Seagate 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

wholly owned subsidiary of the Company, as described more fully in the Current Report on Form 8-

K filed by the Company on July 6, 2010 (the

"Redomestication"). On July 27, 2010, in connection with the Redomestication, the Company, as sole shareholder of Seagate-

Cayman, approved

a form of deed of indemnity (the "Deed of Indemnity"), which provides for the indemnification by Seagate-Cayman of any director, officer,

employee or agent of the Company, Seagate-Cayman or any subsidiary of the Company (each, a "Deed Indemnitee"), in addition to any of a

Deed Indemnitee's indemnification rights under the Company's Articles of Association, applicable law or otherwise, with a similar scope to the

Revised Indemnification Agreement. Seagate-Cayman entered into the Deed of Indemnity with certain Deed Indemnitees effective as of July 3,

2010 and continues to enter into the Deed of Indemnity with additional Deed Indemnitees from time to time.

The nature of these indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential

amount it could be required to pay on behalf of its officers and directors. Historically, the Company has not made any significant indemnification

payments under such agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these

indemnification obligations.

Intellectual Property Indemnification Obligations

The Company has entered into agreements with customers and suppliers that include limited intellectual property indemnification

obligations that are customary in the industry. These guarantees generally require the Company to compensate the other party for certain

damages and costs incurred as a result of third party intellectual property claims arising from these transactions. The nature of the intellectual

property indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be

required to pay to its customers and suppliers. Historically, the Company has not made any significant indemnification payments under such

agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these indemnification

obligations.

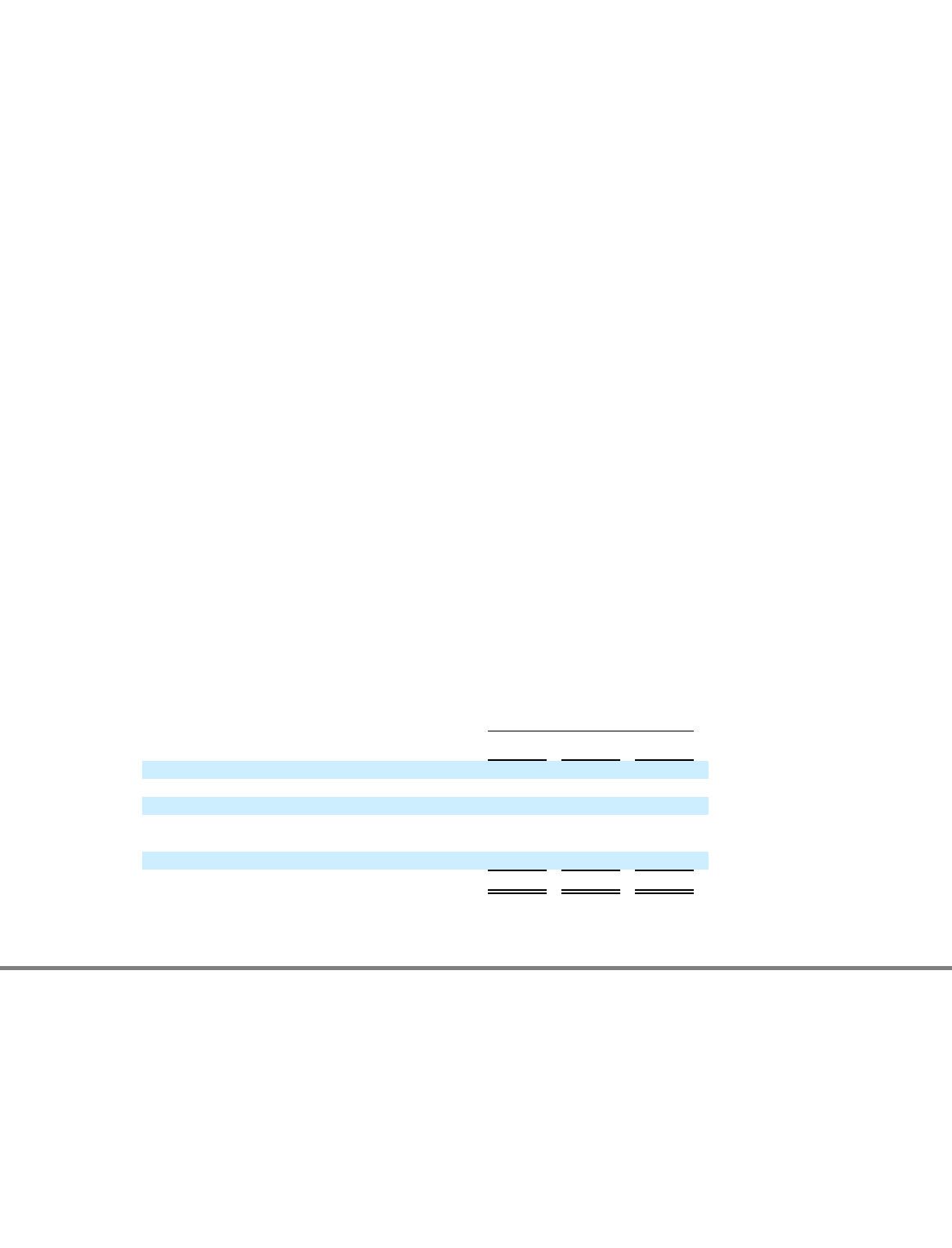

Product Warranty

The Company estimates probable product warranty costs at the time revenue is recognized. The Company generally warrants its products

for a period of 1 to 5 years. The Company uses estimated repair or replacement costs and uses statistical modeling to estimate product return

rates in order to determine its warranty obligation. Changes in the Company's product warranty liability during the fiscal years ended June 27,

2014, June 28, 2013 and June 29, 2012 were as follows:

111

Fiscal Years Ended

(In millions)

June 27,

2014

June 28,

2013

June 29,

2012

Balance, beginning of period

$

320

$

363

$

348

Warranties issued

177

193

169

Repairs and replacements

(228

)

(276

)

(284

)

Changes in liability for pre-existing warranties,

including expirations

1

37

58

Warranty liability assumed from acquisitions

3

3

72

Balance, end of period

$

273

$

320

$

363

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1