Seagate 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

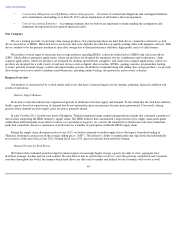

Liquidity Sources

Our primary sources of liquidity as of June 28, 2013, consisted of: (1) approximately $2.2 billion in cash and cash equivalents, and short-

term investments, (2) cash we expect to generate from operations and (3) a $500 million revolving credit facility. We also had $101 million in

restricted cash and investments, of which $79 million was related to our employee deferred compensation liabilities under our non-qualified

deferred compensation plan.

As of June 28, 2013, no borrowings have been drawn under the revolving credit facility, and $2 million had been utilized for letters of

credit. The line of credit is available for borrowings, subject to compliance with financial covenants and other customary conditions to

borrowing.

The credit agreement that governs our revolving credit facility, as amended, contains certain covenants that we must satisfy in order to

remain in compliance with the credit agreement, as amended. The agreement also includes three financial covenants: (1) minimum cash, cash

equivalents and marketable securities; (2) a fixed charge coverage ratio; and (3) a net leverage ratio. As of June 28, 2013, we were in compliance

with all of the covenants under our revolving credit facility and debt agreements.

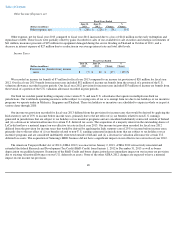

As of June 28, 2013, cash and cash equivalents held by non-

Irish subsidiaries was $1.7 billion. This amount is potentially subject to taxation

in Ireland upon repatriation by means of a dividend into our Irish parent. However, it is our intent to indefinitely reinvest earnings of non-Irish

subsidiaries outside of Ireland and our current plans do not demonstrate a need to repatriate such earnings by means of a taxable Irish dividend.

Should funds be needed in the Irish parent company and should we be unable to fund parent company activities through means other than a

taxable Irish dividend, we would be required to accrue and pay Irish taxes on such dividend.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for at least the next 12 months.

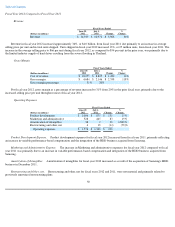

Cash Requirements and Commitments

Our liquidity requirements are primarily to meet our working capital, research and development and capital expenditure needs, to fund

scheduled payments of principal and interest on our indebtedness, and to fund our dividend. Our ability to fund these requirements will depend

on our future cash flows, which are determined by future operating performance, and therefore, subject to prevailing global macroeconomic

conditions and financial, business and other factors, some of which are beyond our control.

On July 24, 2013, our Board of Directors approved a cash dividend of $0.38 per share, which will be payable on August 21, 2013 to

shareholders of record as of the close of business on August 7, 2013.

As of June 28, 2013, we were in compliance with all of the covenants under our debt agreements. Based on our current outlook, we expect

to be in compliance with the covenants of our debt agreements over the next 12 months.

54