Seagate 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

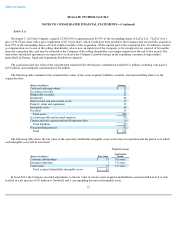

LaCie S.A.

On August 3, 2012 the Company acquired 23,382,904 (or approximately 64.5%) of the outstanding shares of LaCie S.A. ("LaCie") for a

price of €4.05 per share with a price supplement of €

0.12 per share, which would have been payable if the Company had successfully acquired at

least 95% of the outstanding shares of LaCie within 6 months of the acquisition. Of the amount paid at the acquisition date, €9 million is treated

as compensation cost to one of the selling shareholders, who is now an employee of the Company, to be recognized over a period of 36 months

from the acquisition date, and may be refunded to the Company if the selling shareholder is no longer employed at the end of that period. The

transaction and related agreements are expected to accelerate the Company's growth strategy in the expanding consumer storage market,

particularly in Europe, Japan and in premium distribution channels.

The acquisition-date fair value of the consideration transferred for the business combination totaled $111 million, including cash paid of

$107 million, and contingent consideration of $4 million.

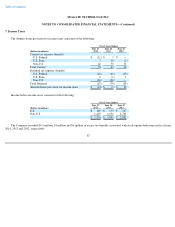

The following table summarizes the estimated fair values of the assets acquired, liabilities assumed, and noncontrolling interest at the

acquisition date:

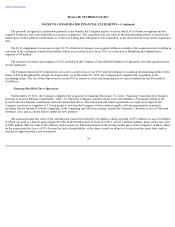

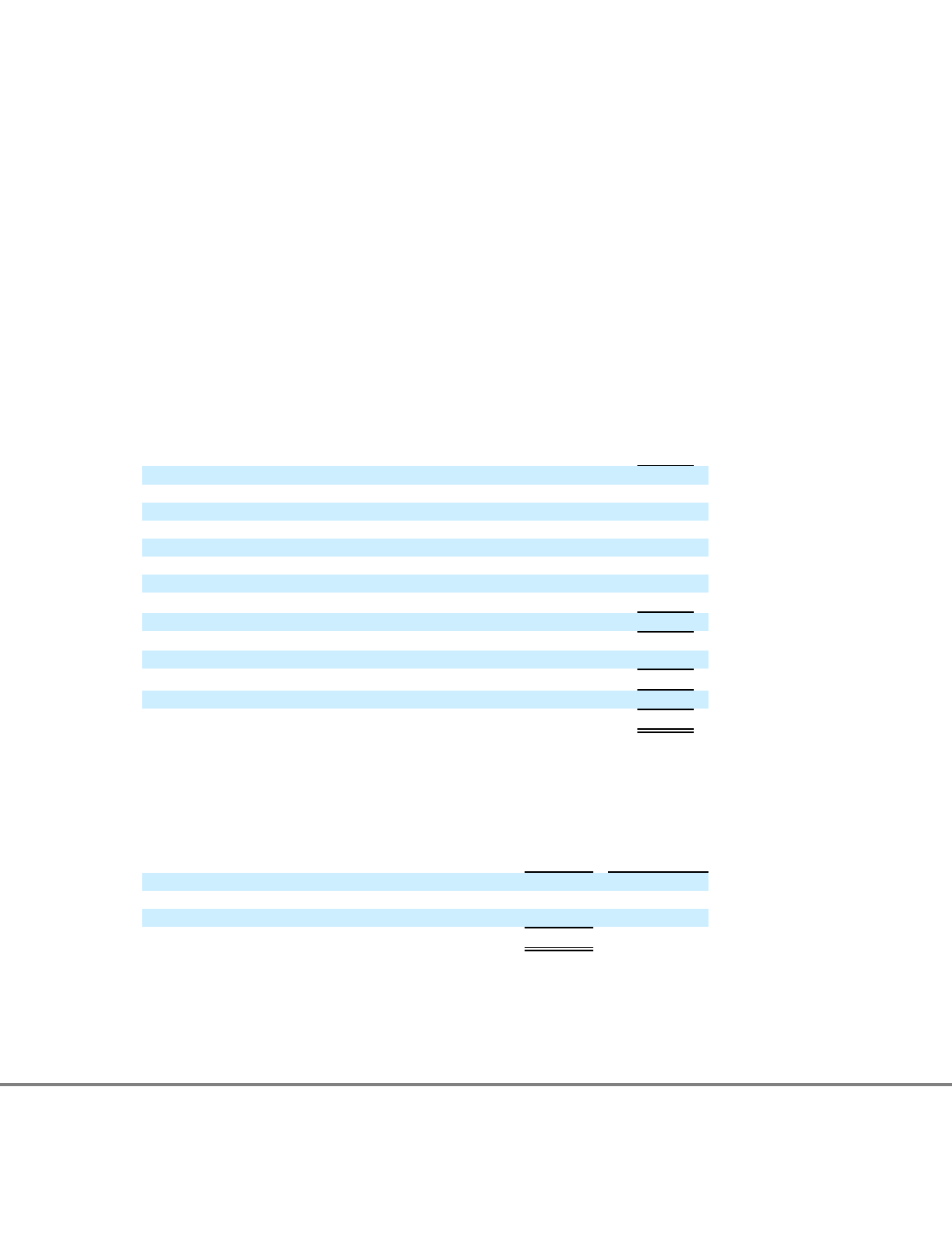

The following table shows the fair value of the separately identifiable intangible assets at the time of acquisition and the period over which

each intangible asset will be amortized:

In fiscal 2013, the Company recorded adjustments to the fair value of certain assets acquired and liabilities assumed with LaCie S.A. that

resulted in a net increase of $1 million to Goodwill, and a corresponding decrease in Intangible assets.

77

(Dollars in millions)

Amount

Cash and cash equivalents

$

71

Accounts receivable

29

Marketable securities

27

Inventories

46

Other current and non

-

current assets

19

Property, plant and equipment

12

Intangible assets

45

Goodwill

13

1

1

1

1

Total assets

262

1

1

1

1

Accounts payable and accrued expenses

(73

)

Current and non

-

current portion of long

-

term debt

(6

)

1

1

1

1

Total liabilities

(79

)

1

1

1

1

Noncontrolling interest

(72

)

Total

$

111

1

1

1

1

1

1

1

1

(Dollars in millions)

Fair Value

Weighted

-

Average

Amortization

Period

Customer relationships

$

31

5.0 years

Existing technology

1

5.0 years

Trade name

13

5.0 years

Total acquired identifiable intangible assets

$

45

1

1

1

1

1

1

1

1

1

1