Seagate 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

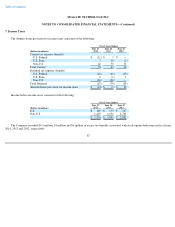

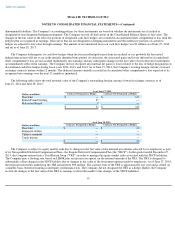

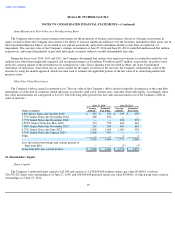

The following table summarizes the activity related to the Company's gross unrecognized tax benefits:

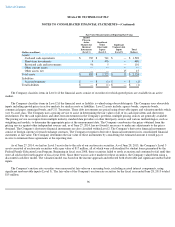

It is the Company's policy to include interest and penalties related to unrecognized tax benefits in the provision for taxes on the

Consolidated Statements of Operations. During fiscal year 2014, the Company recognized net tax expense for interest and penalties of $8 million

as compared to net tax expense for interest and penalties of $2 million during each fiscal year 2013 and fiscal year 2012. As of June 27, 2014,

the Company had $27 million of accrued interest and penalties related to unrecognized tax benefits compared to $19 million in fiscal year 2013.

During the 12 months beginning June 28, 2014, the Company expects that its unrecognized tax benefits could be reduced anywhere from

$3 million to $50 million as a result of audit settlements and the expiration of certain statutes of limitation.

The Company is subject to taxation in many jurisdictions globally and is required to file U.S. federal, U.S. state and non-U.S. income tax

returns. In June, 2014, the Company received the Revenue Agent's Report and Notices of Proposed Adjustments for its U.S. federal income tax

returns for fiscal years 2008, 2009 and 2010. The Company's China subsidiaries are under examination by the Chinese tax administration for

years 2004 through 2012. These examinations may result in proposed adjustments to the income taxes as filed during these periods. The

Company believes that it has adequately provided for these matters, but there is a reasonable possibility that an adverse outcome of these

examinations could have a material effect on the Company's financial results. In this case, the Company would consider pursuing all possible

remedies available, including appeals, judicial review and competent authority.

The Company is no longer subject to tax examination of U.S. federal income tax returns for years prior to fiscal year 2008. With respect to

U.S. state and non-U.S. income tax returns, the Company is generally no longer subject to tax examination for years ending prior to fiscal year

2004. The Company believes it has provided adequately for all reasonable outcomes.

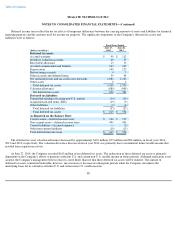

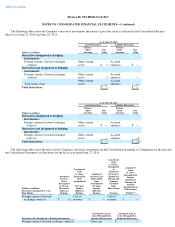

8. Derivative Financial Instruments

The Company is exposed to foreign currency exchange rate, interest rate, and to a lesser extent, equity price risks relating to its ongoing

business operations. The Company enters into foreign currency forward exchange contracts in order to manage the foreign currency exchange

rate risk on forecasted expenses denominated in foreign currencies and to mitigate the remeasurement risk of certain foreign currency

90

Fiscal Years Ended

(Dollars in millions)

June 27,

2014

June 28,

2013

June 29,

2012

Balance of unrecognized tax benefits at the

beginning of the year

$

157

$

135

$

128

Gross increase for tax positions of prior years

10

14

1

Gross decrease for tax positions of prior years

(64

)

(4

)

(3

)

Gross increase for tax positions of current year

13

16

13

Gross decrease for tax positions of current year

—

—

—

Settlements

—

—

—

Lapse of statutes of limitation

(3

)

(5

)

(3

)

Non

-

U.S. exchange (gain)/loss

2

1

(1

)

Balance of unrecognized tax benefits at the end of

the year

$

115

$

157

$

135

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1