Seagate 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

and a decrease in interest expense of $27 million due to a reduction in our average interest rate and total debt levels.

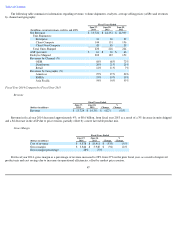

Income Taxes

We recorded an income tax benefit of $7 million for fiscal year 2013 compared to an income tax provision of $20 million for fiscal year

2012. Our fiscal year 2013 benefit for income taxes included $52 million of income tax benefit from the reversal of a portion of the U.S.

valuation allowance recorded in prior periods. Our fiscal year 2012 provision for income taxes included $35 million of income tax benefit from

the reversal of a portion of the U.S. valuation allowance recorded in prior periods.

Our income tax benefit recorded for fiscal year 2013 differed from the provision for income taxes that would be derived by applying the

Irish statutory rate of 25% to income before income taxes, primarily due to the net effect of (i) tax benefits related to non-U.S. earnings

generated in jurisdictions that are subject to tax holidays or tax incentive programs and are considered indefinitely reinvested outside of Ireland,

and (ii) a decrease in valuation allowance for certain U.S. deferred tax assets. The acquisition of a majority interest in the outstanding shares of

LaCie did not have a material impact on our effective tax rate in fiscal year 2013. Our income tax provision recorded for fiscal year 2012

differed from the provision for income taxes that would be derived by applying the Irish statutory rate of 25% to income before income taxes,

primarily due to the net effect of (i) tax benefits related to non-U.S. earnings generated in jurisdictions that are subject to tax holidays or tax

incentive programs and are considered indefinitely reinvested outside of Ireland, and (ii) a decrease in valuation allowance for certain U.S.

deferred tax assets. The acquisition of Samsung's HDD business did not have a significant impact on our effective tax rate in fiscal year 2012.

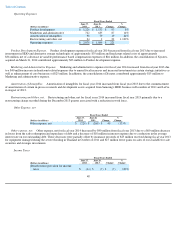

Liquidity and Capital Resources

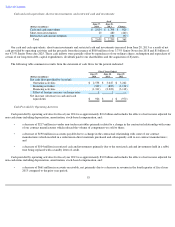

The following sections discuss our principal liquidity requirements, as well as our sources and uses of cash and our liquidity and capital

resources. Our cash and cash equivalents are maintained in investments with remaining maturities of 90 days or less at the time of purchase. Our

short-term investments consist primarily of readily marketable securities with remaining maturities of more than 90 days at the time of purchase.

The principal objectives of our investment policy are the preservation of principal and maintenance of liquidity. We intend to maintain a highly

liquid portfolio by investing only in those marketable securities that we believe have active secondary or resale markets. We believe our cash

equivalents and short-term investments are liquid and accessible. We operate in some countries that have restrictive regulations over the

movement of cash and/or foreign exchange across their borders. However, these restrictions have not impeded our ability to conduct our

business, nor do we expect them to in the next 12 months. We are not aware of any downgrades, losses or other significant deterioration in the

fair value of our cash equivalents or short-term investments and accordingly, we do not believe the fair value of our short-term investments has

significantly changed from the values reported as of June 27, 2014.

52

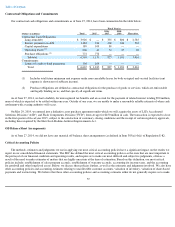

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

(Benefit from) provision for income

taxes

$

(7

)

$

20

$

(27

)

(135

)%