Seagate 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

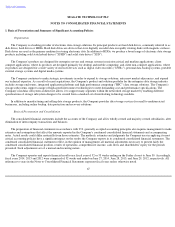

Concentrations

Concentration of Credit Risk. The Company's customer base for disk drive products is concentrated with a small number of OEMs and

distributors. The Company does not generally require collateral or other security to support accounts receivable. To reduce credit risk, the

Company performs ongoing credit evaluations on its customers' financial condition. The Company establishes an allowance for doubtful

accounts based upon factors surrounding the credit risk of customers, historical trends and other information. Hewlett-Packard Company and

Dell Inc. each accounted for more than 10% of the Company's accounts receivable as of June 27, 2014.

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash equivalents, short-term

investments and foreign currency forward exchange contracts. The Company further mitigates concentrations of credit risk in its investments

through diversification, by limiting its investments in the debt securities of a single issuer, and investing in highly rated securities.

In entering into foreign currency forward exchange contracts, the Company assumes the risk that might arise from the possible inability of

counterparties to meet the terms of their contracts. The counterparties to these contracts are major multinational commercial banks, and the

Company has not incurred and does not expect any losses as a result of counterparty defaults.

Supplier Concentration. Certain of the raw materials, components and equipment used by the Company in the manufacture of its

products are available from a sole supplier or a limited number of suppliers. Shortages could occur in these essential materials and components

due to an interruption of supply or increased demand in the industry. If the Company were unable to procure certain materials, components or

equipment at acceptable prices, it would be required to reduce its manufacturing operations, which could have a material adverse effect on its

results of operations. In addition, the Company has made prepayments to certain suppliers. Should these suppliers be unable to deliver on their

obligations or experience financial difficulty, the Company may not be able to recover these prepayments.

Recent Accounting Pronouncements

In July, 2013, the FASB issued ASU No. 2013-11, Income Taxes (ASC Topic 740)—

Presentation of an Unrecognized Tax Benefit When a

Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists

. The amendments in this ASU provide explicit

guidance that an unrecognized tax benefit, or a portion of an unrecognized tax benefit, should be presented in the financial statements as a

reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward, with limited exceptions.

The amendments in this ASU are effective for fiscal years, and interim periods within those years, beginning after December 15, 2013 and do

not require new recurring disclosures. The adoption of this new guidance will not have a material impact on the Company's consolidated

financial statements.

In May 2014, The FASB issued ASU 2014-09 (ASC Topic 606) , Revenue from Contracts with Customers. The ASU outlines a single

comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue

recognition guidance, including industry-specific guidance. It also requires entities to disclose both quantitative and qualitative information that

enable financial statements users to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with

customers. The ASU will be effective for the Company's first quarter of fiscal year 2018. The Company is in the process of assessing the impact,

if any, of ASU 2014-09 on its consolidated financial statements.

71