TCF Bank 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 | TCF Financial Corporation and Subsidiaries

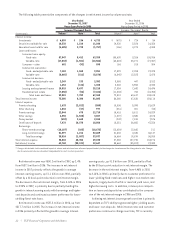

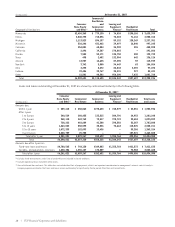

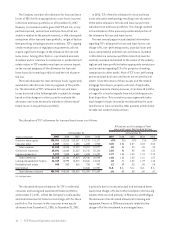

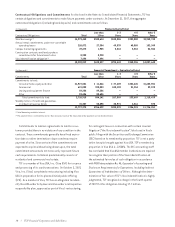

The allocation of TCF’s allowance for loan and lease losses is as follows.

Allocations as a Percentage of Total

Loans and Leases Outstanding by Type

At December 31, At December 31,

(Dollars in thousands) 2007 2006 2005 2004 2003 2007 2006 2005 2004 2003

Consumer home equity $30,951 $12,615 $10,017 $ 9,213 $ 8,177 .47% .21% .19% .21% .23%

Consumer other 2,059 2,211 2,053 1,694 1,900 3.05 3.54 3.57 3.02 3.04

Total consumer 33,010 14,826 12,070 10,907 10,077 .50 .25 .23 .25 .28

Commercial real estate 25,891 22,662 21,222 20,742 25,142 1.01 .95 .92 .96 1.31

Commercial business 7,077 7,503 6,602 7,696 11,797 1.27 1.36 1.52 1.76 2.75

Total commercial 32,968 30,165 27,824 28,438 36,939 1.06 1.03 1.02 1.10 1.57

Leasing and equipment finance 14,319 12,990 15,313 24,566 13,515 .68 .71 1.02 1.79 1.16

Residential real estate 645 562 616 796 942 .12 .09 .08 .08 .08

Unallocated –– – 10,686 10,987 N.A. N.A. N.A. N.A. N.A.

Total allowance balance $80,942 $58,543 $55,823 $75,393 $72,460 .66 .52 .55 .80 .87

N.A. Not Applicable.

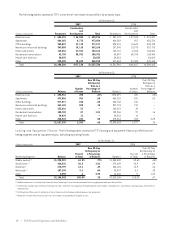

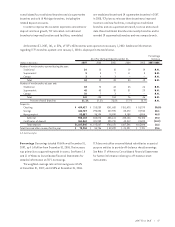

The Company considers the allowance for loan and lease

losses of $80.9 million appropriate to cover losses incurred

in the loan and lease portfolios as of December 31, 2007.

However, no assurance can be given that TCF will not, in any

particular period, sustain loan and lease losses that are

sizable in relation to the amount reserved, or that subsequent

evaluations of the loan and lease portfolio, in light of factors

then prevailing, including economic conditions, TCF’s ongoing

credit review process or regulatory requirements, will not

require significant changes in the allowance for loan and

lease losses. Among other factors, a protracted economic

slowdown and/or a decline in commercial or residential real

estate values in TCF’s markets may have an adverse impact

on the current adequacy of the allowance for loan and

lease losses by increasing credit risk and the risk of poten-

tial loss.

The total allowance for loan and lease losses is generally

available to absorb losses from any segment of the portfo-

lio. The allocation of TCF’s allowance for loan and lease

losses disclosed in the following table is subject to change

based on the changes in criteria used to evaluate the

allowance and is not necessarily indicative of the trend of

future losses in any particular portfolio.

In 2005, TCF refined its allowance for loan and lease

losses allocation methodology resulting in an allocation

of the entire allowance for loan and lease losses to the

individual loan and lease portfolios. This change resulted

in the allocation of the previously unallocated portion of

the allowance for loan and lease losses.

The next several pages include detailed information

regarding TCF’s allowance for loan and lease losses, net

charge-offs, non-performing assets, past due loans and

leases and potential problem loans and leases. Included

in this data are numerous portfolio ratios that must be

carefully reviewed and related to the nature of the underly-

ing loan and lease portfolios before appropriate conclusions

can be reached regarding TCF or for purposes of making

comparisons to other banks. Most of TCF’s non-performing

assets and past due loans and leases are secured by real

estate. Given the nature of these assets and the related

mortgage foreclosure, property sale and, if applicable,

mortgage insurance claims processes, it can take 18 months

or longer for a loan to migrate from initial delinquency to

final disposition. This resolution process generally takes

much longer for loans secured by real estate than for unse-

cured loans or loans secured by other property primarily due

to state real estate foreclosure laws.

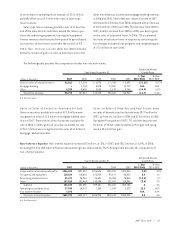

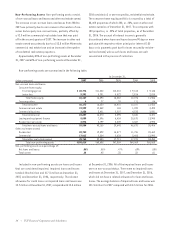

The allocated allowance balances for TCF’s residential,

consumer and leasing and equipment finance portfolios,

at December 31, 2007, reflect the Company’s credit quality

and related low level of historical net charge-offs for these

portfolios. The increase in the consumer home equity

allowance from December 31, 2006, to December 31, 2007,

is primarily due to increased actual and estimated home

equity loan charge-offs due to the slowdown in the housing

markets that occurred primarily in Minnesota and Michigan.

The decrease in the allocated allowance for leasing and

equipment finance in 2005 was primarily related to the

charge-off of the investment in a leveraged lease.