timing, mag-

nitude and frequency of interest rate changes, changes in

market conditions, customer behavior and management

strategies, among other factors.

In addition to the net interest income simulation model,

management utilizes an interest rate gap measure (differ-

ence between interest-earning assets and interest-bearing

liabilities re-pricing within a given period). While the interest

rate gap measurement has some limitations, including no

assumptions regarding future asset or liability production

and a static interest rate assumption (large quarterly

changes may occur related to these items), the interest

rate gap represents the net asset or liability sensitivity at

a point in time. An interest rate gap measure could be signifi-

cantly affected by external factors such as loan prepayments,

early withdrawals of deposits, changes in the correlation of

various interest-bearing instruments, competition, or a rise

or decline in interest rates.

TCF’s one-year interest rate gap was a negative $1 billion,

or 6.4% of total assets at December 31, 2007, compared with

a negative $630 million, or 4.3% of total assets at December

31, 2006. A negative interest rate gap position exists when

the amount of interest-bearing liabilities maturing or

re-pricing exceeds the amount of interest-earning assets

maturing or re-pricing, including assumed prepayments,

within a particular time period.

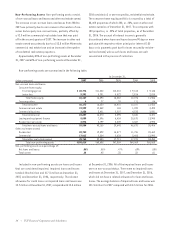

TCF estimates that an immediate100 basis point decrease

in current mortgage loan interest rates would increase

prepayments on the $7.4 billion of fixed-rate mortgage-

backed securities, residential real estate loans and consumer

loans at December 31, 2007, by approximately $977 million,

or 134.4%, in the first year. An increase in prepayments

would decrease the estimated life of the portfolios and may

adversely impact net interest income or net interest margin

in the future. Although prepayments on fixed-rate portfolios

are currently at a relatively low level, TCF estimates that

an immediate 100 basis point increase in current mortgage

loan interest rates would reduce prepayments on the fixed-

rate mortgage-backed securities, residential real estate

loans and consumer loans at December 31, 2007, by approx-

imately $257 million, or 35.4%, in the first year. A slowing

in prepayments would increase the estimated life of the

portfolios and may favorably impact net interest income or

net interest margin in the future.