TCF Bank 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2007 Form 10-K | 49

Note 1. Summary of Significant

Accounting Policies

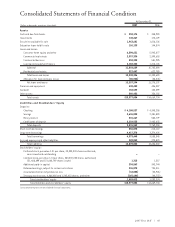

Basis of Presentation The consolidated financial state-

ments include the accounts of TCF Financial Corporation

and its wholly owned subsidiaries. TCF Financial Corporation

(“TCF” or the “Company”) a Delaware corporation, is a

financial holding company engaged primarily in community

banking and leasing and equipment finance through its pri-

mary subsidiaries, TCF National Bank and TCF National Bank

Arizona, collectively (“TCF Bank”). TCF Bank owns leasing

and equipment finance, investment and insurance sales

and Real Estate Investment Trust (“REIT”) subsidiaries.

These subsidiaries are consolidated with TCF Bank and are

included in the consolidated financial statements of TCF

Financial Corporation. All significant intercompany accounts

and transactions have been eliminated in consolidation.

Certain reclassifications have been made to prior years’

financial statements to conform to the current year presen-

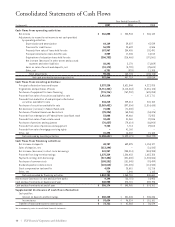

tation. For Consolidated Statements of Cash Flows purposes,

cash and cash equivalents include cash and due from banks.

The preparation of financial statements in conformity

with generally accepted accounting principles requires man-

agement to make estimates and assumptions that affect

the reported amounts of assets and liabilities, disclosure of

contingent assets and liabilities at the date of the financial

statements and the reported amount of revenues and

expenses during the reporting period. These estimates are

based on information available to management at the time

the estimates are made. Actual results could differ from

those estimates.

Policies Related to Critical Accounting Estimates

Summary of Critical Accounting Estimates Critical

accounting estimates occur in certain accounting policies

and procedures and are particularly susceptible to signifi-

cant change. Policies that contain critical accounting esti-

mates include the determination of the allowance for loan

and lease losses, lease financings and income taxes. Critical

accounting policies are discussed with and reviewed by

TCF’s Audit Committee.

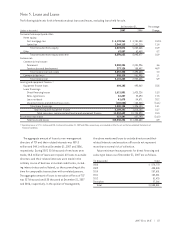

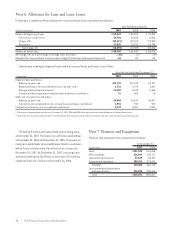

Allowance for Loan and Lease Losses The allowance

for loan and lease losses is maintained at a level believed

by management to be appropriate to provide for probable

loan and lease losses incurred in the portfolio as of the

balance sheet date, including known or anticipated prob-

lem loans and leases, as well as for loans and leases which

are not currently known to require specific allowances.

Management’s judgement as to the amount of the allowance

is a result of ongoing review of larger individual loans and

leases, the overall risk characteristics of the portfolios,

changes in the character or size of the portfolios, geographic

location and prevailing economic conditions. Additionally,

the level of impaired and non-performing assets, historical

net charge-off amounts, delinquencies in the loan and lease

portfolios, values of underlying loan and lease collateral

and other relevant factors are reviewed to determine the

amount of the allowance. Impaired loans include non-

accrual and restructured commercial real estate and com-

mercial business loans and equipment finance loans. Loan

impairment is measured as the present value of the expected

future cash flows discounted at the loan’s initial effective

interest rate or the fair value of the collateral for collateral-

dependent loans. Consumer loans, residential real estate

loans and leases are excluded from the definition of an

impaired loan and are evaluated on a pool basis.

Loans and leases are charged off to the extent they are

deemed to be uncollectible. The amount of the allowance

for loan and lease losses is highly dependent upon manage-

ment’s estimates of variables affecting valuation, appraisals

of collateral, evaluations of performance and status, and

the amounts and timing of future cash flows expected to

be received on impaired loans. Such estimates, appraisals,

evaluations and cash flows may be subject to frequent

adjustments due to changing economic prospects of bor-

rowers, lessees or properties. These estimates are reviewed

periodically and adjustments, if necessary, are recorded in

the provision for credit losses in the periods in which they

become known.

Notes to Consolidated Financial Statements