Seagate 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

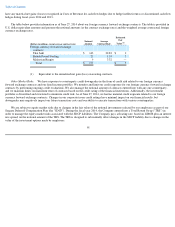

employees. Employee termination benefits covered by existing benefit arrangements are recorded in accordance with ASC Topic 712, Non-

retirement Postemployment Benefits. These costs are recognized when management has committed to a restructuring plan and the severance

costs are probable and estimable.

Advertising Expense. The cost of advertising is expensed as incurred. Advertising costs were approximately $52 million, $51 million and

$39 million in fiscal years 2014, 2013 and 2012, respectively.

Stock-Based Compensation. The Company accounts for stock-based compensation under the provisions of ASC Topic 718 (ASC 718),

Compensation-Stock Compensation. The Company has elected to apply the with-and-without method to assess the realization of excess tax

benefits.

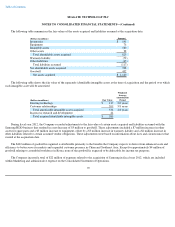

Accounting for Income Taxes. The Company accounts for income taxes pursuant to ASC Topic 740 (ASC 740), Incomes Taxes. In

applying ASC 740, the Company makes certain estimates and judgments in determining income tax expense for financial statement purposes.

These estimates and judgments occur in the calculation of tax credits, recognition of income and deductions and calculation of specific tax assets

and liabilities, which arise from differences in the timing of recognition of revenue and expense for tax and financial statement purposes, as well

as tax liabilities associated with uncertain tax positions. The calculation of tax liabilities involves uncertainties in the application of complex tax

rules and the potential for future adjustment of the Company's uncertain tax positions by the Internal Revenue Service or other tax jurisdictions.

If estimates of these tax liabilities are greater or less than actual results, an additional tax benefit or provision will result. The deferred tax assets

the Company records each period depend primarily on the Company's ability to generate future taxable income in the United States and certain

non-U.S. jurisdictions. Each period, the Company evaluates the need for a valuation allowance for its deferred tax assets and, if necessary,

adjusts the valuation allowance so that net deferred tax assets are recorded only to the extent the Company concludes it is more likely than not

that these deferred tax assets will be realized. If the Company's outlook for future taxable income changes significantly, the Company's

assessment of the need for a valuation allowance may also change.

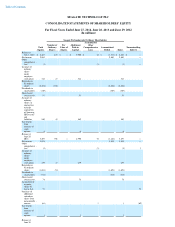

Comprehensive Income. In the first quarter of fiscal 2013, the Company adopted the revised requirements of ASU No. 2011-05,

Comprehensive Income (Topic 220)—Presentation of Comprehensive Income to present comprehensive income in a separate statement.

Comprehensive income is comprised of net income and other gains and losses affecting equity that are excluded from net income.

Foreign Currency Remeasurement and Translation. The U.S. dollar is the functional currency for the majority of the Company's foreign

operations. Monetary assets and liabilities denominated in foreign currencies are remeasured into the functional currency of the subsidiary at the

balance sheet date. The gains and losses from the remeasurement of foreign currency denominated balances into the functional currency of the

subsidiary are included in Other, net on the Company's Consolidated Statements of Operations.

The Company translates the assets and liabilities of its non-U.S. dollar functional currency subsidiaries into U.S. dollars using exchange

rates in effect at the end of each period. Revenue and expenses for these subsidiaries are translated using rates that approximate those in effect

during the period. Gains and losses from these translations are recognized in foreign currency translation included in Accumulated other

comprehensive loss, which is a component of shareholders' equity. The Company's subsidiaries that use the U.S. dollar as their functional

currency remeasure monetary assets and liabilities at exchange rates in effect at the end of each period, and inventories, property, and

nonmonetary assets and liabilities at historical rates. Gains and losses from these remeasurements were not significant and have been included in

the Company's results of operations.

70