Seagate 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

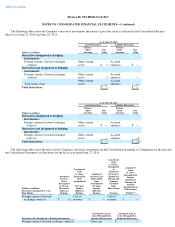

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

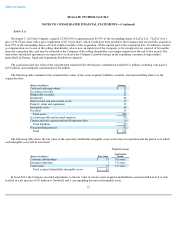

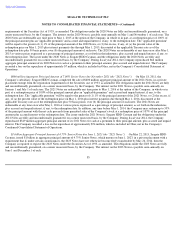

As of June 27, 2014, expected amortization expense for other intangible assets for each of the next five years and thereafter is as follows:

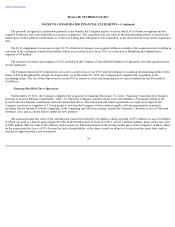

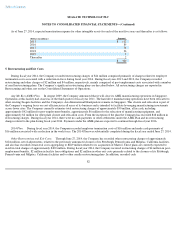

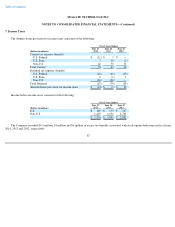

5. Restructuring and Exit Costs

During fiscal year 2014, the Company recorded restructuring charges of $24 million comprised primarily of charges related to employee

termination costs associated with a reduction in force during fiscal year 2014. During fiscal years 2013 and 2012, the Company recorded

restructuring and other charges of $2 million and $4 million, respectively, mainly comprised of post-

employment costs associated with a number

of small restructuring plans. The Company's significant restructuring plans are described below. All restructuring charges are reported in

Restructuring and other, net on the Consolidated Statements of Operations.

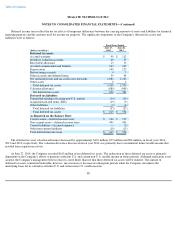

Ang Mo Kio (AMK) Plan. In August 2009, the Company announced that it will close its AMK manufacturing operations in Singapore.

Operations at this facility had ceased as of the third quarter of fiscal year 2011. The hard drive manufacturing operations have been relocated to

other existing Seagate facilities and the Company's Asia International Headquarters remains in Singapore. This closure and relocation is part of

the Company's ongoing focus on cost efficiencies in all areas of its business and is intended to facilitate leveraging manufacturing investments

across fewer sites. The Company currently estimates total restructuring charges of approximately $50 million, all in cash, including

approximately $42 million for post-employment benefits, approximately $6 million for the relocation of manufacturing equipment, and

approximately $2 million for other plant closure and relocation costs. From the inception of the plan the Company has recorded $48 million in

restructuring charges. During fiscal year 2014, there were no cash payments or other settlements under the AMK Plan and no restructuring

charges related to the plan during fiscal year 2014. Payments under the AMK plan are expected to continue through fiscal year 2016.

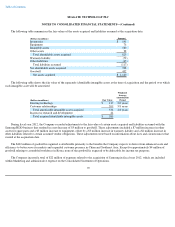

2014 Plan. During fiscal year 2014, the Company recorded employee termination costs of $16 million and made cash payments of

$16 million associated with a reduction in the work force. The 2014 Plan was substantially completed during the fiscal year ended June 27, 2014.

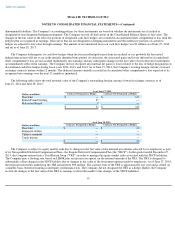

Other Restructuring and Exit Costs. Through June 27, 2014, the Company has recorded other restructuring charges of approximately

$124 million, net of adjustments, related to the previously announced closures of its Pittsburgh, Pennsylvania and Milpitas, California facilities,

and also has recorded certain exit costs aggregating to $269 million related to its acquisition of Maxtor. These plans are currently expected to

result in total charges of approximately $400 million. During fiscal year 2014, the Company incurred restructuring charges of $4 million in post-

employment benefits, $2 million in facility lease obligations and $2 million in other exit costs primarily related to the closures of its Pittsburgh,

Pennsylvania and Milpitas, California facilities and to other smaller restructuring plans. In addition, recorded cash

82

(Dollars in millions)

Amount

2015

$

112

2016

89

2017

78

2018

36

2019

3

Thereafter

2

1

1

1

1

$

320

1

1

1

1

1

1

1

1