Seagate 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Dependence on Key Personnel

—The loss of key executive officers and employees could negatively impact our business prospects.

Our future performance depends to a significant degree upon the continued service of key members of management as well as marketing,

sales and product development personnel. The loss of one or more of our key personnel may have a material adverse effect on our business,

results of operations and financial condition. We believe our future success will also depend in large part upon our ability to attract, retain and

further motivate highly skilled management, marketing, sales and product development personnel. We have experienced intense competition for

personnel, and we cannot assure you that we will be able to retain our key employees or that we will be successful in attracting, assimilating and

retaining personnel in the future.

Securities Litigation

—Significant fluctuations in the market price of our ordinary shares could result in securities class action claims

against us.

Significant price and value fluctuations have occurred with respect to the publicly traded securities of disk drive companies and technology

companies generally. The price of our ordinary shares is likely to be volatile in the future. In the past, following periods of decline in the market

price of a company's securities, class action lawsuits have often been pursued against that company. If similar litigation were pursued against us,

it could result in substantial costs and a diversion of management's attention and resources, which could materially adversely affect our results of

operations, financial condition and liquidity.

Global Credit and Financial Market Conditions—Deterioration in global credit and financial market conditions could negatively impact the

value of our current portfolio of cash equivalents or short-term investments and our ability to meet our financing objectives.

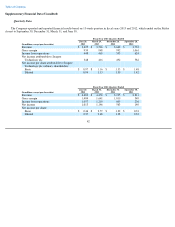

Our cash and cash equivalents are maintained in highly liquid investments with remaining maturities of 90 days or less at the time of

purchase. Our short-term investments consist primarily of readily marketable debt securities with remaining maturities of more than 90 days at

the time of purchase. Our investment policy has as its principal objectives the preservation of principal and maintenance of liquidity. We

mitigate default risk by investing in high-quality investment grade securities, limiting the time to maturity and by monitoring the counter-parties

and underlying obligors closely.

While as of the date of this filing, we are not aware of any other material downgrades, losses, or other significant deterioration in the fair

value of our cash equivalents or short-term investments , no assurance can be given that further deterioration in conditions of the global credit

and financial markets would not negatively impact our current portfolio of cash equivalents or short-term investments or our ability to meet our

financing objectives.

Environmental Regulations

—Failure to comply with applicable environmental laws and regulations could have a material adverse effect on

our business, results of operations and financial condition.

The sale and manufacturing of products in certain states and countries may subject us and our suppliers to state, federal and international

laws and regulations governing protection of the environment, including those governing discharges of pollutants into the air and water, the

management and disposal of hazardous substances and wastes, the cleanup of contaminated sites, restrictions on the presence of certain

substances in electronic products and the responsibility for environmentally safe disposal or recycling. We endeavor to ensure that we and our

suppliers comply with all applicable environmental laws and regulations, however, compliance may increase our operating costs and otherwise

impact future financial results. If additional or more stringent requirements are imposed on us in the future, we could incur additional operating

costs and capital expenditures. If we fail to comply with applicable environmental laws, regulations, initiatives, or standards of conduct, our

customers may refuse to purchase our products and we could be subject to fines, penalties and possible prohibition of sales of our products into

one or

33