Seagate 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

$11 million. This cost is being amortized on a straight-line basis over a weighted-average remaining term of 2.8 years and will be adjusted for

subsequent changes in estimated forfeitures. The aggregate fair value of nonvested awards vested during fiscal year 2014 was approximately

$73 million.

Performance Awards

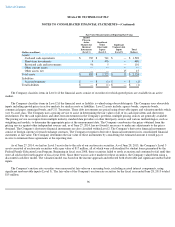

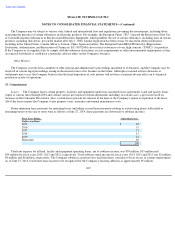

The following is a summary of nonvested award activities which contain a performance condition:

At June 27, 2014, the total compensation cost related to performance awards granted to employees but not yet recognized was

approximately $52 million. This cost is being amortized on a straight-line basis over a weighted-average remaining term of 3.0 years.

ESPP

During fiscal years 2014, 2013 and 2012, the aggregate intrinsic value of shares purchased under the Company's ESPP was approximately

$26 million, $17 million and $17 million respectively. At June 27, 2014, the total compensation cost related to options to purchase the

Company's ordinary shares under the ESPP but not yet recognized was approximately $1.6 million. This cost will be amortized on a straight-line

basis over a weighted-

average period of approximately one month. During fiscal year 2014, the Company issued 1.7 million ordinary shares with

a weighted-average purchase price of $31.95 per share.

Tax-Deferred Savings Plan

The Company has a tax-deferred savings plan, the Seagate 401(k) Plan (the "40l(k) plan"), for the benefit of qualified employees. The 40l

(k) plan is designed to provide employees with an accumulation of funds at retirement. Qualified employees may elect to make contributions to

the 401(k) plan on a bi-weekly basis. Pursuant to the 401(k) plan, the Company matches 50% of employee contributions, up to 6% of

compensation, subject to maximum annual contributions of $4,500 per participating employee. During fiscal years 2014, 2013, and 2012, the

Company made matching contributions of $16 million, $14 million and $13 million, respectively.

Deferred Compensation Plan

On January 1, 2001, the Company adopted the SDCP for the benefit of eligible employees. This plan is designed to permit certain

discretionary employer contributions, in excess of the tax limits applicable to the 401(k) plan and to permit employee deferrals in excess of

certain tax limits. In the quarter ended December 27, 2013, the Company entered into a Total Return Swap ("TRS") in order to manage the

equity market risks associated with the SDCP liabilities. See "Note 8. Derivative Financial Instruments" contained in this report for additional

information about the TRS.

104

Performance Awards

Number of

Shares

Weighted

-

Average

Grant-

Date

Fair Value

(In millions)

Performance units at June 28, 2013

2.6

$

18.44

Granted

0.7

$

42.50

Forfeitures

—

$

—

Vested

(0.6

)

$

14.55

1

1

1

1

1

1

Performance units at June 27, 2014

2.7

$

25.43

1

1

1

1

1

1

1

1

1

1

1

1