TCF Bank 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 | TCF Financial Corporation and Subsidiaries

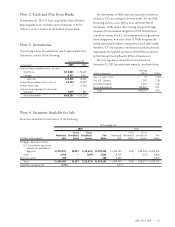

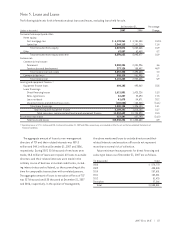

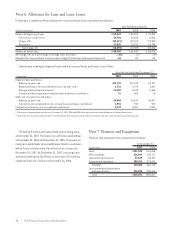

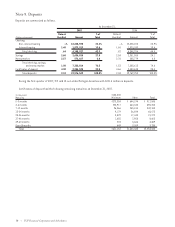

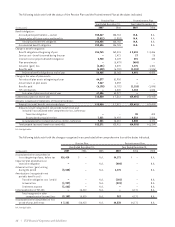

Note 6. Allowance for Loan and Lease Losses

Following is a summary of the allowance for loan and lease losses and selected statistics.

Year Ended December 31,

(Dollars in thousands) 2007 2006 2005

Balance at beginning of year $ 58,543 $ 55,823 $ 75,393

Provision for credit losses 56,992 20,689 8,586

Charge-offs (52,421) (33,221) (47,904)

Recoveries 17,828 15,252 19,748

Net charge-offs (34,593) (17,969) (28,156)

Balance at end of year $ 80,942 $ 58,543 $ 55,823

Net charge-offs as a percentage of average loans and leases .30% .17% .29%

Allowance for loan and lease losses as a percentage of total loans and leases at year end .66 .52 .55

Information relating to impaired loans and non-accrual loans and leases is as follows.

At or For the Year Ended December 31,

(In thousands) 2007 2006 2005

Impaired loans and leases:

Balance, at year-end $24,770 $17,512 $3,791

Related allowance for loan and lease losses, at year-end (1) 2,718 2,470 1,642

Average impaired loans and leases 21,490 8,169 5,345

Interest income recognized on impaired loans and leases (cash basis) 91 603 76

Other non-accrual loans and leases:

Balance, at year-end 35,084 25,673 25,857

Interest income recognized on non-accrual loans and leases (cash basis) 1,915 978 960

Contractual interest on non-accrual loans and leases (2) 5,724 3,557 2,900

(1) There were no impaired loans and leases at December 31, 2007, 2006 and 2005 which did not have a related allowance for loan and lease losses.

(2) Represents interest which would have been recorded had the loans and leases performed in accordance with their contractual terms during the period.

TCF had $4.9 million of troubled debt restructuring loans

at December 31, 2007. There were no such loans outstanding

at December 31, 2006 and December 31, 2005. There were no

material commitments to lend additional funds to customers

whose loans or leases were classified as non-accrual at

December 31, 2007. At December 31, 2007, accruing loans

and leases delinquent for 90 days or more was $15.4 million,

compared with $12.2 million at December 31, 2006.

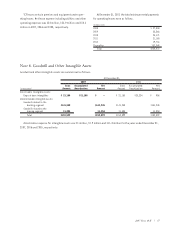

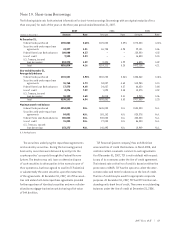

Note 7. Premises and Equipment

Premises and equipment are summarized as follows.

At December 31,

(In thousands) 2007 2006

Land $131,942 $118,656

Office buildings 236,893 218,171

Leasehold improvements 57,639 54,474

Furniture and equipment 288,876 273,412

Subtotal 715,350 664,713

Less accumulated depreciation

and amortization 276,898 258,626

Total $438,452 $406,087