TCF Bank 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

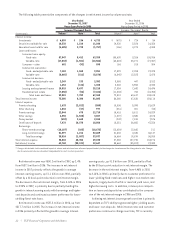

Net interest income was $550.2 million for 2007, up 2.4%

from $537.5 million in 2006. The increase in net interest

income in 2007 primarily reflects the growth in average

interest-earning assets, up $1.1 billion over 2006, partially

offset by a 22 basis point reduction in net interest margin.

The decrease in the net interest margin, from 4.16% in 2006

to 3.94% in 2007, is primarily due to partially funding the

growth in interest earning assets with borrowings and higher-

cost deposits and continued customer preference for lower-

yielding fixed-rate loans.

Net interest income was $537.5 million in 2006, up from

$517.7 million in 2005. The increase in net interest income

in 2006 primarily reflected the growth in average interest

earning assets, up $1.3 billion over 2005, partially offset

by the 30 basis point reduction in net interest margin. The

decrease in the net interest margin, from 4.46% in 2005

to 4.16% in 2006 is primarily due to customer preference for

lower-yielding fixed-rate loans and higher-cost market-rate

deposits, largely due to the flat or inverted yield curve, and

higher borrowing costs. In addition, intense price competi-

tion on loans and deposits has contributed to the compres-

sion of the net interest margin in 2006 and 2005.

Achieving net interest income growth over time is primarily

dependent on TCF’s ability to generate higher-yielding assets

and lower-cost deposits. While interest rates and customer

preferences continue to change over time, TCF is currently

22 | TCF Financial Corporation and Subsidiaries

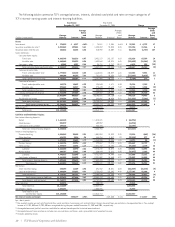

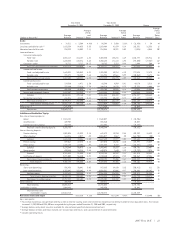

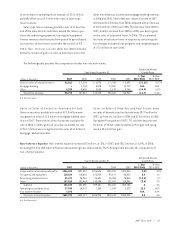

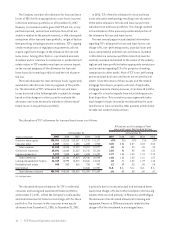

The following table presents the components of the changes in net interest income by volume and rate.

Year Ended Year Ended

December 31, 2007 December 31, 2006

Versus Same Period in 2006 Versus Same Period in 2005

Increase (Decrease) Due to Increase (Decrease) Due to

(In thousands) Volume(1) Rate(1) Total Volume(1) Rate(1) Total

Interest income:

Investments $ 4,599 $ 134 $ 4,733 $ (670) $ 724 $ 54

Securities available for sale 10,336 1,210 11,546 14,030 2,526 16,556

Education loans held for sale (4,485) 2,728 (1,757) (186) 4,274 4,088

Loans and leases:

Consumer home equity:

Fixed-rate 57,947 5,412 63,359 105,630 3,286 108,916

Variable-rate (17,033) (1,551) (18,584) (62,828) 35,271 (27,557)

Consumer – other 682 (92) 590 186 318 504

Commercial real estate:

Fixed- and adjustable-rate 7,183 1,868 9,051 17,592 2,283 19,875

Variable-rate (8,665) (211) (8,876) (6,845) 12,523 5,678

Commercial business:

Fixed- and adjustable-rate 2,249 133 2,382 3,065 447 3,512

Variable-rate 1,454 (126) 1,328 2,060 5,984 8,044

Leasing and equipment finance 19,518 5,697 25,215 17,054 7,642 24,696

Residential real estate (7,050) (52) (7,102) (11,004) 754 (10,250)

Total loans and leases 59,581 7,782 67,363 72,801 60,617 133,418

Total interest income 73,505 8,380 81,885 86,280 67,836 154,116

Interest expense:

Premier checking 1,633 (2,522) (889) 10,536 5,093 15,629

Other checking 1,034 (57) 977 (351) 301 (50)

Premier savings 12,044 675 12,719 18,418 5,611 24,029

Other savings 4,555 (1,528) 3,027 (1,207) 4,585 3,378

Money market (403) 2,668 2,265 (242) 7,818 7,576

Certificates of deposit 7,472 10,578 18,050 18,551 28,805 47,356

Borrowings:

Short-term borrowings (18,107) (565) (18,672) (12,654) 12,865 211

Long-term borrowings 51,397 1,212 52,609 31,802 4,345 36,147

Total borrowings 35,024 (1,087) 33,937 16,684 19,674 36,358

Total interest expense 28,884 40,354 69,238 27,080 107,196 134,276

Net interest income 42,768 (30,121) 12,647 55,662 (35,822) 19,840

(1) Changes attributable to the combined impact of volume and rate have been allocated proportionately to the change due to volume and the change due to rate. Changes

due to volume and rate are calculated independently for each line item presented.