Seagate 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

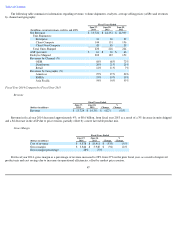

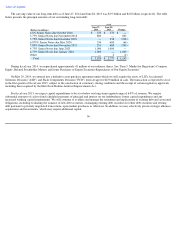

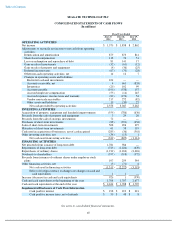

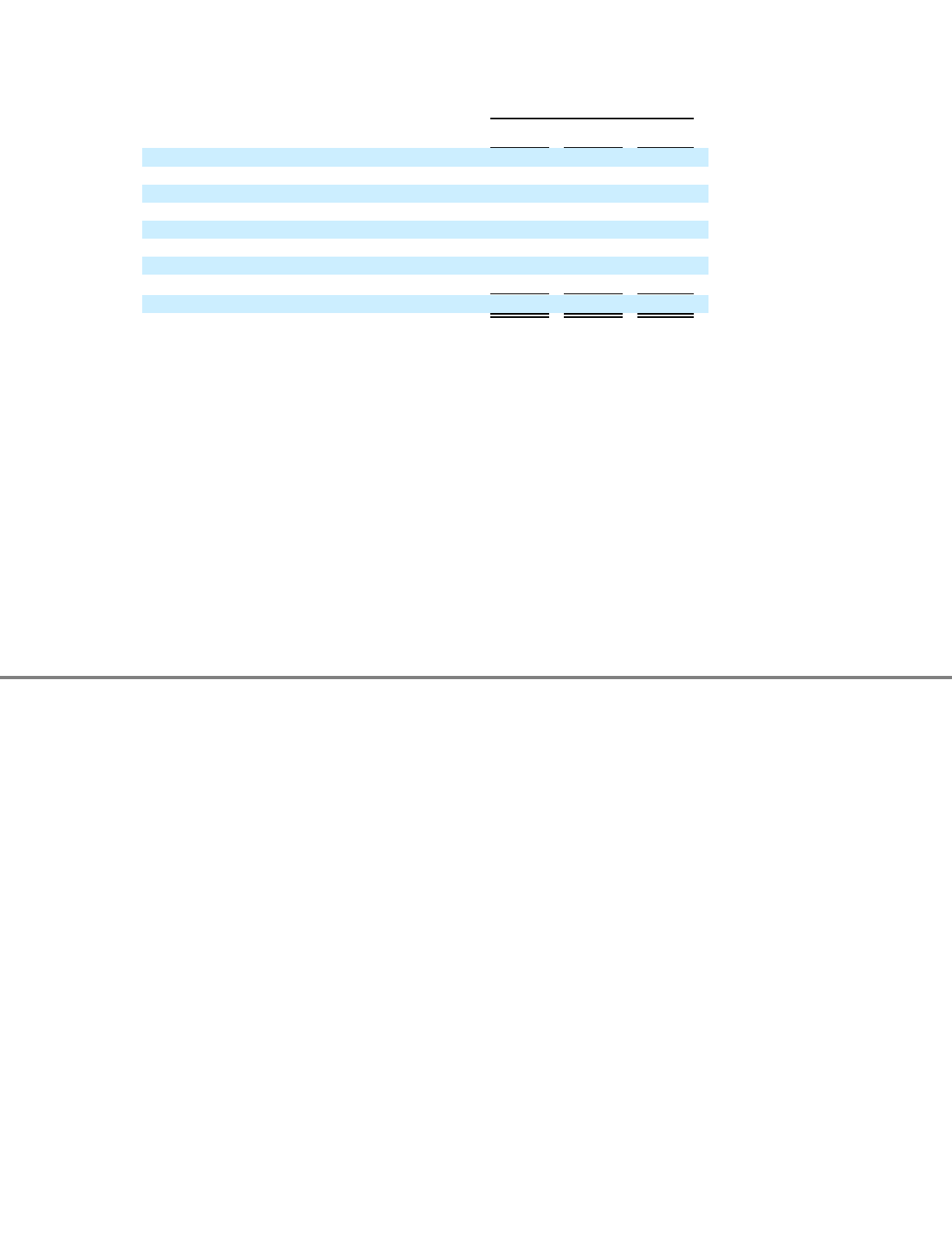

The carrying value of our long-term debt as of June 27, 2014 and June 28, 2013 was $3.9 billion and $2.8 billion, respectively. The table

below presents the principal amounts of our outstanding long-term debt:

During fiscal year 2014, we repurchased approximately 41 million of our ordinary shares. See "Item 5. Market for Registrant's Common

Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities-Repurchases of Our Equity Securities."

On May 29, 2014, we entered into a definitive asset purchase agreement under which we will acquire the assets of LSI's Accelerated

Solutions Division ("ASD") and Flash Components Division ("FCD") from Avago for $450 million in cash. The transaction is expected to close

in the first quarter of fiscal year 2015, subject to the satisfaction of customary closing conditions and the receipt of certain regulatory approvals,

including those required by the Hart-Scott-Rodino Antitrust Improvements Act.

For fiscal year 2015, we expect capital expenditures to be at or below our long-term targeted range of 6-8% of revenue. We require

substantial amounts of cash to fund scheduled payments of principal and interest on our indebtedness, future capital expenditures and any

increased working capital requirements. We will continue to evaluate and manage the retirement and replacement of existing debt and associated

obligations, including evaluating the issuance of new debt securities, exchanging existing debt securities for other debt securities and retiring

debt pursuant to privately negotiated transactions, open market purchases or otherwise. In addition, we may selectively pursue strategic alliances,

acquisitions and investments, which may require additional capital.

56

As of

(Dollars in millions)

June 27,

2014

June 28,

2013

Change

6.8% Senior Notes due October 2016

$

335

$

335

$

—

3.75% Senior Notes due November 2018

800

—

800

7.75% Senior Notes due December 2018

—

238

(238

)

6.875% Senior Notes due May 2020

534

600

(66

)

7.00% Senior Notes due November 2021

251

600

(349

)

4.75% Senior Notes due June 2023

1,000

1,000

—

4.75% Senior Notes due January 2025

1,000

—

1,000

Other

—

4

(4

)

1

1

1

1

1

1

1

1

Total

$

3,920

$

2,777

$

1,143

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1