Seagate 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Equity securities which do not have a contractual maturity date are not included in the above table.

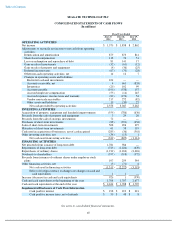

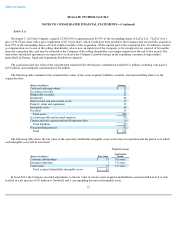

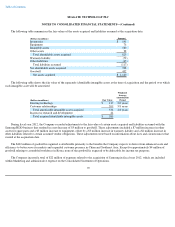

The following table summarizes, by major type, the fair value and amortized cost of the Company's investments as of June 28, 2013:

As of June 28, 2013, the Company's Restricted cash and investments consisted of $79 million in cash and investments held in trust for

payment of its non-qualified deferred compensation plan liabilities and $22 million in cash and investments held as collateral at banks for

various performance obligations.

As of June 28, 2013, the Company's available-for-sale securities include investments in auction rate securities. Beginning in fiscal year

2008, the Company's auction rate securities failed to settle at auction and continued to fail through June 28, 2013. Since the Company continued

to earn interest on its auction rate securities at the maximum contractual rate, there were no payment defaults with respect to such securities, and

they were all collateralized, the Company expected to recover the entire amortized cost basis of these auction rate securities. During fiscal year

2013, the Company did not intend to sell these securities and as of June 28, 2013, concluded it was not more likely than not that the Company

would have been required to sell the securities before the recovery of their amortized cost basis. As such, as of June 28, 2013, the Company

believed the impairments totaling $2 million were not other-than-temporary and therefore were recorded in Accumulated other comprehensive

loss. Given the uncertainty as to when the liquidity issues associated with these securities would improve, as of June 28, 2013, these securities

were classified within Other assets, net in the Company's Consolidated Balance Sheet.

As of June 28, 2013, with the exception of the Company's auction rate securities, the Company had no available-for-sale securities that had

been in a continuous unrealized loss position for a period greater than 12 months. The Company determined no available-for-

sale securities were

other-than-temporarily impaired as of June 28, 2013.

73

(Dollars in millions)

Amortized

Cost

Unrealized

Gain/(Loss)

Fair

Value

Available

-

for

-

sale securities:

Money market funds

$

804

$

—

$

804

Commercial paper

655

—

655

Corporate bonds

211

—

211

U.S. treasuries and agency bonds

96

—

96

Certificates of deposit

154

—

154

Auction rate securities

17

(2

)

15

Equity securities

4

—

4

Other debt securities

107

(1

)

106

1

1

1

1

1

1

1

1

2,048

(3

)

2,045

Trading securities

74

5

79

1

1

1

1

1

1

1

1

Total

$

2,122

$

2

$

2,124

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

Included in Cash and cash equivalents

$

1,528

Included in Short

-

term investments

480

Included in Restricted cash and investments

101

Included in Other assets, net

15

1

1

1

1

1

1

1

1

Total

$

2,124

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1