Seagate 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

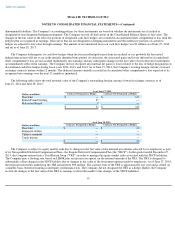

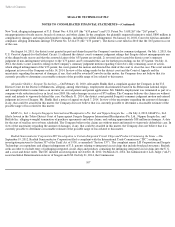

Items Measured at Fair Value on a Non-Recurring Basis

The Company enters into certain strategic investments for the promotion of business and strategic objectives. Strategic investments in

equity securities where the Company does not have the ability to exercise significant influence over the investees, included in Other assets, net in

the Consolidated Balance Sheets, are recorded at cost and are periodically analyzed to determine whether or not there are indicators of

impairment. The carrying value of the Company's strategic investments at June 27, 2014 and June 28, 2013 totaled $46 million and $66 million,

respectively, and consisted primarily of privately held equity securities without a readily determinable fair value.

During the fiscal years 2014, 2013 and 2012, the Company determined that certain of its equity investments accounted for under the cost

method were other-than-temporarily impaired, and recognized charges of $2 million, $5 million and $7 million, respectively, in order to write

down the carrying amount of the investment to its estimated fair value. These amounts were recorded in Other, net in the Consolidated

Statements of Operations. Since there was no active market for the equity securities of the investee, the Company estimated fair value of the

investee by using the market approach, which was then used to estimate the applicable portion of the fair value of its underlying intellectual

property assets.

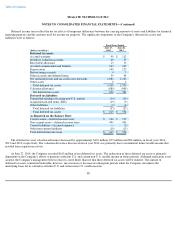

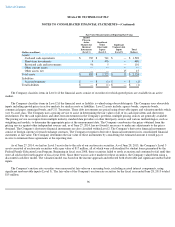

Other Fair Value Disclosures

The Company's debt is carried at amortized cost. The fair value of the Company's debt is derived using the closing price of the same debt

instruments as of the date of valuation, which takes into account the yield curve, interest rates, and other observable inputs. Accordingly, these

fair value measurements are categorized as Level 2. The following table presents the fair value and amortized cost of the Company's debt in

order of maturity:

10. Shareholders' Equity

Share Capital

The Company's authorized share capital is $13,500 and consists of 1,250,000,000 ordinary shares, par value $0.00001, of which

326,539,322 shares were outstanding as of June 27, 2014, and 100,000,000 preferred shares, par value $0.00001, of which none were issued or

outstanding as of June 27, 2014.

97

June 27, 2014

June 28, 2013

(Dollars in millions)

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

6.8% Senior Notes due October 2016

$

335

$

374

$

335

$

370

3.75% Senior Notes due November 2018

800

820

—

—

7.75% Senior Notes due December 2018

—

—

238

259

6.875% Senior Notes due May 2020

534

578

600

644

7.00% Senior Notes due November 2021

251

284

600

645

4.75% Senior Notes due June 2023

1,000

1,009

1,000

938

4.75% Senior Notes due January 2025

1,000

995

—

—

Other

—

—

4

4

1

1

1

1

1

1

1

1

1

1

3,920

4,060

2,777

2,860

Less short-term borrowings and current portion of

long

-

term debt

—

—

(

3

)

(3

)

Long

-

term debt, less current portion

$

3,920

$

4,060

$

2,774

$

2,857

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1