Seagate 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

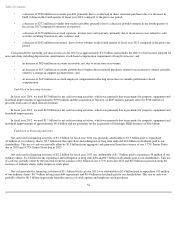

As of June 27, 2014 and June 28, 2013, we had approximately $115 million and $157 million, respectively, of unrecognized tax benefits

excluding interest and penalties. The unrecognized tax benefits that, if recognized, would impact the effective tax rate is $115 million and

$157 million as of June 27, 2014 and June 28, 2013, respectively, subject to certain future valuation allowance reversals.

It is our policy to include interest and penalties related to unrecognized tax benefits in the provision for taxes on the Consolidated

Statements of Operations. During fiscal year 2014, we recognized a net tax expense for interest and penalties of $8 million as compared to a net

tax expense for interest and penalties of $2 million during each fiscal year 2013 and fiscal year 2012. As of June 27, 2014, we had $27 million of

accrued interest and penalties related to unrecognized tax benefits compared to $19 million in fiscal year 2013.

During the fiscal year ended June 27, 2014, our unrecognized tax benefits excluding interest and penalties decreased by approximately

$42 million primarily due to (i) net decreases in prior years unrecognized tax benefits of $54 million, (ii) increases in current year unrecognized

tax benefits of $13 million, (iii) decreases associated with the expiration of certain statutes of limitation of $3 million, (iv) increases from other

activity, including non-U.S. exchange gains, of $2 million.

During the 12 months beginning June 28, 2014, we expect that our unrecognized tax benefits could be reduced anywhere from $3 million to

$50 million as a result of audit settlements and the expiration of certain statutes of limitation.

We are subject to taxation in many jurisdictions globally and are required to file U.S. federal, U.S. state, and non-

U.S income tax returns. In

June, 2014, we received the Revenue Agent's Report and Notices of Proposed Adjustments for our U.S. federal income tax returns for fiscal

years 2008, 2009 and 2010. Our China subsidiaries are under examination by the Chinese tax administration for years 2004 through 2012. These

examinations may result in proposed adjustments to our income taxes as filed during these periods. We believe that we have adequately provided

for these matters, but there is a reasonable possibility that an adverse outcome of these examinations could have a material effect on our financial

results. In this case, we would consider pursuing all possible remedies available to us, including appeals, judicial review and competent

authority.

We are no longer subject to tax examination of U.S. federal income tax returns for years prior to fiscal year 2008. With respect to U.S. state

and non-

U.S. income tax returns, we are generally no longer subject to tax examination for years ending prior to fiscal year 2004. We believe we

have provided adequately for all reasonable outcomes.

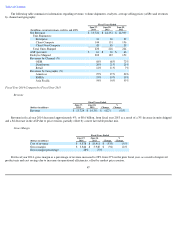

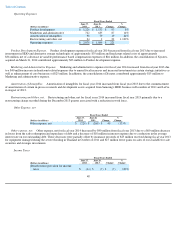

Fiscal Year 2013 Compared to Fiscal Year 2012

Revenue

Revenue in fiscal year 2013 decreased approximately 4%, or $0.6 billion, from fiscal year 2012 due to a decrease in the average selling

price per unit. The decrease in the average selling price to $63 per unit during fiscal year 2013, as compared to $66 per unit in the prior year, was

primarily due to supply constraints beginning in the second quarter of fiscal year 2012 as a result of the severe flooding in Thailand, partially

offset by a favorable product mix and slightly higher volumes in fiscal year 2013, which included a full period of Samsung labeled HDD

products.

50

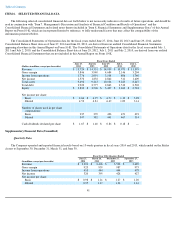

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

Revenue

$

14,351

$

14,939

$

(588

)

(4

)%