Seagate 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

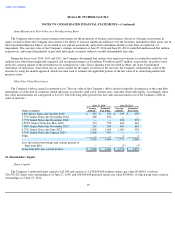

Seagate Technology plc Stock Purchase Plan (the "ESPP"). There are 50.0 million ordinary shares authorized to be issued under the

ESPP. In no event shall the total number of shares issued under the ESPP exceed 75.0 million ordinary shares. The ESPP consists of a six-

month

offering period with a maximum issuance of 1.5 million ordinary shares per offering period. The ESPP permits eligible employees to purchase

ordinary shares through payroll deductions generally at 85% of the fair market value of the ordinary shares. As of June 27, 2014 there were

approximately 10.2 million ordinary shares available for issuance under the ESPP.

i365, Inc. 2010 Equity Incentive Plan (the "i365 Plan").

In October 2010, i365, Inc. ("i365"), a wholly owned subsidiary of the Company,

adopted the i365, Inc. 2010 Equity Incentive Plan (the "i365 Plan"). A maximum of 5.0 million shares of i365's common stock are issuable under

the i365 Plan. Options granted to employees generally vest as follows: 25% of the options on the first anniversary of the vesting commencement

date and the remaining 75% proportionately each month over the next 36 months. Options expire ten years from the date of grant. The

compensation expense associated with options granted to date under the i365 Plan was not material for fiscal years 2014, 2013, and 2012,

respectively.

LyveMinds Inc. 2012 Equity Incentive Plan (the "LyveMinds Plan"). On October 19, 2012, LyveMinds Inc., a majority-owned subsidiary

of the Company, adopted the LyveMinds Inc. 2012 Equity Incentive Plan (the "LyveMinds Plan"). A maximum of 31.9 million shares of

LyveMinds' common stock are issuable under the LyveMinds Plan to employees, directors, and consultants of LyveMinds. Options granted to

LyveMinds employees generally vest as follows: 25% of the options on the first anniversary of the vesting commencement date and the

remaining 75% proportionately each month over the next 36 months. Options expire ten years from the date of grant. LyveMinds, Inc. adopted

the Amended and Restated 2012 Equity Incentive Plan on March 26, 2014 in connection with LyveMinds' reincorporation as a Delaware

corporation. The compensation expense associated with options granted to date under the LyveMinds Plan was not material for fiscal years 2014,

2013, and 2012, respectively.

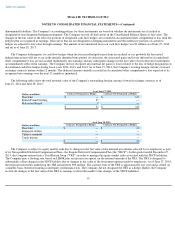

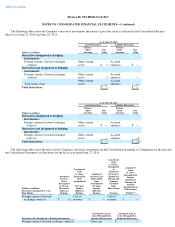

Equity Awards

Full-Value Share Awards (e.g. restricted share units) generally vest over a period of three to four years, with cliff vesting of a portion of

each award occurring annually. Options generally vest as follows: 25% of the options will vest on the first anniversary of the vesting

commencement date and the remaining 75% will vest ratably each month thereafter over the next 36 months. Options granted under the EIP and

SCP have an exercise price equal to the closing price of the Company's ordinary shares on date of grant.

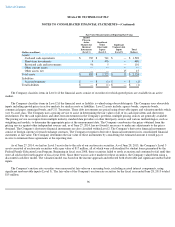

The Company granted performance awards to its senior executive officers under the SCP and the EIP where vesting is subject to both the

continued employment of the participant by the Company and the achievement of certain performance goals established by the Compensation

Committee of the Company's Board of Directors, including market based performance goals. A single award represents the right to receive a

single ordinary share of the Company. During fiscal year 2014, 2013 and 2012, the Company granted 0.4 million, 0.7 million and 0.6 million

performance awards, respectively, where performance is measured based on a three-year average return on invested capital (ROIC) goal and a

relative total shareholder return (TSR) goal, which is based on the Company's ordinary shares measured against a benchmark TSR of a peer

group over the same three-year period (the "TSR/ROIC" awards). These awards vest after the end of the performance period of three years from

the grant date. A percentage of these units may vest only if at least the minimum ROIC goal is met regardless of whether the TSR goal is met.

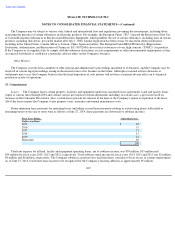

The number of stock units to vest will range from 0% to 200% of the targeted units. In evaluating the fair value of these units, the Company used

a Monte Carlo simulation on the grant date, taking the market-

based TSR goal into consideration. Compensation expense related to these units is

only recorded in a

100