Seagate 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

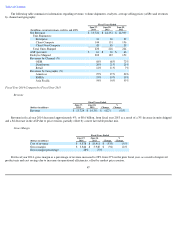

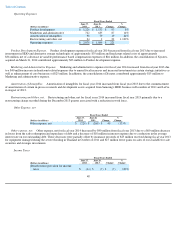

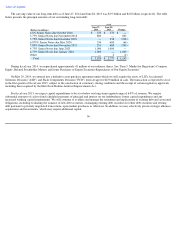

Gross Margin

For fiscal year 2013, gross margin as a percentage of revenue decreased to 27% from 31% in the prior fiscal year, as a result of higher ASPs

during fiscal year 2012. Our ASPs during fiscal year 2012 were increased due to the limited industry supply of hard drives as a result of the

severe flooding in Thailand.

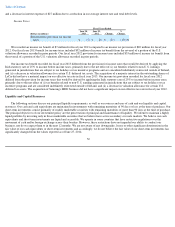

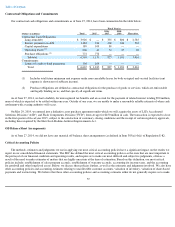

Operating Expenses

Product Development Expense. Product development expenses for fiscal year 2013 increased from fiscal year 2012, primarily due to

increased investments in HDD and alternative storage technologies of approximately $84 million, and headcount related costs of approximately

$41 million, net of a decrease in variable performance based compensation of approximately $7 million.

Marketing and Administrative Expense. Marketing and administrative expenses for fiscal year 2013 increased from fiscal year 2012

primarily due to further investments in certain strategic initiatives as well as enhancement of our core business operations. This, along with our

annual focal increases, resulted in additional headcount related costs of $64 million, net of a reduction in variable performance based

compensation of $7 million. In addition, the consolidation of LaCie in fiscal year 2013 contributed approximately $32 million to Marketing and

administrative expense.

Amortization of Intangibles. Amortization of intangibles for fiscal year 2013 increased as a result of the acquisition of Samsung's HDD

business in December of 2011, and LaCie in August of 2012.

Restructuring and Other, net. Restructuring and other, net for fiscal years 2013 and 2012, was not material and primarily related to

previously announced restructuring plans.

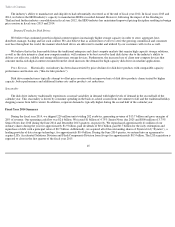

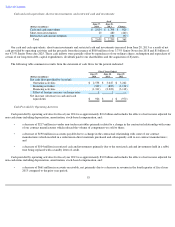

Other Expense, net

Other expense, net for fiscal year 2013 compared to fiscal year 2012 increased due to a loss of $141 million on the early redemption and

repurchase of debt. These losses were partially offset by gains recorded for sales of our available for sale securities and strategic investments of

$61 million, insurance proceeds of $25 million for equipment damaged during the severe flooding in Thailand in October of 2011,

51

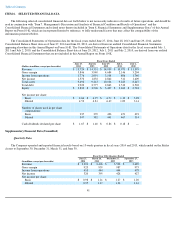

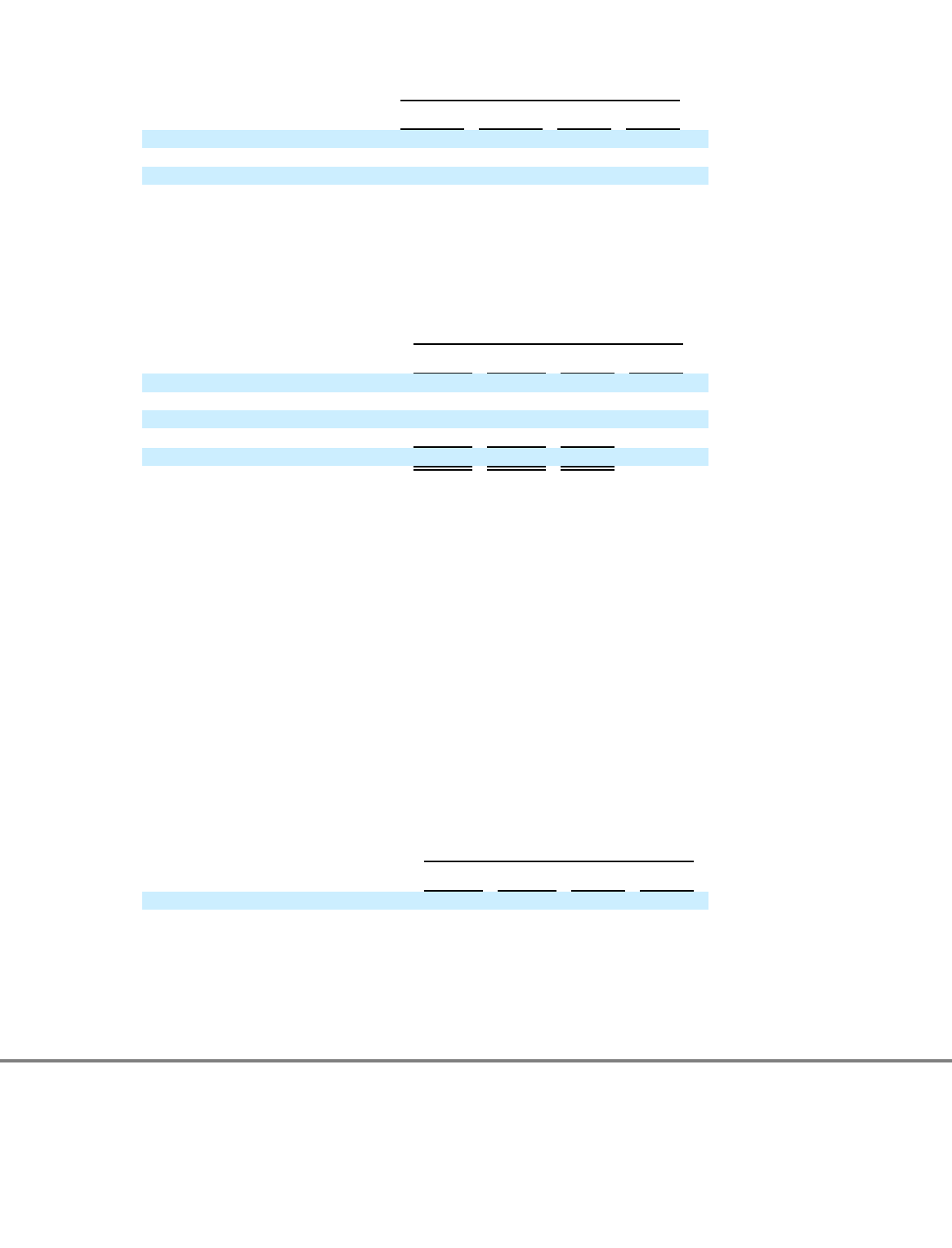

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

Cost of revenue

$

10,411

$

10,255

$

156

2

%

Gross margin

$

3,940

$

4,684

$

(744

)

(16

)%

Gross margin percentage

27

%

31

%

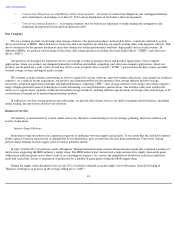

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

Product development

$

1,133

$

1,006

$

127

13

%

Marketing and administrative

635

528

107

20

%

Amortization of intangibles

79

38

41

108

%

Restructuring and other, net

2

4

(2

)

(50

)%

1

1

1

1

1

1

1

1

1

1

Operating expenses

$

1,849

$

1,576

$

273

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

Other expense, net

$

(260

)

$

(226

)

$

(34

)

15

%