TCF Bank 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 47

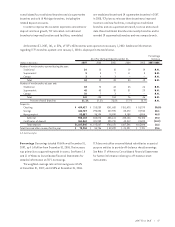

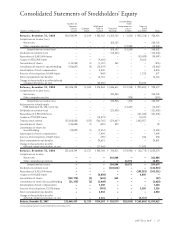

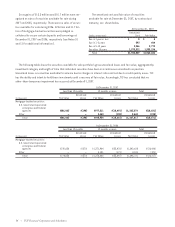

Consolidated Statements of Stockholders’ Equity

Accumulated

Number of Other

Common Additional Comprehensive Treasury

Shares Common Paid-in Retained (Loss)/ Stock

(Dollars in thousands) Issued Stock Capital Earnings Income and Other Total

Balance, December 31, 2004 184,939,094 $1,849 $ 505,542 $1,385,760 $ (1,415) $ (933,318) $ 958,418

Comprehensive income (loss):

Net income – – – 265,132 – – 265,132

Other comprehensive loss – – – – (19,800) – (19,800)

Comprehensive income (loss) – – – 265,132 (19,800) – 245,332

Dividends on common stock – – – (114,543) – – (114,543)

Repurchase of 3,450,000 shares – – – – – (93,499) (93,499)

Issuance of 526,900 shares – – (9,658) – – 9,658 –

Cancellation of shares (114,004) (1) (1,137) 262 – – (876)

Cancellation of shares for tax withholding (438,897) (4) (13,479) – – – (13,483)

Amortization of stock compensation – – 5,830 – – – 5,830

Exercise of stock options, 66,064 shares – – (648) – – 1,225 577

Stock compensation tax benefits – – 10,716 – – – 10,716

Change in shares held in trust for deferred

compensation plans, at cost – – (20,282) – – 20,282 –

Balance, December 31, 2005 184,386,193 $1,844 $ 476,884 $1,536,611 $(21,215) $ (995,652) $ 998,472

Comprehensive income (loss):

Net income – – – 244,943 – – 244,943

Other comprehensive loss – – – – (374) – (374)

Comprehensive income (loss) – – – 244,943 (374) – 244,569

Adjustment to initially apply

FASB Statement No.158, net of tax – – – – (13,337) – (13,337)

Dividends on common stock – – – (121,405) – – (121,405)

Repurchase of 3,900,000 shares – – – – – (101,045) (101,045)

Issuance of 738,890 shares – – (13,874) – – 13,874 –

Treasury stock retired (52,500,000) (525) (126,765) (876,667) – 1,003,957 –

Cancellation of shares (134,635) (1) (490) 529 – – 38

Cancellation of shares for

tax withholding (90,809) (1) (2,451) – – – (2,452)

Amortization of stock compensation – – 7,499 – – – 7,499

Exercise of stock options, 28,667 shares – – (192) – – 546 354

Stock compensation tax benefits – – 20,681 – – – 20,681

Change in shares held in trust for

deferred compensation plans, at cost – – (17,548) – – 17,548 –

Balance, December 31, 2006 131,660,749 $1,317 $ 343,744 $ 784,011 $(34,926) $ (60,772) $ 1,033,374

Comprehensive income:

Net income – – – 266,808 – – 266,808

Other comprehensive income ––––16,871 – 16,871

Comprehensive income – – – 266,808 16,871 – 283,679

Dividends on common stock – – – (124,513) – – (124,513)

Repurchase of 3,910,000 shares –––––(105,251) (105,251)

Issuance of 198,850 shares – – (4,850) – – 4,850 –

Cancellation of shares (140,775) (1) (615) 569 – – (47)

Cancellation of shares for tax withholding (51,275) (1) (1,409) – – – (1,410)

Amortization of stock compensation – – 7,430 – – – 7,430

Exercise of stock options, 87,083 shares – – (992) – – 2,208 1,216

Stock compensation tax benefits – – 4,534 – – – 4,534

Change in shares held in trust for

deferred compensation plans, at cost – – 6,721 – – (6,721) –

Balance, December 31, 2007 131,468,699 $1,315 $354,563 $ 926,875 $(18,055) $(165,686) $1,099,012

See accompanying notes to consolidated financial statements.