TCF Bank 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 63

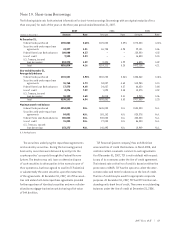

stocks. There were no company contributions to these plans,

other than payment of administrative expenses. The amounts

deferred are invested in TCF stock or other publicly traded

stocks, bonds or mutual funds. Directors were and still are

allowed to defer up to 100% of their fees and restricted stock

awards. TCF has a supplemental nonqualified Employee

Stock Purchase Plan in which certain employees can

contribute from 0% to 50% of their salary and bonus. At

December 31, 2007, the fair value of the assets in the plans

totaled $93.3 million and included $70.6 million invested in

TCF common stock. The cost of TCF common stock held by

TCF’s deferred compensation plans is reported separately in a

manner similar to treasury stock (that is, changes in fair

value are not recognized) with a corresponding deferred com-

pensation obligation reflected in additional paid-in capital.

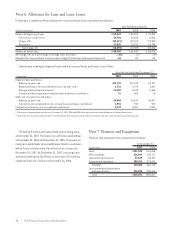

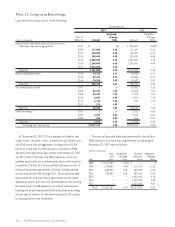

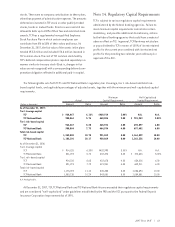

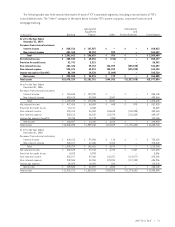

Note 14. Regulatory Capital Requirements

TCF is subject to various regulatory capital requirements

administered by the federal banking agencies. Failure to

meet minimum capital requirements can initiate certain

mandatory, and possible additional discretionary, actions

by the federal banking agencies that could have a material

adverse effect on TCF. In general, TCF Bank may not declare

or pay a dividend to TCF in excess of 100% of its net retained

profits for the current year combined with its retained net

profits for the preceding two calendar years without prior

approval of the OCC.

The following table sets forth TCF’s and TCF National Bank’s regulatory tier 1 leverage, tier 1 risk-based and total risk-

based capital levels, and applicable percentages of adjusted assets, together with the minimum and well-capitalized capital

requirements.

Minimum Well-Capitalized

Actual Capital Requirement Capital Requirement

(Dollars in thousands) Amount Ratio Amount Ratio Amount Ratio

As of December 31, 2007:

Tier 1 leverage capital

TCF $ 964,467 6.16% $469,914 3.00% N.A. N.A.

TCF National Bank 900,864 5.76 468,806 3.00 $ 781,343 5.00%

Tier 1 risk-based capital

TCF 964,467 8.28 465,931 4.00 698,897 6.00

TCF National Bank 900,864 7.75 464,934 4.00 697,402 6.00

Total risk-based capital

TCF 1,245,808 10.70 931,863 8.00 1,164,829 10.00

TCF National Bank 1,182,196 10.17 929,869 8.00 1,162,336 10.00

As of December 31, 2006:

Tier 1 leverage capital

TCF $ 914,128 6.33% $432,993 3.00% N.A. N.A.

TCF National Bank 821,273 5.70 432,374 3.00 $ 720,623 5.00%

Tier 1 risk-based capital

TCF 914,128 8.65 422,678 4.00 634,016 6.00

TCF National Bank 821,273 7.79 421,941 4.00 632,911 6.00

Total risk-based capital

TCF 1,173,073 11.10 845,355 8.00 1,056,694 10.00

TCF National Bank 1,080,218 10.24 843,881 8.00 1,054,851 10.00

N.A. Not Applicable.

At December 31, 2007, TCF, TCF National Bank and TCF National Bank Arizona exceeded their regulatory capital requirements

and are considered “well-capitalized” under guidelines established by the FRB and the OCC pursuant to the Federal Deposit

Insurance Corporation Improvement Act of 1991.