Seagate 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

1.6% and 1.5% of revenue during fiscal years 2014, 2013 and 2012, respectively, while warranty cost related to new shipments (exclusive of the

impact of re-estimates of pre-existing liabilities) were 1.3%, 1.3% and 1.1% respectively, for the same periods. Changes in anticipated failure

rates of specific products and significant changes in repair or replacement costs have historically been the major reasons for significant changes

in prior estimates. Any future changes in failure rates of certain products, as well as changes in repair costs or the cost of replacement parts, may

result in increased or decreased warranty accruals.

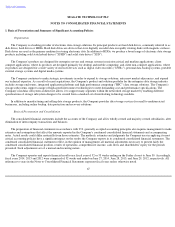

Accounting for Income Taxes.

We account for income taxes pursuant to Accounting Standards Codification (ASC) Topic 740 (ASC 740),

Income Taxes. In applying, ASC 740, we make certain estimates and judgments in determining income tax expense for financial statement

purposes. These estimates and judgments occur in the calculation of tax credits, recognition of income and deductions and calculation of specific

tax assets and liabilities, which arise from differences in the timing of recognition of revenue and expense for tax and financial statement

purposes, as well as tax liabilities associated with uncertain tax positions. The calculation of tax liabilities involves uncertainties in the

application of complex tax rules and the potential for future adjustment of our uncertain tax positions by the Internal Revenue Service or other

tax jurisdictions. If estimates of these tax liabilities are greater or less than actual results, an additional tax benefit or provision will result. The

deferred tax assets we record each period depend primarily on our ability to generate future taxable income in the United States and certain non-

U.S. jurisdictions. Each period, we evaluate the need for a valuation allowance for our deferred tax assets and, if necessary, we adjust the

valuation allowance so that net deferred tax assets are recorded only to the extent we conclude it is more likely than not that these deferred tax

assets will be realized. If our outlook for future taxable income changes significantly, our assessment of the need for a valuation allowance may

also change.

Assessing Goodwill and Other Long-lived Assets for Impairment. We account for goodwill in accordance with ASC Topic 350,

Intangibles

—Goodwill and Other. As permitted by ASC 350, we perform a qualitative assessment at the end of each reporting period to

determine if any events or circumstances exist, such as an adverse change in business climate or a decline in the overall industry that would

indicate that it would more likely than not reduce the fair value of a reporting unit below its carrying amount. Based on the qualitative

assessment, if it is not more likely than not that the fair value of a reporting unit is less than its carrying amount, then the Company is not

required to perform the two-step goodwill impairment test.

In accordance with ASC 360-05-4, Impairment or Disposal of Long-lived Assets, we test other long-lived assets, including property,

equipment and leasehold improvements and other intangible assets subject to amortization, for recoverability whenever events or changes in

circumstances indicate that the carrying values of those assets may not be recoverable. We assess the recoverability of an asset group by

determining if the carrying value of the asset group exceeds the sum of the projected undiscounted cash flows expected to result from the use and

eventual disposition of the assets over the remaining economic life of the primary asset in the asset group. If the recoverability test indicates that

the carrying value of the asset group is not recoverable, we will estimate the fair value of the asset group using the same approaches indicated

above for ASC 360 step two and compare it to its carrying value. The excess of the carrying value over the fair value is allocated pro rata to

derive the adjusted carrying value of each asset in the asset group. The adjusted carrying value of each asset in the asset group is not reduced

below its fair value.

Recent Accounting Pronouncements

See "Item 8. Financial Statements and Supplementary Data-

Note 1. Basis of Presentation and Summary of Significant Accounting Policies"

for information regarding the effect of new accounting pronouncements on our financial statements.

59