TCF Bank 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

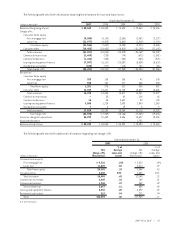

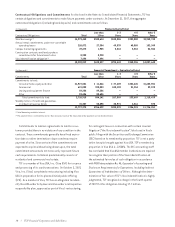

Commitments to lend are agreements to lend to a cus-

tomer provided there is no violation of any condition in the

contract. These commitments generally have fixed expira-

tion dates or other termination clauses and may require

payment of a fee. Since certain of the commitments are

expected to expire without being drawn upon, the total

commitment amounts do not necessarily represent future

cash requirements. Collateral predominantly consists of

residential and commercial real estate.

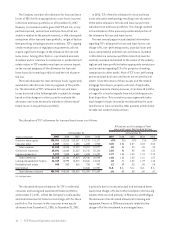

TCF is a member of Visa USA, Inc. (Visa USA) for issuance

and processing of its card transactions. On October 3, 2007,

Visa, Inc. (Visa) completed a restructuring including Visa

USA in preparation for its planned initial public offering

(IPO). As a member of Visa, TCF has an obligation to indem-

nify Visa USA under its bylaws and Visa under a retrospective

responsibility plan, approved as part of Visa’s restructuring,

for contingent losses in connection with certain covered

litigation (“the Visa indemnification”) disclosed in Visa’s

public filings with the Securities and Exchange Commission

(SEC) based on its membership proportion. TCF is not a party

to the lawsuits brought against Visa USA. TCF’s membership

proportion in Visa USA is .12554%. The SEC accounting staff

has concluded that Visa USA member institutions are required

to recognize their portion of the Visa indemnification at

the estimated fair value of such obligation in accordance

with FASB Interpretation No. 45, Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect

Guarantees of Indebtedness of Others. Although the deter-

mination of fair value of TCF’s Visa indemnification is highly

judgmental, TCF recognized a charge in the fourth quarter

of 2007 for this obligation totaling $7.7 million.

38 | TCF Financial Corporation and Subsidiaries

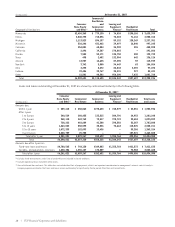

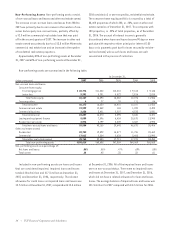

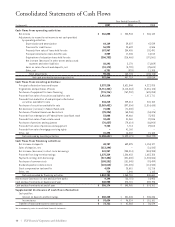

Contractual Obligations and Commitments As disclosed in the Notes to Consolidated Financial Statements, TCF has

certain obligations and commitments to make future payments under contracts. At December 31, 2007, the aggregate

contractual obligations (excluding bank deposits) and commitments are as follows.

(In thousands) Payments Due by Period

Less than 1-3 4-5 After 5

Contractual Obligations Total 1 Year Years Years Years

Total borrowings(1) $4,973,448 $582,614 $240,086 $202,008 $3,948,740

Annual rental commitments under non-cancelable

operating leases 220,072 27,304 49,539 40,880 102,349

Campus marketing agreements 49,675 1,985 5,818 5,318 36,554

Construction contracts and land purchase

commitments for future branch sites 8,928 8,928 – – –

Visa indemnification obligation(2) 7,696 7,696 – – –

$5,259,819 $628,527 $295,443 $248,206 $4,087,643

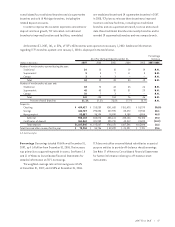

(In thousands) Amount of Commitment – Expiration by Period

Less than 1-3 4-5 After 5

Commitments Total 1 Year Years Years Years

Commitments to lend:

Consumer home equity and other $1,927,001 $ 11,246 $ 27,409 $202,445 $1,685,901

Commercial 621,025 320,003 240,190 31,254 29,578

Leasing and equipment finance 89,206 89,206 – – –

Other 83,686 83,686 – – –

Total commitments to lend 2,720,918 504,141 267,599 233,699 1,715,479

Standby letters of credit and guarantees

on industrial revenue bonds 76,357 52,298 20,971 2,516 572

$2,797,275 $556,439 $288,570 $236,215 $1,716,051

(1) Total borrowings excludes interest.

(2) The payment time is estimated to be less than one year, however the exact date of the payment can not be determined.