TCF Bank 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Form 10-K | 27

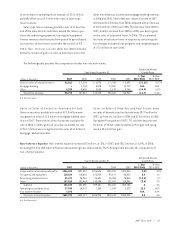

increase state income tax expense. Thus, TCF’s annual

effective income tax rate will likely increase in future years.

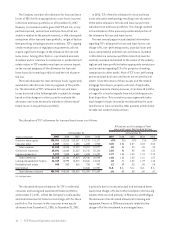

The determination of current and deferred income taxes

is a critical accounting estimate which is based on complex

analyses of many factors including interpretation of federal

and state income tax laws, the evaluation of uncertain tax

positions, differences between the tax and financial report-

ing bases of assets and liabilities (temporary differences),

estimates of amounts due or owed such as the timing of

reversal of temporary differences and current financial

accounting standards. Additionally, there can be no

assurance that estimates and interpretations used in deter-

mining income tax liabilities may not be challenged by federal

and state taxing authorities. Actual results could differ sig-

nificantly from the estimates and tax law interpretations used

in determining the current and deferred income tax liabilities.

In addition, under generally accepted accounting princi-

ples, deferred income tax assets and liabilities are recorded

at the federal and state income tax rates expected to apply

to taxable income in the periods in which the deferred income

tax assets or liabilities are expected to be realized. If such

rates change, deferred income tax assets and liabilities must

be adjusted in the period of change through a charge or credit

to the Consolidated Statements of Income. See Note 12 of

Notes to Consolidated Financial Statements for information

regarding TCF’s adoption of Financial Accounting Standards

Board Interpretation No. 48, Accounting for Uncertainty in

Income Taxes, an interpretation of FASB Statement 109.

Consolidated Financial Condition Analysis

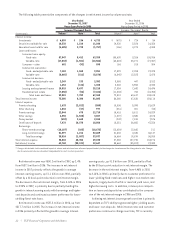

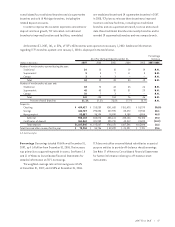

Securities Available for Sale Securities available for

sale increased $147.6 million to $2.0 billion at December 31,

2007. This increase reflects purchases of $1.6 billion and

sales of $1.2 billion of mortgage-backed securities, and

normal payment and prepayment activity. At December 31,

2007, the increase in mortgage-backed securities partially

offsets the decline in residential real estate loans. TCF’s

securities available for sale portfolio primarily included

fixed-rate mortgage-backed securities. Net unrealized

pre-tax losses on securities available for sale totaled $16.4

million at December 31, 2007, compared with net unrealized

pre-tax losses of $33.3 million at December 31, 2006. TCF

may, from time to time, sell mortgage-backed securities

and utilize the proceeds to reduce borrowings, fund growth

in loans and leases or for other corporate purposes.

TCF’s securities portfolio does not contain commercial

paper, asset-backed commercial paper or asset-backed

securities secured by credit cards or car loans. TCF also

does not participate in structured investment vehicles.

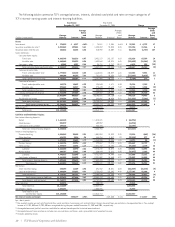

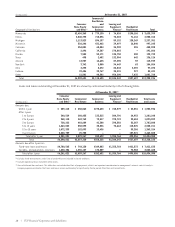

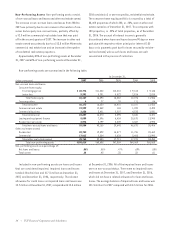

Loans and Leases The following tables set forth information about loans and leases held in TCF’s portfolio, excluding loans

held for sale.

Compound Annual

(Dollars in thousands) At December 31, Growth Rate

1-Year 5-Year

Portfolio Distribution: 2007 2006 2005 2004 2003 2007/2006 2007/2002

Consumer home equity and other:

Home equity:

Line of credit(1) $ 1,429,633 $ 1,232,315 $ 1,389,741 $1,472,165 $1,093,945 16.0% 9.1%

Closed-end loans 5,093,441 4,650,353 3,758,947 2,909,592 2,493,715 9.5 20.2

Total consumer home equity 6,523,074 5,882,668 5,148,688 4,381,757 3,587,660 10.9 17.2

Other 67,557 62,409 57,587 56,183 62,538 8.2 (.1)

Total consumer home equity

and other 6,590,631 5,945,077 5,206,275 4,437,940 3,650,198 10.9 16.9

Commercial real estate 2,557,330 2,390,653 2,297,500 2,154,396 1,916,701 7.0 6.9

Commercial business 558,325 551,995 435,203 436,696 429,401 1.1 4.8

Total commercial 3,115,655 2,942,648 2,732,703 2,591,092 2,346,102 5.9 6.5

Leasing and equipment finance (2) 2,104,343 1,818,165 1,503,794 1,375,372 1,160,397 15.7 15.2

Residential real estate 527,607 627,790 770,441 1,014,166 1,212,643 (16.0) (21.8)

Total loans and leases $12,338,236 $11,333,680 $10,213,213 $9,418,570 $8,369,340 8.9 8.7

(1) Excludes fixed-term amounts under lines of credit which are included in closed-end loans.

(2) Excludes operating leases included in other assets.