Seagate 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

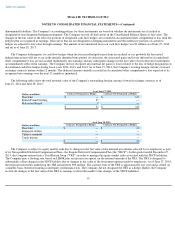

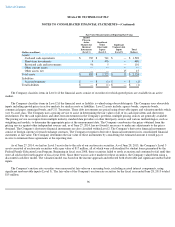

The Company classifies items in Level 1 if the financial assets consist of securities for which quoted prices are available in an active

market.

The Company classifies items in Level 2 if the financial asset or liability is valued using observable inputs. The Company uses observable

inputs including quoted prices in active markets for similar assets or liabilities. Level 2 assets include: agency bonds, corporate bonds,

commercial paper, municipal bonds, and U.S. Treasuries. These debt investments are priced using observable inputs and valuation models which

vary by asset class. The Company uses a pricing service to assist in determining the fair values of all of its cash equivalents and short-term

investments. For the cash equivalents and short-term investments in the Company's portfolio, multiple pricing sources are generally available.

The pricing service uses inputs from multiple industry standard data providers or other third party sources and various methodologies, such as

weighting and models, to determine the appropriate price at the measurement date. The Company corroborates the prices obtained from the

pricing service against other independent sources and, as of June 27, 2014, has not found it necessary to make any adjustments to the prices

obtained. The Company's derivative financial instruments are also classified within Level 2. The Company's derivative financial instruments

consist of foreign currency forward exchange contracts. The Company recognizes derivative financial instruments in its consolidated financial

statements at fair value. The Company determines the fair value of these instruments by considering the estimated amount it would pay or

receive to terminate these agreements at the reporting date.

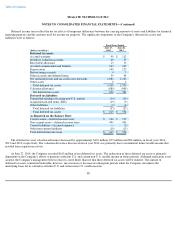

As of June 27, 2014, we had no Level 3 assets due to the sale of our auction rate securities. As of June 28, 2013, the Company's Level 3

assets consisted of auction rate securities with a par value of $17 million, all of which were collateralized by student loans guaranteed by the

Federal Family Education Loan Program. Beginning in fiscal year 2008, these securities failed to settle at auction and continued to fail until they

were all sold in the fourth quarter of fiscal year 2014. Since there was no active market for these securities, the Company valued them using a

discounted cash flow model. The valuation model was based on the income approach and reflected both observable and significant unobservable

inputs.

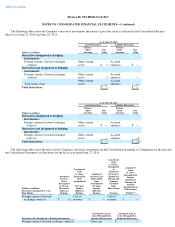

The Company's auction rate securities were measured at fair value on a recurring basis, excluding accrued interest components, using

significant unobservable inputs (Level 3). The fair value of the Company's auction rate securities for the fiscal year ended June 28, 2013 totaled

$15 million.

96

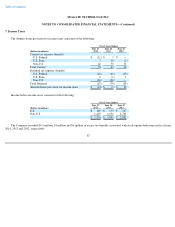

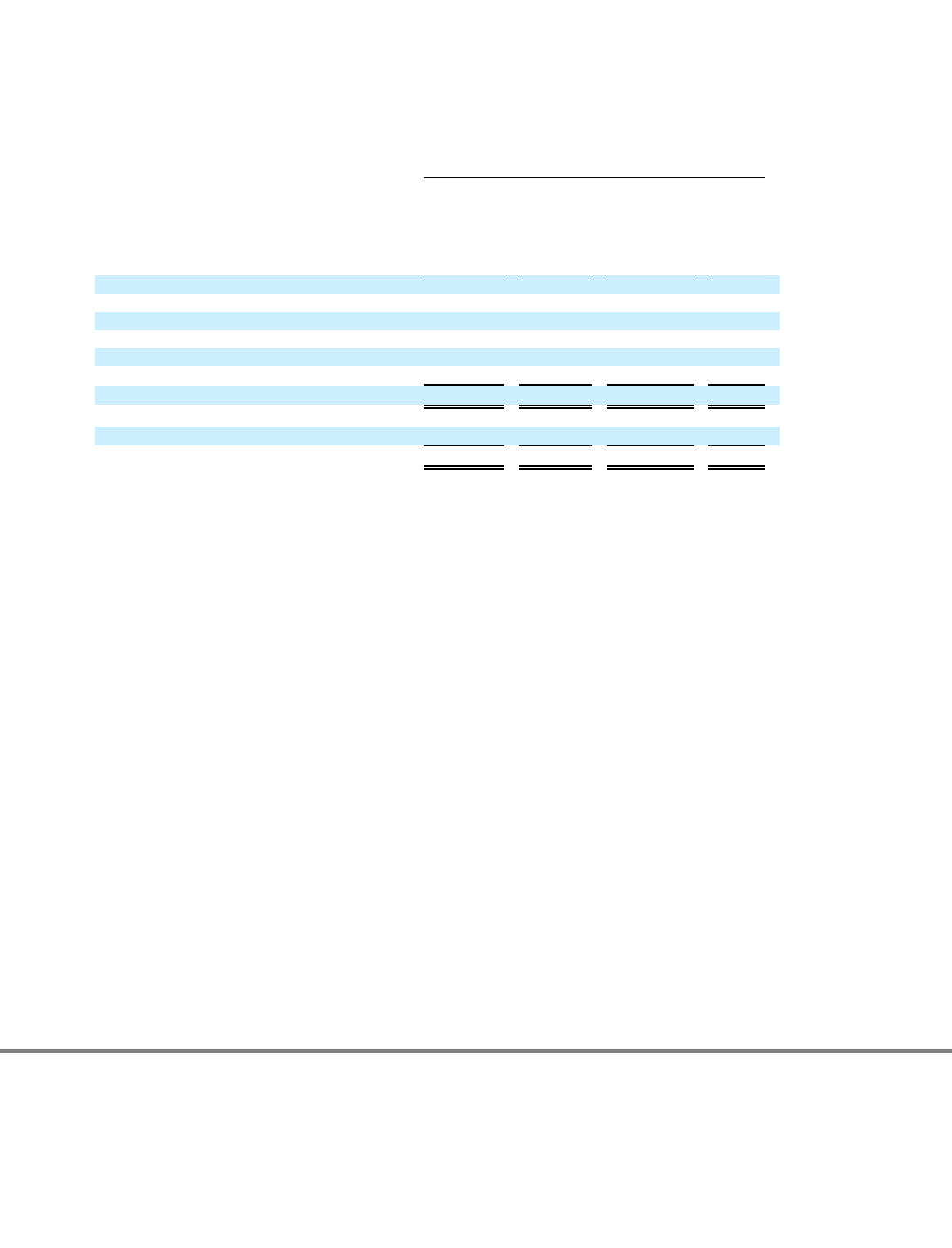

Fair Value Measurements at Reporting Date Using

(Dollars in millions)

Quoted

Prices in

Active

Markets for

Identical

Instruments

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Balance

Assets:

Cash and cash equivalents

$

787

$

741

$

—

$

1,528

Short

-

term investments

4

476

—

480

Restricted cash and investments

96

5

—

101

Other current assets

—

—

—

—

Other assets, net

—

—

15

15

Total assets

$

887

$

1,222

$

15

$

2,124

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

Liabilities:

Accrued expenses

$

—

$

(

1

)

$

—

$

(

1

)

1

1

1

1

1

1

1

1

1

1

Total liabilities

$

—

$

(

1

)

$

—

$

(

1

)

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1