Seagate 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

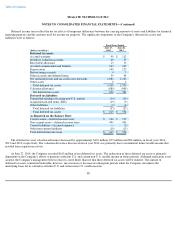

denominated liabilities. The Company's accounting policies for these instruments are based on whether the instruments are classified as

designated or non-designated hedging instruments. The Company records all derivatives in the Consolidated Balance Sheets at fair value. The

changes in the fair value of the effective portions of designated cash flow hedges are recorded in Accumulated other comprehensive loss until the

hedged item is recognized in earnings. Derivatives that are not designated as hedging instruments and the ineffective portions of cash flow

hedges are adjusted to fair value through earnings. The amount of net unrealized losses on cash flow hedges was $1 million as of June 27, 2014

and nil as of June 28, 2013.

The Company dedesignates its cash flow hedges when the forecasted hedged transactions are realized or it is probable the forecasted

hedged transactions will not occur in the initially identified time period. At such time, the associated gains and losses deferred in Accumulated

other comprehensive loss are reclassified immediately into earnings and any subsequent changes in the fair value of such derivative instruments

are immediately reflected in earnings. The Company did not recognize any material net gains or losses related to the loss of hedge designation on

discontinued cash flow hedges during fiscal years 2014, 2013, and 2012. As of June 27, 2014, the Company's existing foreign currency forward

exchange contracts mature within 12 months. The deferred amount currently recorded in Accumulated other comprehensive loss expected to be

recognized into earnings over the next 12 months is immaterial.

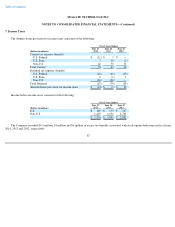

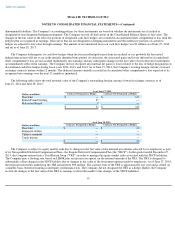

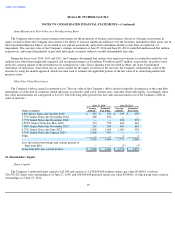

The following tables show the total notional value of the Company's outstanding foreign currency forward exchange contracts as of

June 27, 2014 and June 28, 2013:

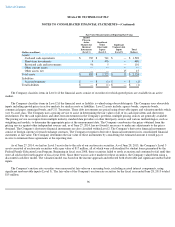

The Company is subject to equity market risks due to changes in the fair value of the notional investments selected by its employees as part

of its Non-qualified Deferred Compensation Plan—the Seagate Deferred Compensation Plan (the "SDCP"). In the quarter ended December 27,

2013, the Company entered into a Total Return Swap ("TRS") in order to manage the equity market risks associated with the SDCP liabilities.

The Company pays a floating rate, based on LIBOR plus an interest rate spread, on the notional amount of the TRS. The TRS is designed to

substantially offset changes in the SDCP liability due to changes in the value of the investment options made by employees. As of June 27, 2014,

the notional investments underlying the TRS amounted to $90 million. The contract term of the TRS is approximately one year and is settled on

a monthly basis, therefore limiting counterparty performance risk. The Company did not designate the TRS as a hedge. Rather, the Company

records all changes in the fair value of the TRS to earnings to offset the market value changes of the SDCP liabilities.

91

As of June 27, 2014

(Dollars in millions)

Contracts Designated as Hedges

Contracts Not Designated as Hedges

Thai baht

$

—

$

143

British Pound Sterling

25

—

Malaysian Ringitt

9

—

1

1

1

1

1

1

$

34

$

143

1

1

1

1

1

1

1

1

1

1

1

1

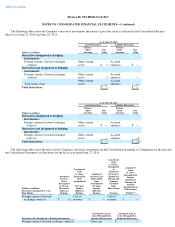

As of June 28, 2013

(Dollars in millions)

Contracts Designated as Hedges

Contracts Not Designated as Hedges

Thai baht

$

—

$

20

Singapore dollars

—

—

Chinese renminbi

—

—

Czech koruna

—

—

1

1

1

1

1

1

$

—

$

20

1

1

1

1

1

1

1

1

1

1

1

1