Seagate 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

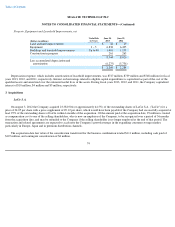

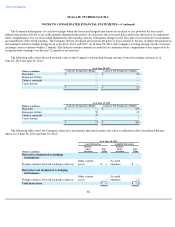

6. Debt

Short-Term Borrowings

On January 18, 2011, the Company, and its subsidiary Seagate HDD Cayman entered into a Credit Agreement which provided for a

$350 million senior secured revolving credit facility (the "Revolving Credit Facility"). On April 30, 2013, the Company and Seagate HDD

Cayman entered into the Second Amendment to the Credit Agreement which increased the commitments available under the Revolving Credit

Facility from $350 million to $500 million. The Company and certain of its material subsidiaries fully and unconditionally guarantee the

Revolving Credit Facility. The Revolving Credit Facility matures in April 2018, and is available for cash borrowings and for the issuance of

letters of credit up to a sub-limit of $75 million. As of June 28, 2013, no borrowings have been drawn under the Revolving Credit Facility, and

$2 million had been utilized for letters of credit. The line of credit is available for borrowings, subject to compliance with financial covenants

and other customary conditions to borrowing. The credit agreement that governs the Revolving Credit Facility contains certain covenants that the

Company must satisfy in order to remain in compliance with the credit agreement, including three financial covenants: (1) minimum amount of

cash, cash equivalents and marketable securities; (2) a fixed charge coverage ratio; and (3) a net leverage ratio. As of June 28, 2013, the

Company was in compliance with all covenants, including the financial ratio that it is required to maintain.

Long-Term Debt

$430 million Aggregate Principal Amount of 10.00% Senior Secured Second-Priority Notes due May 2014 (the "2014 Notes"). On

May 1, 2009, the Company's subsidiary, Seagate Technology International, completed the sale of $430 million aggregate principal amount of the

2014 Notes, in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended.

On March 15, 2013, the Company gave notice that it elected to redeem all of the remaining outstanding 2014 Notes on May 1, 2013. Also

on March 15, 2013, the Company irrevocably deposited with the Trustee of the 2014 Notes cash equal to the principal amount of the outstanding

notes, a redemption premium, plus accrued and unpaid interest through May 1, 2013, for a total of $351 million, which released the Company

from its obligations under the 2014 Notes and extinguished the associated liability. During fiscal years 2013, 2012 and 2011, the Company

repurchased $320 million, $96 million and $14 million, aggregate principal amount of its 2014 Notes, respectively, for cash at a premium to their

principal amount, plus accrued and unpaid interest. During 2013, 2012 and 2011, the Company recorded a loss on the repurchases of

approximately $22 million, $17 million and $2 million, respectively, which are included in Other, net in the Company's Consolidated Statements

of Operations.

$600 million Aggregate Principal Amount of 6.8% Senior Notes due October 2016 (the "2016 Notes"). On September 20, 2006, the

Company's subsidiary, Seagate Technology HDD Holdings, completed the sale of $600 million aggregate principal amount of the 2016 Notes, in

a private placement exempt from the registration requirements of the Securities Act of 1933, as amended. The interest on the 2016 Notes is

payable semi-annually on April 1 and October 1 of each year. The issuer under the 2016 notes is Seagate Technology HDD Cayman, and the

obligations under the 2016 Notes are unconditionally guaranteed by certain of the Company's significant subsidiaries. The 2016 Notes are

redeemable at the option of the Company in whole or in part, on not less than 30, nor more than 60 days notice, at a "make-whole" premium

redemption price. The "make-whole" redemption price will be equal to the greater of (1) 100% of the principal amount of the notes being

redeemed, or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the 2016 Notes being redeemed,

discounted at the redemption date on a semi-annual basis at a rate equal to the sum of the applicable Treasury rate plus 50

81