Seagate 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other Income (Expense), net

Other expense, net for fiscal year 2013 compared to fiscal year 2012 increased due to a loss of $141 million on the early redemption and

repurchase of debt. These losses were partially offset by gains recorded for sales of our available for sale securities and strategic investments of

$61 million, insurance proceeds of $25 million for equipment damaged during the severe flooding in Thailand in October of 2011, and a

decrease in interest expense of $27 million due to a reduction in our average interest rate and total debt levels.

Income Taxes

We recorded an income tax benefit of $7 million for fiscal year 2013 compared to an income tax provision of $20 million for fiscal year

2012. Our fiscal year 2013 benefit from income taxes included $52 million of income tax benefit from the reversal of a portion of the U.S.

valuation allowance recorded in prior periods. Our fiscal year 2012 provision for income taxes included $35 million of income tax benefit from

the reversal of a portion of the U.S. valuation allowance recorded in prior periods.

Our Irish tax resident parent holding company owns various U.S. and non-U.S. subsidiaries that operate in multiple non-Irish tax

jurisdictions. Our worldwide operating income is either subject to varying rates of tax or is exempt from tax due to tax holidays or tax incentive

programs we operate under in Malaysia, Singapore and Thailand. These tax holidays or incentives are scheduled to expire in whole or in part at

various dates through 2020.

Our income tax provision recorded for fiscal year 2013 differed from the provision for income taxes that would be derived by applying the

Irish statutory rate of 25% to income before income taxes, primarily due to the net effect of (i) tax benefits related to non-U.S. earnings

generated in jurisdictions that are subject to tax holidays or tax incentive programs and are considered indefinitely reinvested outside of Ireland

and (ii) a decrease in valuation allowance for certain U.S. deferred tax assets. The acquisition of a majority interest in the outstanding shares of

LaCie did not have a material impact on our effective tax rate in fiscal year 2013. Our income tax provision recorded for fiscal year 2012

differed from the provision for income taxes that would be derived by applying the Irish statutory rate of 25% to income before income taxes,

primarily due to the net effect of (i) tax benefits related to non-U.S. earnings generated in jurisdictions that are subject to tax holidays or tax

incentive programs and are considered indefinitely reinvested outside of Ireland, and (ii) a decrease in valuation allowance for certain U.S.

deferred tax assets. The acquisition of Samsung's HDD business did not have a significant impact on our effective tax rate in fiscal year 2012.

The American Taxpayer Relief Act of 2012 (ATRA 2012) was enacted on January 2, 2013. ATRA 2012 retroactively reinstated and

extended the federal Research and Development Tax Credit (R&D Credit) from January 1, 2012 to December 31, 2013 as well as bonus

depreciation on qualified property. Extension of the R&D Credit and bonus depreciation has no immediate impact on our income tax provision

due to existing valuation allowances on our U.S. deferred tax assets. None of the other ATRA 2012 changes are expected to have a material

impact on our income tax provision.

48

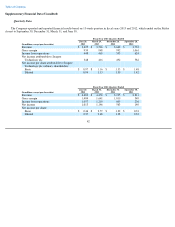

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

Other expense, net

$

(260

)

$

(226

)

$

(34

)

15

%

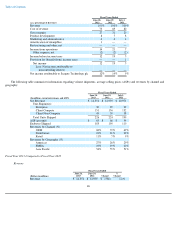

Fiscal Years Ended

(Dollars in millions)

June 28,

2013

June 29,

2012

Change

%

Change

Provision for (benefit from) income

taxes

$

(7

)

$

20

$

(27

)

(135

)%