TCF Bank 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 35

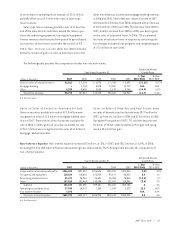

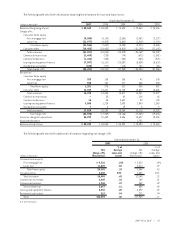

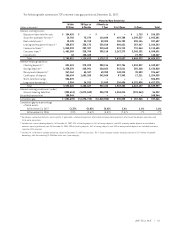

Past Due Loans and Leases The following table sets forth information regarding TCF’s delinquent loan and lease portfolio,

excluding loans held for sale and non-accrual loans and leases. TCF’s delinquency rates are determined based on the contrac-

tual terms of the loan or lease.

At December 31,

2007 2006

Percentage of Percentage of

Principal Loans and Principal Loans and

(Dollars in thousands) Balances Leases Balances Leases

Accruing loans and leases delinquent for:

30-59 days $46,748 .38% $34,607 .30%

60-89 days 20,445 .17 24,872 .22

90 days or more 15,384 .12 12,214 .11

Total $82,577 .67% $71,693 .63%

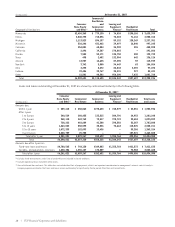

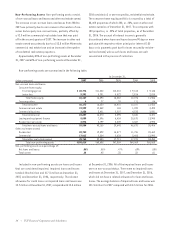

The following table summarizes TCF’s over 30-day delinquent loan and lease portfolio by loan type, excluding loans held for

sale and non-accrual loans and leases.

At December 31,

2007 2006

Principal Percentage of Principal Percentage of

(Dollars in thousands) Balances Portfolio Balances Portfolio

Consumer home equity

First mortgage lien $31,784 .76% $22,527 .60%

Junior lien 12,289 .53 11,406 .54

Total home equity 44,073 .68 33,933 .58

Consumer other 377 .56 380 .61

Total consumer 44,450 .68 34,313 .58

Commercial real estate 11,382 .45 18,072 .76

Commercial business 1,071 .19 762 .14

Total commercial 12,453 .40 18,834 .64

Leasing and equipment finance 15,691 .75 8,499 .47

Residential real estate 9,983 1.90 10,047 1.61

Total $82,577 .67 $71,693 .63

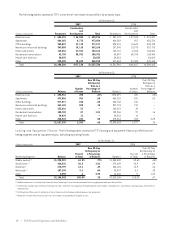

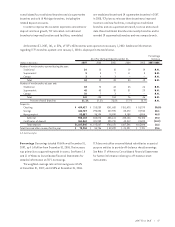

Potential Problem Loans and Leases In addition to

non-performing assets, there were $55.2 million of loans

and leases at December 31, 2007, for which management

has concerns regarding the ability of the borrowers to meet

existing repayment terms, compared with $66.1 million at

December 31, 2006. These loans and leases are primarily

classified as substandard for regulatory purposes and reflect

the distinct possibility, but not the probability, that the

Company will not be able to collect all amounts due accord-

ing to the contractual terms of the loan or lease agreement.

Although these loans and leases have been identified as

potential problem loans and leases, they may never become

delinquent, non-performing or impaired. Additionally, these

loans and leases are generally secured by commercial real

estate or other assets, thus reducing the potential for loss

should they become non-performing. Potential problem

loans and leases are considered in the determination of the

adequacy of the allowance for loan and lease losses. There

were no material leasing and equipment finance potential

problem loans at December 31, 2007, and 2006, respectively,

that were funded on a non-recourse basis.