Seagate 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

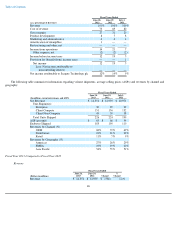

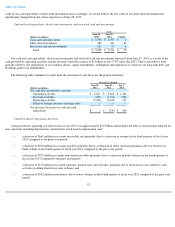

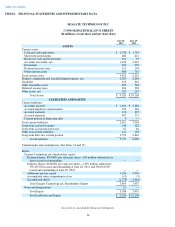

The carrying value of our long-term debt as of June 28, 2013 and June 29, 2012 was $2.8 billion and $2.9 billion, respectively. The table

below presents the principal amounts of our outstanding long-term debt:

During fiscal year 2013, we repurchased approximately 54 million of our ordinary shares. See "Item 5. Market for Registrant's Shares,

Related Shareholder Matters and Issuer Purchases of Equity Securities-Repurchases of Our Equity Securities."

For fiscal year 2014, we expect capital investments to remain within our long-term targeted range of 6-8% of revenue. We require

substantial amounts of cash to fund scheduled payments of principal and interest on our indebtedness, future capital expenditures and any

increased working capital requirements. We will continue to evaluate and manage the retirement and replacement of existing debt and associated

obligations, including evaluating the issuance of new debt securities, exchanging existing debt securities for other debt securities and retiring

debt pursuant to privately negotiated transactions, open market purchases or otherwise. In addition, we may selectively pursue strategic alliances,

acquisitions and investments, which may require additional capital.

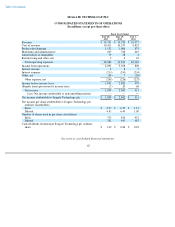

Contractual Obligations and Commitments

Our contractual cash obligations and commitments as of June 28, 2013, have been summarized in the table below:

55

As of

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

10.0% Senior Secured Second-Priority Notes due

May 2014

$

—

$

319

$

(319

)

6.8% Senior Notes due October 2016

335

600

(265

)

7.75% Senior Notes due December 2018

238

750

(512

)

6.875% Senior Notes due May 2020

600

600

—

7.00% Senior Notes due November 2021

600

600

—

4.75% Senior Notes due June 2023

1,000

—

1,000

Other

4

—

4

Total

$

2,777

$

2,869

$

(92

)

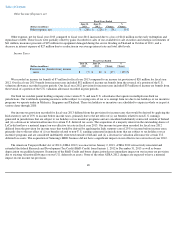

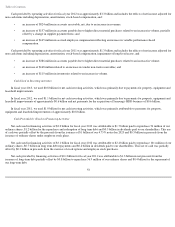

Fiscal Year(s)

(Dollars in millions)

Total

2014

2015

-

2016

2017

-

2018

Thereafter

Contractual Cash Obligations:

Long

-

term debt

$

2,777

$

3

$

1

$

335

$

2,438

Interest payments on debt

1,317

173

365

288

491

Capital expenditures

284

168

116

—

—

Operating leases

(1)

165

31

35

18

81

Purchase obligations

(2)

1,470

1,286

184

—

—

Other funding requirements

30

30

—

—

—

Subtotal

6,043

1,691

701

641

3,010

Commitments:

Letters of credit or bank guarantees

31

28

3

—

—

Total

$

6,074

$

1,719

$

704

$

641

$

3,010

(1) Includes total future minimum rent expense under non-cancelable leases for both occupied and vacated facilities (rent

expense is shown net of sublease income).