Seagate 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Establishment of Warranty Accruals. The Company estimates probable product warranty costs at the time revenue is recognized. The

Company generally warrants its products for a period of 1 to 5 years. The Company's warranty provision considers estimated product failure

rates and trends (including the timing of product returns during the warranty periods), and estimated repair or replacement costs related to

product quality issues, if any. The Company also exercises judgment in estimating its ability to sell certain repaired disk drives. Should actual

experience in any future period differ significantly from its estimates, the Company's future results of operations could be materially affected.

Revenue Recognition, Sales Returns and Allowances, and Sales Incentive Programs.

The Company's revenue recognition policy complies

with ASC Topic 605 (ASC 605), Revenue Recognition. Revenue from sales of products, including sales to distribution customers, is generally

recognized when title and risk of loss has passed to the buyer, which typically occurs upon shipment from the Company or third party warehouse

facilities, persuasive evidence of an arrangement exists, including a fixed or determinable price to the buyer, and when collectability is

reasonably assured. Revenue from sales of products to certain direct retail customers and to customers in certain indirect retail channels is

recognized on a sell-through basis.

The Company records estimated product returns at the time of shipment. The Company also estimates reductions to revenue for sales

incentive programs, such as price protection, and volume incentives, and records such reductions when revenue is recorded. The Company

establishes certain distributor and OEM sales programs aimed at increasing customer demand. For OEM sales, rebates are typically based on an

OEM customer's volume of purchases from Seagate or other agreed upon rebate programs. For the distribution channel, these programs typically

involve rebates related to a distributor's level of sales, order size, advertising or point of sale activity and price protection adjustments. The

Company provides for these obligations at the time that revenue is recorded based on estimated requirements. Marketing development programs

are either recorded as a reduction to revenue or as an addition to marketing expense depending on the contractual nature of the program.

Shipping and Handling. The Company includes costs related to shipping and handling in Cost of revenue for all periods presented.

Restructuring Costs. The Company records restructuring activities including costs for one-time termination benefits in accordance with

ASC Topic 420 (ASC 420), Exit or Disposal Cost Obligations. The timing of recognition for severance costs accounted for under ASC 420

depends on whether employees are required to render service until they are terminated in order to receive the termination benefits. If employees

are required to render service until they are terminated in order to receive the termination benefits, a liability is recognized ratably over the future

service period. Otherwise, a liability is recognized when management has committed to a restructuring plan and has communicated those actions

to employees. Employee termination benefits covered by existing benefit arrangements are recorded in accordance with ASC Topic 712, Non-

retirement Postemployment Benefits. These costs are recognized when management has committed to a restructuring plan and the severance

costs are probable and estimable.

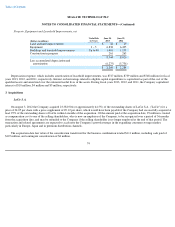

Advertising Expense. The cost of advertising is expensed as incurred. Advertising costs were approximately $51 million, $39 million and

$21 million in fiscal years 2013, 2012 and 2011, respectively.

Stock-Based Compensation. The Company accounts for stock-based compensation under the provisions of ASC Topic 718 (ASC 718),

Compensation—Stock Compensation. The Company has elected to apply the with-and-without method to assess the realization of excess tax

benefits.

68