Seagate 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

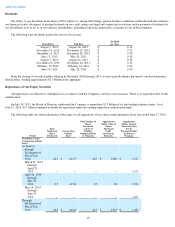

We recorded an income tax benefit of $14 million for fiscal year 2014 compared to an income tax benefit of $7 million for fiscal year 2013.

Our fiscal year 2014 benefit from income taxes included $58 million of income tax benefits related to the reversal of a portion of the valuation

allowances recorded in prior periods and a net decrease in tax reserves related to audit settlements offset by tax reserves on non-U.S. tax

positions taken in prior fiscal years. Our fiscal year 2013 benefit for income taxes included $52 million of income tax benefit from the reversal of

a portion of the U.S. valuation allowance recorded in prior periods.

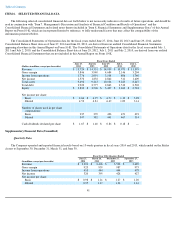

Our Irish tax resident parent holding company owns various U.S. and non-U.S. subsidiaries that operate in multiple non-Irish tax

jurisdictions. Our worldwide operating income is either subject to varying rates of tax or is exempt from tax due to tax holidays or tax incentive

programs we operate under in Malaysia, Singapore and Thailand. These tax holidays or incentives are scheduled to expire in whole or in part at

various dates through 2020.

Our income tax benefit recorded for fiscal year 2014 differed from the provision for income taxes that would be derived by applying the

Irish statutory rate of 25% to income before income taxes, primarily due to the net effect of (i) tax benefits related to non-U.S. earnings

generated in jurisdictions that are subject to tax holidays or tax incentive programs and are considered indefinitely reinvested outside of Ireland

and (ii) a decrease in valuation allowance for certain deferred tax assets. The acquisition of Xyratex is not expected to have a material impact on

our effective tax rate in future periods. Fiscal year 2014 included a valuation allowance release associated with post-acquisitions restructuring.

Our income tax benefit recorded for fiscal year 2013 differed from the provision for income taxes that would be derived by applying the Irish

statutory rate of 25% to income before income taxes, primarily due to the net effect of (i) tax benefits related to non-U.S. earnings generated in

jurisdictions that are subject to tax holidays or tax incentive programs and are considered indefinitely reinvested outside of Ireland, and (ii) a

decrease in valuation allowance for certain U.S. deferred tax assets. The acquisition of a majority interest in the outstanding shares of LaCie did

not have a material impact on our effective tax rate in fiscal year 2013.

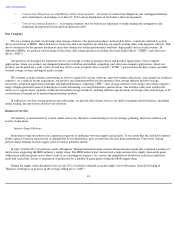

Based on our non-U.S. ownership structure and subject to (i) potential future increases in our valuation allowance for deferred tax assets;

and (ii) a future change in our intention to indefinitely reinvest earnings from our subsidiaries outside of Ireland, we anticipate that our effective

tax rate in future periods will generally be less than the Irish statutory rate.

At June 27, 2014, our deferred tax asset valuation allowance was approximately $888 million.

At June 27, 2014, we had net deferred tax assets of $615 million. The realization of these deferred tax assets is primarily dependent on our

ability to generate sufficient U.S. and certain non-U.S. taxable income in future periods. Although realization is not assured, we believe that it is

more likely than not that these deferred tax assets will be realized. The amount of deferred tax assets considered realizable, however, may

increase or decrease in subsequent periods when we re-evaluate the underlying basis for our estimates of future U.S. and certain non-

U.S. taxable

income.

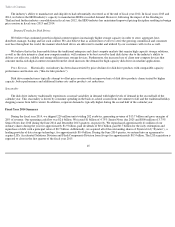

As of June 27, 2014, the use of approximately $376 million and $90 million of our total U.S. net operating loss and tax credit carry

forwards, respectively, is subject to an aggregate annual limitation of $46 million pursuant to U.S. tax law. If certain ownership changes occur in

the foreseeable future, there may be an additional annual limitation on our ability to use our total U.S. federal and state net operating loss and

credit carryforwards of $2.9 billion, $1.8 billion and $429 million, respectively. It is reasonably possible that such a change could occur. If these

ownership changes were to occur, we estimate a one-time charge for additional U.S. income tax expense of approximately $400 million to

$500 million may be recorded in the period such change occurs. This additional income tax expense results from a decrease in our net U.S.

deferred tax assets recorded through a combination of the write off of deferred tax assets and associated changes to our valuation allowance. We

also estimate that the ensuing additional annual limitation on our ability to use our tax attribute carryovers may result in increased U.S. income

tax expense associated with such change of approximately $70 million to $85 million each year.

49