Seagate 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

have any material net gains (losses) recognized in Costs of Revenue for cash flow hedges due to hedge ineffectiveness or discontinued cash flow

hedges during fiscal years 2014 and 2013.

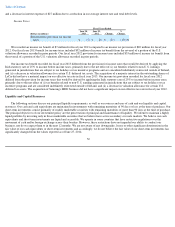

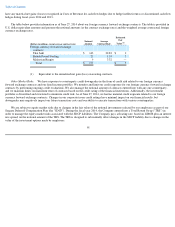

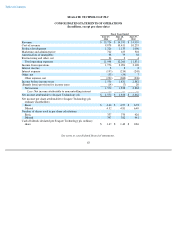

The table below provides information as of June 27, 2014 about our foreign currency forward exchange contracts. The table is provided in

U.S. dollar equivalent amounts and presents the notional amounts (at the contract exchange rates) and the weighted average contractual foreign

currency exchange rates.

Other Market Risks. We have exposure to counterparty credit downgrades in the form of credit risk related to our foreign currency

forward exchange contracts and our fixed income portfolio. We monitor and limit our credit exposure for our foreign currency forward exchange

contracts by performing ongoing credit evaluations. We also manage the notional amount of contracts entered into with any one counterparty,

and we maintain limits on maximum tenor of contracts based on the credit rating of the financial institutions. Additionally, the investment

portfolio is diversified and structured to minimize credit risk. As of June 27, 2014, we had no material credit exposure related to our foreign

currency forward exchange contracts. Changes in our corporate issuer credit ratings have minimal impact on our financial results, but

downgrades may negatively impact our future transaction costs and our ability to execute transactions with various counterparties.

We are subject to equity market risks due to changes in the fair value of the notional investments selected by our employees as part of our

Seagate Deferred Compensation Plan (the "SDCP"). During the fiscal year 2014, the Company entered into a Total Return Swap ("TRS") in

order to manage the equity market risks associated with the SDCP liabilities. The Company pays a floating rate, based on LIBOR plus an interest

rate spread, on the notional amount of the TRS. The TRS is designed to substantially offset changes in the SDCP liability due to changes in the

value of the investment options made by employees.

61

(Dollars in millions, except average contract rate)

Notional

Amount

Average

Contract Rate

Estimated

Fair

Value

(1)

Foreign currency forward exchange

contracts:

Thai baht

$

143

32.83

$

2

British Pound Sterling

25

1.55

3

Malaysian Ringitt

9

3.32

—

Total

$

177

$

5

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

(1)

Equivalent to the unrealized net gain (loss) on existing contracts.