Seagate 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

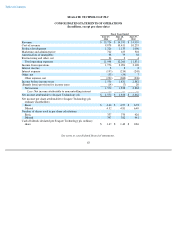

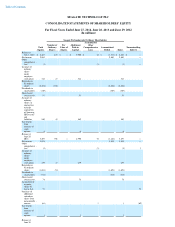

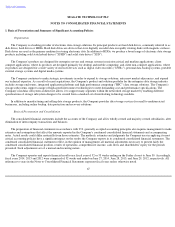

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

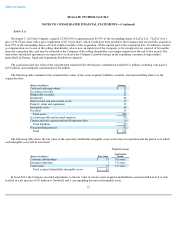

2. Balance Sheet Information

Investments

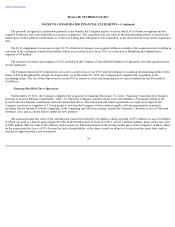

The following table summarizes, by major type, the fair value and amortized cost of the Company's investments as of June 27, 2014:

As of June 27, 2014, the Company's Restricted cash and investments consisted of $4 million in cash and investments held as collateral at

banks for various performance obligations.

During the fourth quarter of 2014, the Company sold all of its auction rate securities and recognized an immaterial loss on the sale which is

included in Other, net in the Company's Consolidated Statement of Operations.

As of June 27, 2014, the Company had no available-for-sale securities that had been in a continuous unrealized loss position for a period

greater than 12 months. The Company determined no available-for-sale securities were other-than-temporarily impaired as of June 27, 2014.

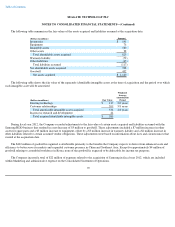

The fair value and amortized cost of the Company's investments classified as available-for-sale at June 27, 2014 by remaining contractual

maturity was as follows:

72

(Dollars in millions)

Amortized

Cost

Unrealized

Gain/(Loss)

Fair

Value

Available

-

for

-

sale securities:

Money market funds

$

793

$

—

$

793

Commercial paper

1,261

—

1,261

Corporate bonds

6

—

6

U.S. treasuries and agency bonds

—

—

—

Certificates of deposit

273

—

273

Auction rate securities

—

—

—

Equity securities

—

—

—

Other debt securities

—

—

—

1

1

1

1

1

1

1

1

2,333

—

2,333

Trading securities

—

—

—

Total

$

2,333

$

—

$

2,333

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

Included in Cash and cash equivalents

$

2,309

Included in Short

-

term investments

20

Included in Restricted cash and investments

4

Included in Other assets, net

—

Total

$

2,333

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

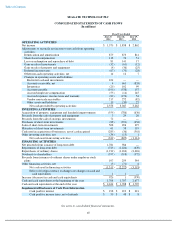

(Dollars in millions)

Amortized

Cost

Fair

Value

Due in less than 1 year

$

2,332

$

2,332

Due in 1 to 5 years

1

1

Due in 5 to 10 years

—

—

Thereafter

—

—

1

1

1

1

1

1

Total

$

2,333

$

2,333

1

1

1

1

1

1

1

1

1

1

1

1